Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Sky-high cattle market

24 June 2021

Key points:

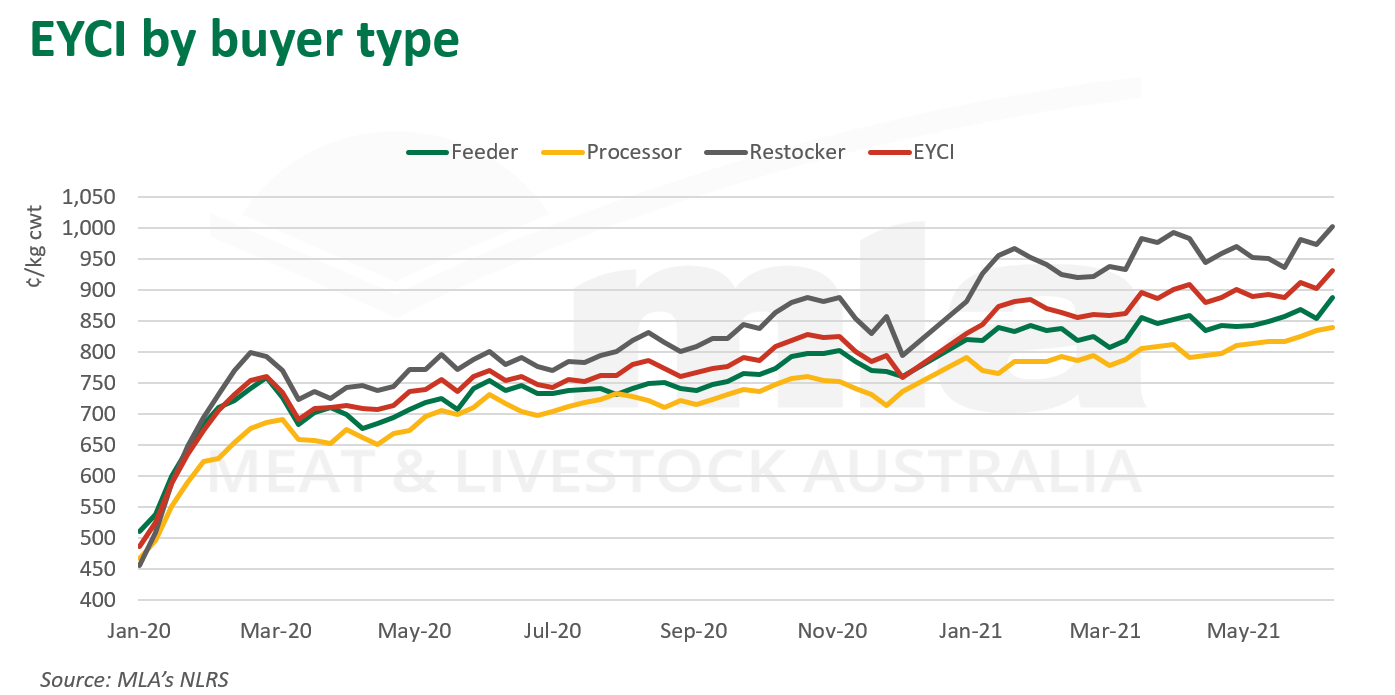

- EYCI achieves new record of 932.50/kg cwt, with other indicators also reaching new heights

- Restocker to feeder cattle weight gap increases overtime for EYCI eligible cattle

- Exports see 5% lift month-on-month in May, mirroring slaughter volumes

Domestic prices

Several indicators across the supply chain broke records this week, continuing their strong momentum, demonstrating sustained confidence in the cattle market.

Once again, rainfall was a key driver on top of continued demand outstripping supply. The Eastern Young Cattle Indicator (EYCI) reached 932.50¢/kg cwt on Tuesday, on the back of the Wagga market coming back online after the long weekend break and impressive results in southern Queensland and northern NSW.

A larger feeder steer contingent made up the EYCI yarding, highlighting the continued strength of the feeder market. Other national indicators also broke records, including the Feeder Steer, Heavy Steer and Processor Yearling Steer, which achieved 462.60¢/kg, 411.50¢/kg and 487.40¢/kg cwt, respectively.

EYCI weight margin

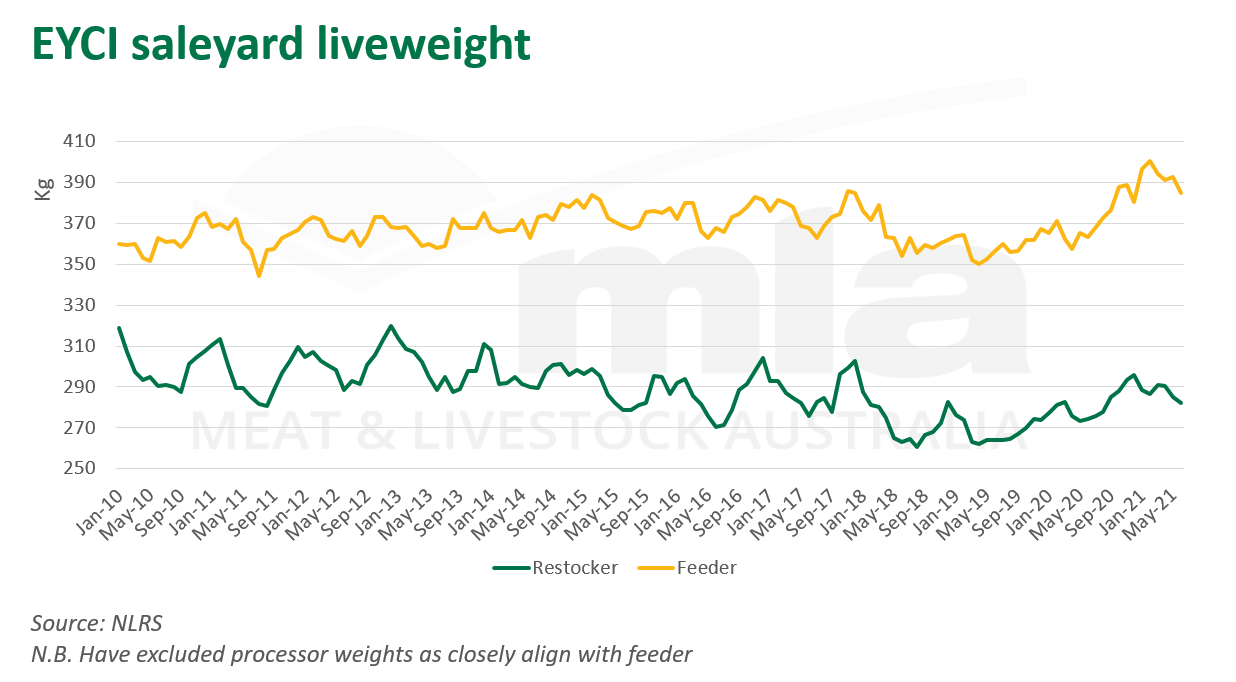

A breakdown of buyer weights highlights an upward trend in the weight gap between what feeders and restockers are purchasing at the saleyard.

The margin has grown 60kg in 10 years, currently sitting at 103kg, highlighting producers maximising weight to cater to the feeder market as lofted programs grow.

In 2021, feeders have closely mirrored the weight buying pattern to restockers, showcasing the alignment of buying behaviour as they compete to sure up supply and maximise margins as they become tighter down the supply chain.

Traditionally, the difference remains similar, however, the long-term trend does present a broadening gap in the past 10 years, on average. This points to the prevalence of store cattle at the saleyard versus those finished, and the growth of the backgrounding operations helping to push out weight gain.

Exports

Beef and veal export volumes saw a 5% lift in May, in line with increasing slaughter volumes.

Exports have mirrored slaughter volumes so far in 2021, highlighting dependency on supply for exports and abilities to process cattle.

Japan experienced the largest volume growth month-on-month in May, up 18% to reach 21,865 tonnes. This makes Japan Australia’s largest importer for the year-to-date.

© Meat & Livestock Australia Limited, 2021