Restocker premium in EYCI cattle holds strong

16 June 2022

Key points:

- The restocker to feeder premium in EYCI cattle in 2022 has averaged 144¢/kg cwt.

- Restocker prices remain at a premium, illustrating continued market confidence.

- Buyer selectivity and a tightening of the premium may indicate overall market confidence and demand.

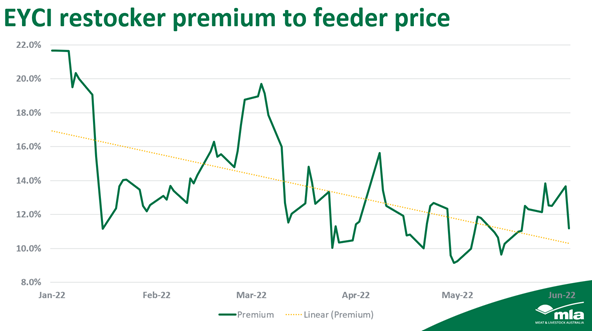

Analysis conducted by MLA’s Market Information team on the premium between restocker and feeder prices in the Eastern Young Cattle Indicator (EYCI) have shown a gradual linear tightening since January this year.

Traditionally, feeder buyers purchase at a lower price, whether those cattle are backgrounded prior or directly consigned to a feedlot due to the costs of feeding. However, competition between the buyers at the saleyards has remained prominent, even as prices reached records before softening. For much of this year, the premium has been operating between 10% and 20%.

EYCI restocker premium

In 2022, the restocker premium to feeders in the EYCI has averaged 13.6% or 144¢, with a high of 21.7% or 232¢ on 13 January and a low of 9.1% or 96¢/kg cwt on 11 May.

Transport and buyers drive prices

While the feeder price has operated more consistently, the volatility of the restocker EYCI price shows how rainfall and weather systems can drive buyer confidence or intentions.

Transportation challenges also contribute to this volatility and the availability of cattle at the saleyards.

However, while the EYCI has softened by 7% or 80¢/kg cwt in 2022, the restocker premium’s resilience provides an indication that market demand for young cattle is yet to wane significantly this year.

Looking ahead

From these current market conditions and buying behaviours, two separate predictions can be made:

1. Due to buyer selectivity dependent on quality, well-bred cattle, market performance may be expected to soften the EYCI overall in the medium term.

2. The softening of the restocker EYCI price due to buyer selectivity may cause a tightening of the premium to feeder prices and act as a lead indicator to cattle demand in the market.

At present, with the confidence in the market reflecting the continuation of elevated prices, buyers will become more selective moving forward.

This increasingly selective buyer behaviour may see the market impacted in the medium term as demand for cattle tapers while numbers rebuild on-farm.

This softening of overall restocker prices due to buyer behaviour will in turn tighten the premium between restockers and feeders, assuming lot fed cattle demand continues. The product of this premium tightening could be seen as a lead indicator for the overall market moving lower in the medium term.