Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Tight domestic supplies drive strong mutton prices

29 October 2020

Key points:

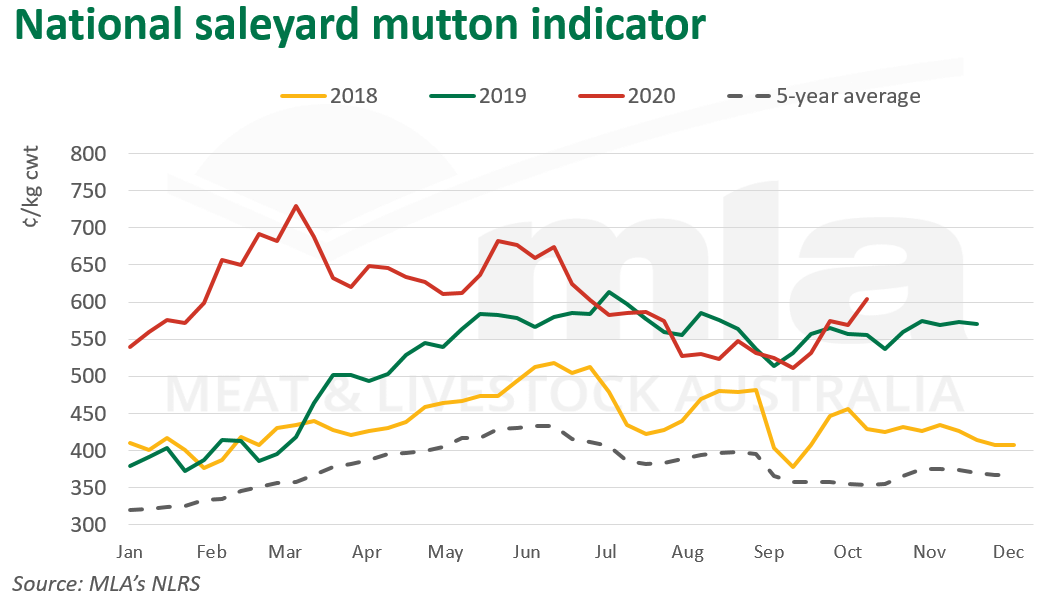

- The national mutton indicator has continued to track at historically high levels

- Demand remains steady despite volatile offshore market conditions

- Low supplies continue to support mutton prices

For the year-to-date the National Mutton Indicator has averaged 606¢/kg carcase weight (cwt), up 96¢/kg, or 19%, on the same time last year. This has largely been driven by price movements in the eastern states, which saw the Eastern States Mutton Indicator lift 15% year-on-year on Tuesday 27 October to 644¢/kg cwt.

While mutton prices have typically been buoyed by international demand, impacts of COVID-19 have seen key offshore markets moving through different stages of foodservice recovery, which is a major channel for Australian mutton. Coinciding with an appreciating Australian dollar, the flow of Australian sheepmeat exports has wavered in response to these headwinds. For the year to September, total mutton exports eased 21% on the same time last year to 95,900 tonnes shipped weight (swt). However, demand out of the US has strengthened, with year-to-September exports lifting 21% year-on-year to 14,500 tonnes swt.

This year has seen prices track at historically high levels, compounded by significantly low supply and steady demand. This reflects the national flock rebuild gaining momentum, with producers retaining a greater portion of breeding ewes and subsequently reducing the pool of available sheep. For the year-to-date, national sheep yardings averaged 2.5 million head, down 60% on the same time last year at 4.1 million head.

© Meat & Livestock Australia Limited, 2020