Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Brazilian beef expands into China and Saudi Arabia

22 November 2016

Brazilian beef exports have continued to grow in 2016, supported by the country re-gaining access to Saudi Arabia and China last year. In addition, weak economic conditions in Brazil have hampered domestic demand for beef, while the currency, albeit increasing marginally this year, is half of where it tracked in 2011 – both factors have added to the attractiveness of overseas markets.

- Over the January to October period, Brazil exported 913,000 tonnes swt of beef, up 4% year-on-year (GTA/SECEX)

- In comparison, Australia exported 842,000 tonnes swt over the same period, back 22% year-on-year (DAWR)

Brazil has traditionally exported beef to markets where Australia has not had a large footprint – such as Hong Kong, Egypt, Russia, Venezuela, Iran and Chile – however it recently regained access to China and Saudi Arabia, Australia’s 4th and 8th largest markets on a volume basis in 2015, respectively. At a time when Australian beef supplies are tight, Brazil has overtaken Australia as the number one supplier of imported beef into China and now has greater market share in Saudi Arabia (second only to Indian buffalo meat).

In recent months, Brazil also regained access to the US market, following the determination that their animal health and food safety protocols met equivalence with US standards. Since then, Brazil has exported 127 tonnes swt and 200 tonnes swt to the US in September and October, respectively, in what appear to be test shipments (GTA/SECEX). Looking ahead, any future growth in Brazilian exports to the US will be limited by quota allocation (Brazil has access to the shared ‘other countries’ quota, currently totalling 64,805 tonnes) and a 26.5% out-of-quota tariff.

China

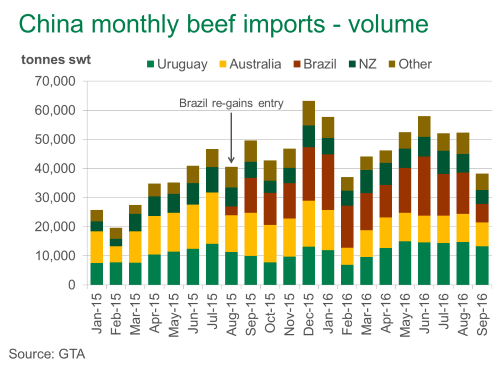

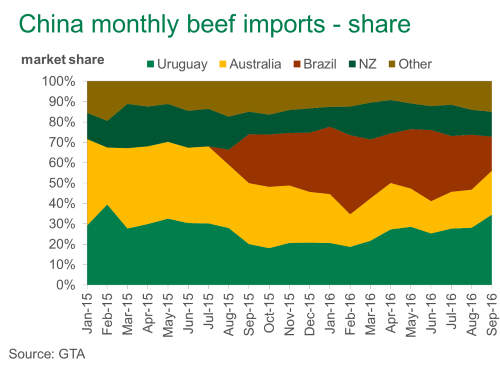

As illustrated in the figures below, Chinese imports from Brazil have expanded rapidly since the supplier regained access. Furthermore, at a time when Australian shipments to the market have reduced due to tight supplies, Uruguay has also increased exports and now has greater market share than Australia.

While overall Australian beef shipments to China are back so far this year, chilled product is steady and grainfed beef has increased 17% year-on-year, reflecting the access level of Australian beef (being the only export supplier of chilled product) and segments where product is differentiated.

While it is likely some Brazilian beef previously exported to Hong Kong has since been redirected to mainland China, overall exports between January and October to the entire region were up 51% year-on-year (China was up 116% and Hong Kong was up 20%).

Saudi Arabia

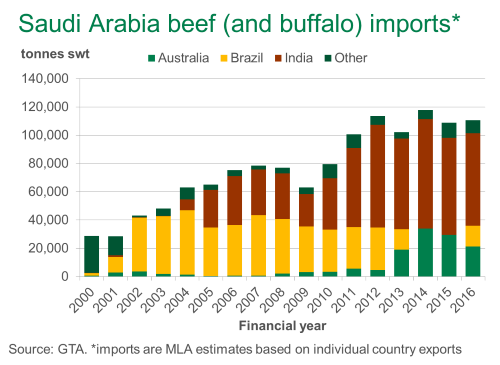

As illustrated below, Brazil lost access to Saudi Arabia in 2013 and Australia quickly made up the beef shortfall. Exports from both Brazil and Australia have tracked at close to 40,000 tonnes swt per year over the past decade, but since re-gaining access last year Brazil has returned to reclaim market share.

Brazilian exports this year-to-October to Saudi Arabia have totalled almost 24,000 tonnes swt, compared to nothing in 2015, while Australian shipments over the same period were just less than 10,000 tonnes swt, back 60% year-on-year.

As illustrated above however, India is clearly the dominant supplier into Saudi Arabia, with the majority of import growth in recent years into the market coming from the low cost commodity buffalo meat supplier.