Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Exports subdued due to ongoing supply constraints

11 March 2021

Key points:

- Beef exports in February were back 28% on the same month last year

- Lamb exports to Qatar sharply down after removal of import subsidy

- China accounts for half of Australian mutton exports in February.

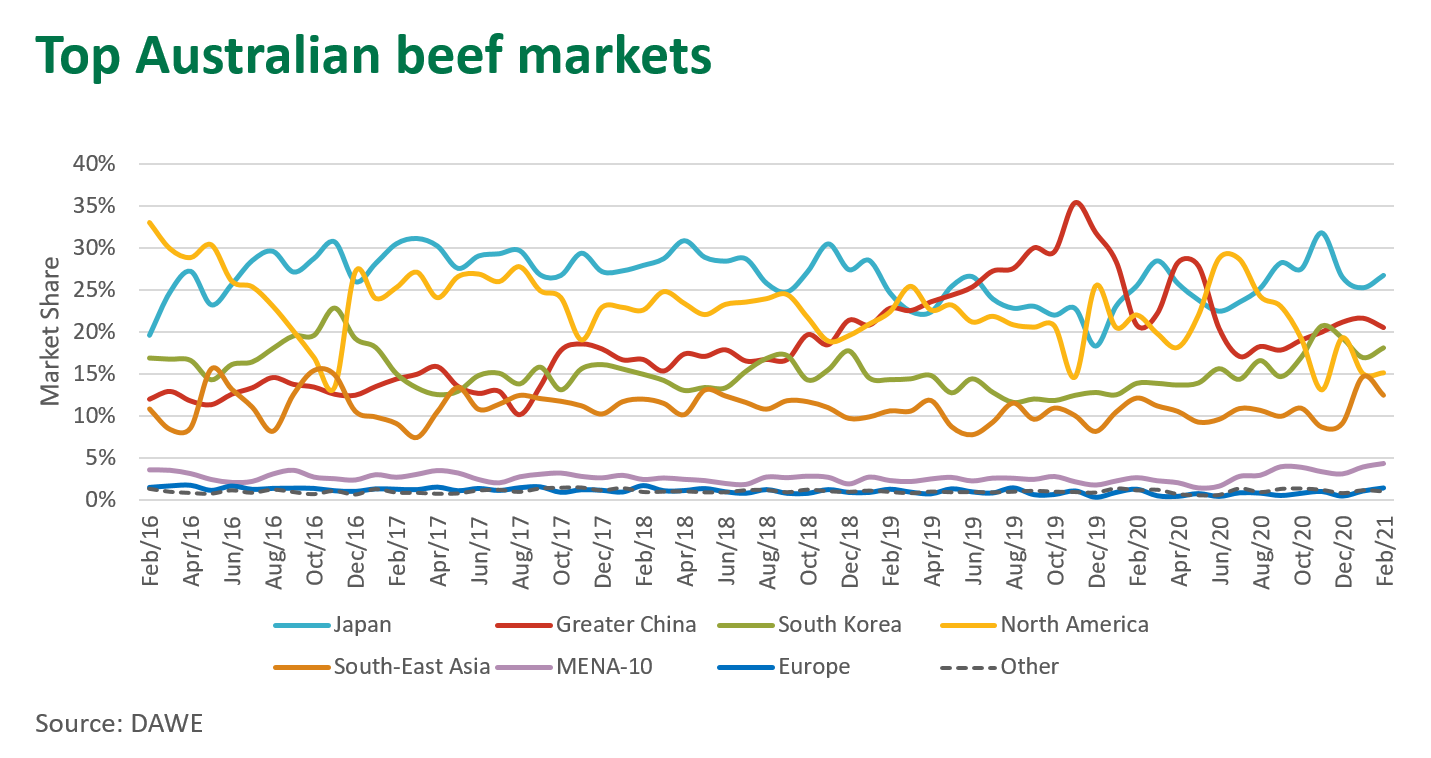

February red meat export figures were released last week, with subdued trade volumes largely influenced by ongoing low production levels. Beef exports in February totalled 67,000 tonnes shipped weight (swt), down 28% from the same month last year. Japan and South Korea were the top markets for the month, while trade to Vietnam and Saudi Arabia experienced decent month-on-month lifts, up 15% and 18%, respectively.

Beef trade to the US was down on year-ago levels – a trend that has unfortunately continued since July last year. High Australian cattle prices remain a challenge for US importers, combined with a weakened US exchange rate and low cattle slaughter levels in Australia. Furthermore, strong import demand from Asia, combined with some logistical challenges and disruptions to the supply of shipping containers down the US West Coast, are contributing to the slowdown.

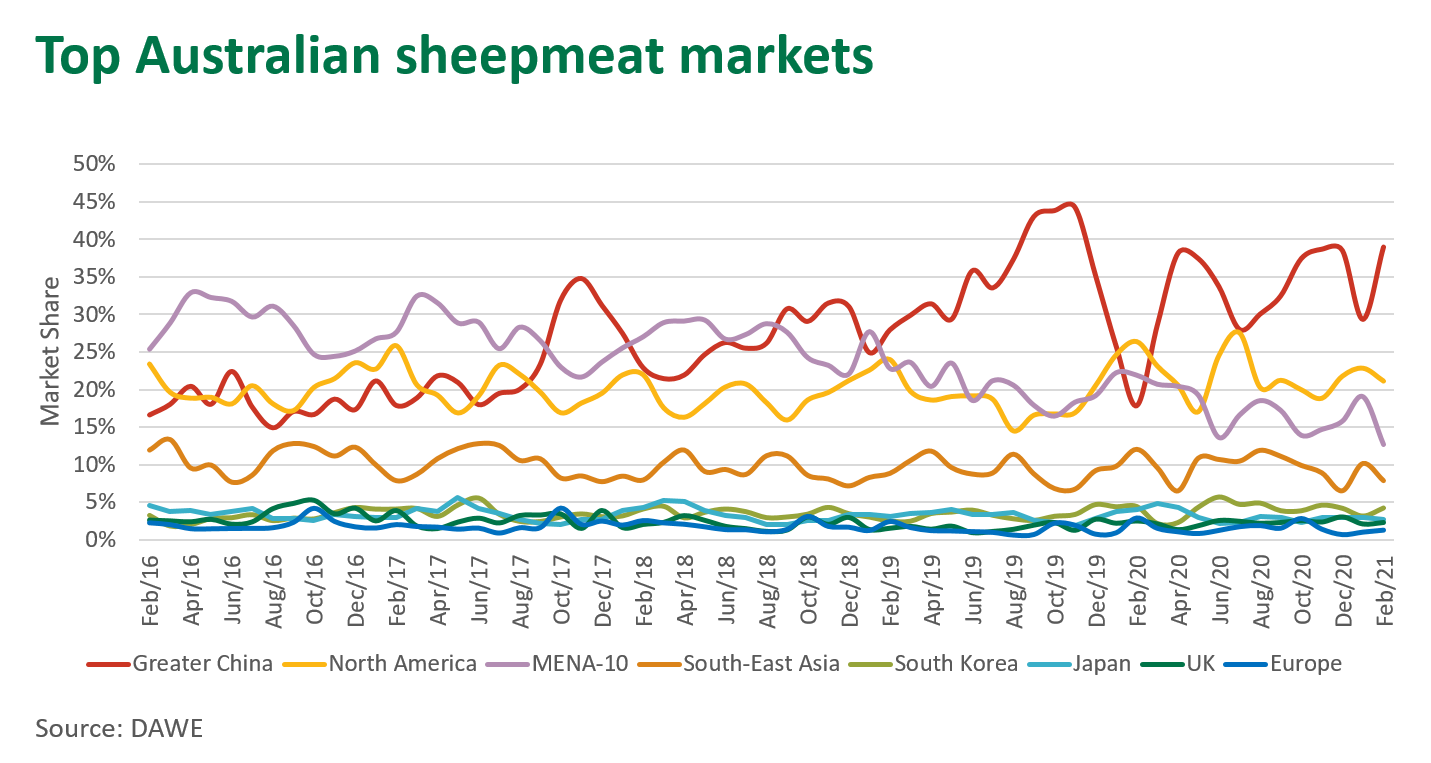

Turning to sheepmeat, lamb exports reached 21,600 tonnes last month, a decline of 9% on February last year, however, this was a marked improvement on the level of trade seen in January (13,600 tonnes swt). China was the major destination, taking 5,600 tonnes swt for the month, while the US was close behind with 5,300 tonnes swt. Lamb continues to perform well through retail channels across the US, with trade in February mirroring some of the good export volumes through the second half of 2020.

Unfortunately, lamb exports to the Middle East remain constrained relative to some of the levels seen early last year. Much of this is to do with the Qatari Government abruptly ending the subsidy on imported lamb, which came into effect at the end of December 2020. Australian lamb exports to Qatar averaged 1,600 tonnes swt per month through 2020, however, were just shy of 600 tonnes swt in both January and February this year.

For mutton, exports in February were 12,200 tonnes swt, back slightly from the 14,700 tonnes swt in February 2020. China remains the largest destination by far, accounting for over half of all mutton exports in February. Mutton exports to the Middle East did pick up, reaching 1,400 tonnes swt, marking the highest total since April last year. Mutton exports to Qatar are up 91% for the year-to-February (albeit off a low base), with importers evidently making a switch from buying lamb.

Goatmeat exports were 1,400 tonnes in February – fairly steady looking at the past two years, but well down on some of the volumes through 2016–18. Last month the US accounted for just over 70% of all goatmeat exports, with South Korea (12%) and Taiwan (8%) rounding out the top three markets.

© Meat & Livestock Australia Limited, 2021