Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Heavy lamb prices fall

25 June 2020

Key points:

- The heavy lamb indicator fell this week on the back of easing offshore demand.

- Despite a downturn in prices, further declines have been offset by local conditions.

- Light lamb prices remain elevated with store competition driving prices higher.

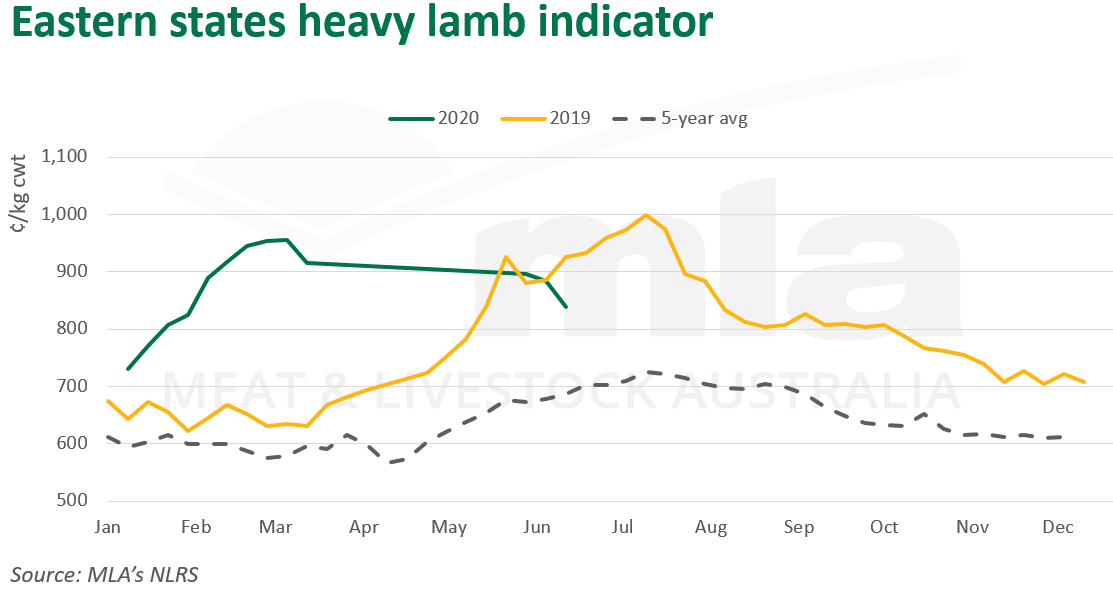

The heavy lamb indicator came off the boil this week, now tracking below year-ago levels and significantly back from the highs seen in March of this year. Ongoing global uncertainty, economic impacts and subdued foodservice demand have underpinned easing heavy lamb prices.

Despite tight supply, evidenced by the 28% year-on-year decline in yardings to 127,000 head last week, the eastern states heavy lamb indicator failed to find support, now back 87¢ to 838¢/kg carcase weight (cwt) on year-ago levels. With ongoing uncertainty in global markets and restrictions still in place, overseas demand, in particular from high-end foodservice, remains subdued.

Exports to the US – a key market for Australian heavy lambs – contracted 7% during May. This is the result of a decline in demand for Australian product and a backlog of lambs on feed in the US starting to hit the market.

Domestically, favourable conditions have continued to uphold prices, with increased feed availability causing a higher retention of lambs. For the week ending 19 June, eastern states lamb slaughter was reported 11% lower compared to year-ago levels at 275,600 head. Despite the aforementioned price decline, prices in June have remained above 800¢/kg, and well above the five-year average at 683¢/kg cwt.

Light lamb prices have maintained a premium over heavy lambs since March. Robust store competition continues to push the eastern states light lamb indicator higher, up 86¢ year-on-year to 900¢/kg cwt. Restocker buyers remain active in the market, incentivised by improved conditions and positive rainfall forecasts.

Looking ahead, heavy lamb prices will continue to be squeezed as demand uncertainty drives the current market trend. This could be exacerbated by an increase in lambs starting to enter the market from August onwards should the demand picture show no signs of a recovery. However, with African Swine Fever still prevalent in Asian markets and the overall supply of lambs anticipated to track below year-ago levels through winter, this should provide a cushion to prices.

© Meat & Livestock Australia Limited, 2020