How is global foodservice weathering the COVID storm?

Key points

- The foodservice sector is a critically important outlet for Australian red meat, but the pandemic has severely impacted its performance across markets.

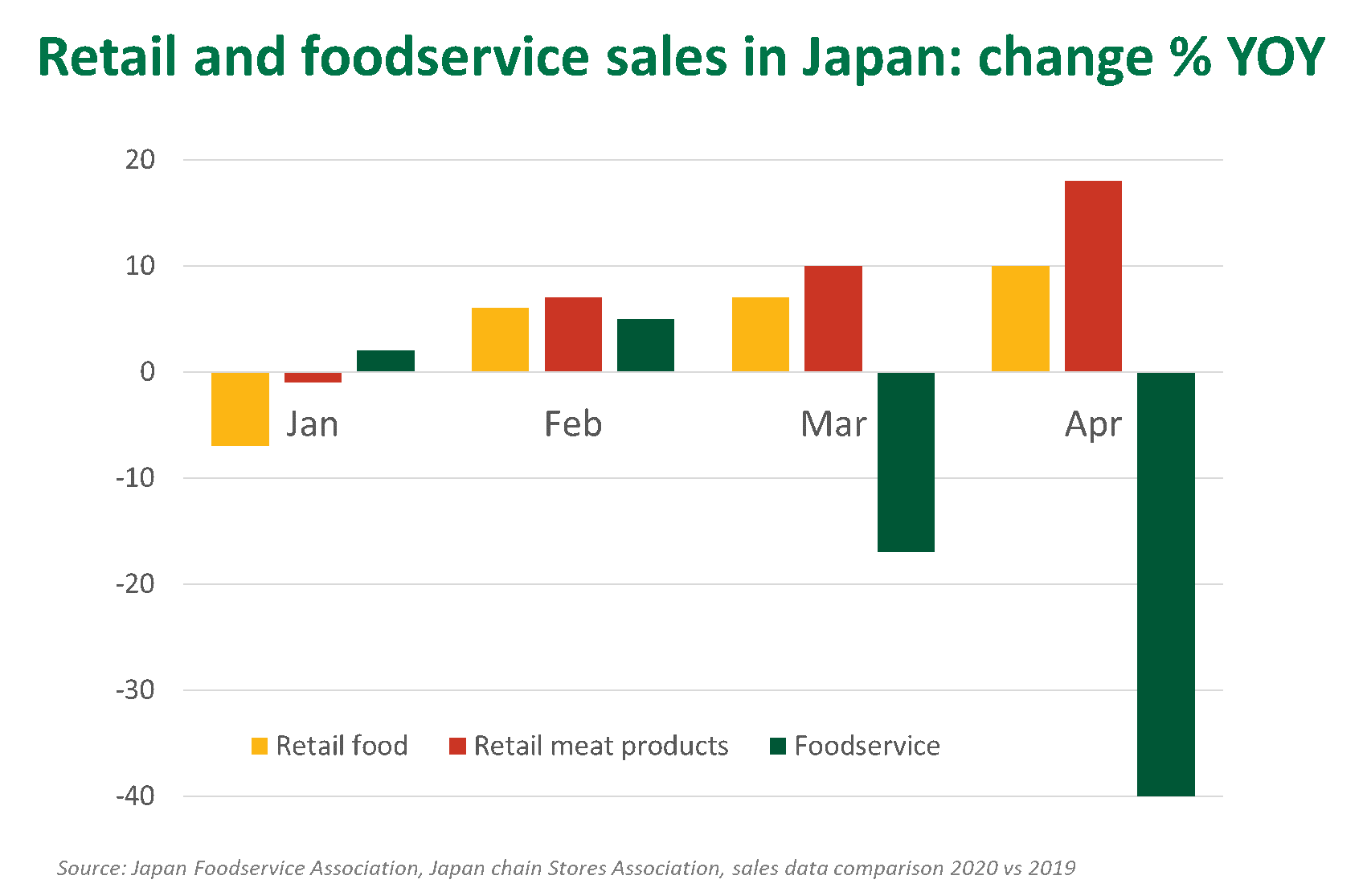

- Reduction in demand from foodservice is being partially offset by increased sales in retail.

- Consumer behavior towards foodservice will continue to be influenced by a number of factors.

- View a snapshot of the latest food trends in Japan.

Importance of foodservice sector for Australian red meat

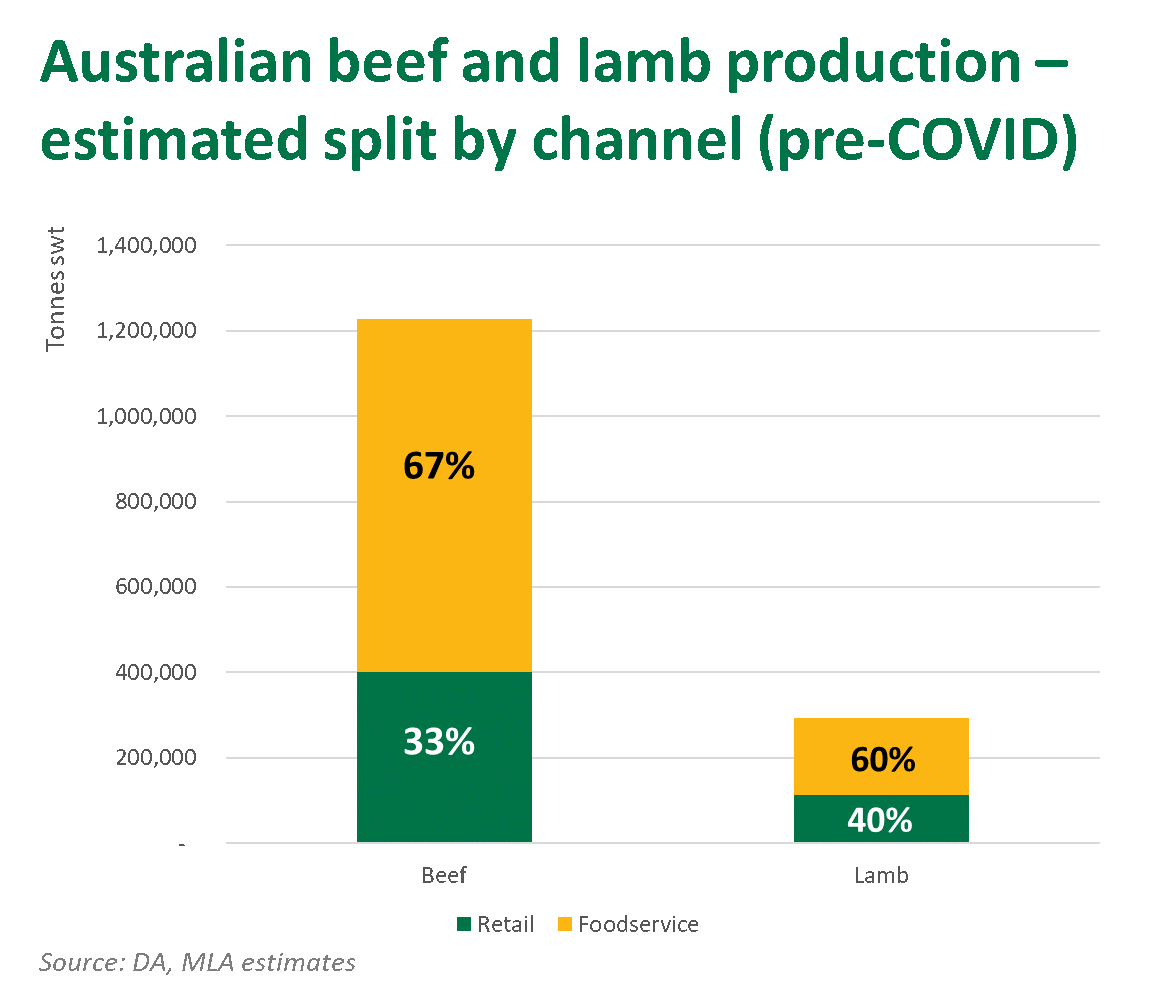

While the domestic market is the largest single outlet of Australian red meat, around three quarters of production was sent to overseas markets in 2019. Furthermore, MLA estimates that nearly two thirds of Australia’s exports are ultimately consumed within foodservice outlets. Performance of this sector is critical to the Australian industry, as it encompasses a diverse range of occasions – such as hawker markets and premium restaurants – and the products they require, ranging from offal, to manufacturing meat, to high end Wagyu. However, this sector has been the most impacted by COVID-19, with wide-scale shutdowns and operation restrictions across almost all countries in recent months.

Global foodservice hit by the pandemic

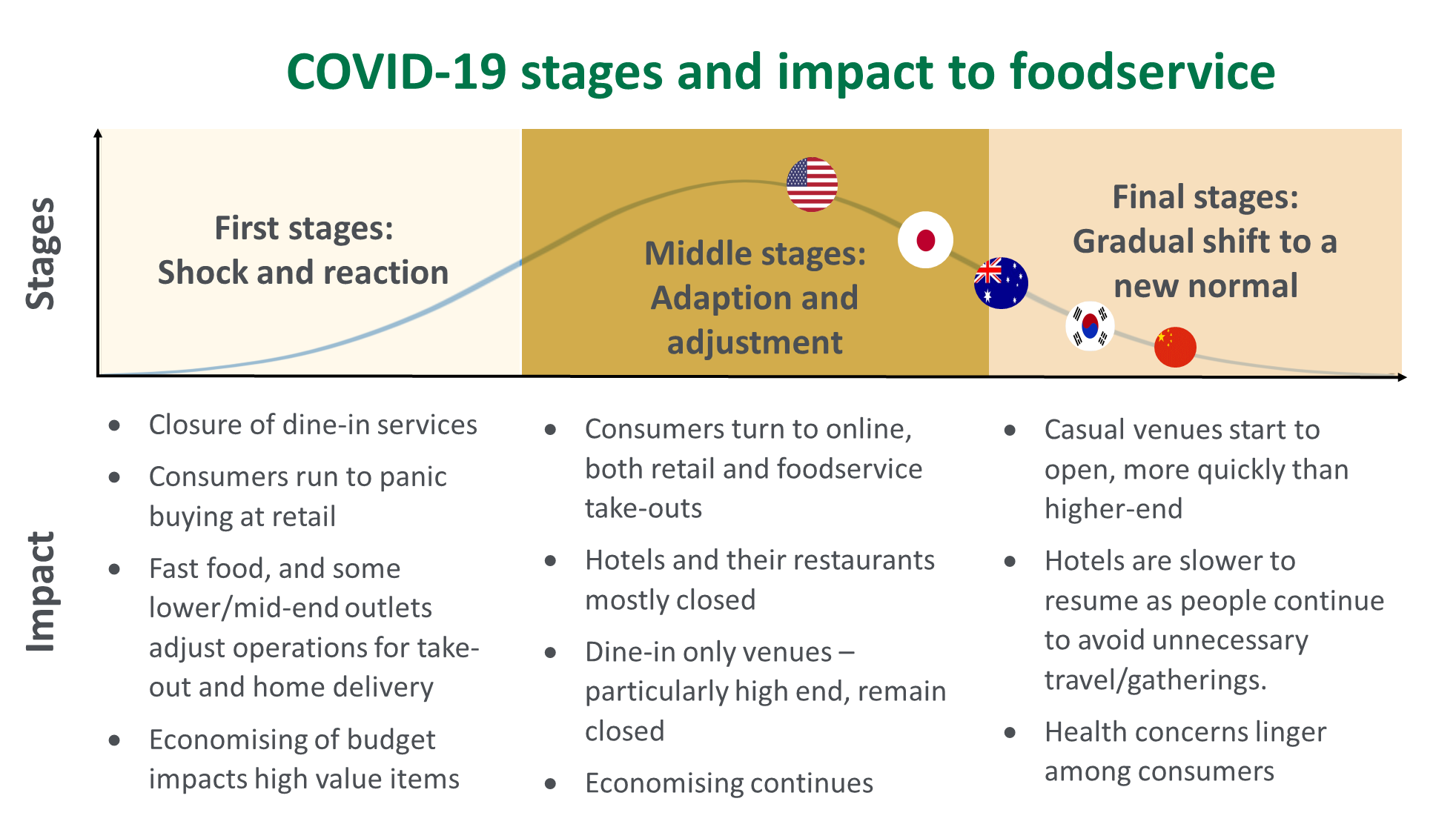

Globally, the impact of the pandemic to the foodservice sector is observed over three stages – ‘shock and reaction’, ‘adaption and adjustment’, then ‘gradual shift to new normal’.

Each stage directly impacts consumer sentiment, and while gradual easing of the pandemic situation and social distancing measures have started to appear in some markets, reports across the world indicates a long recovery journey for the foodservice sector. It is estimated that 2020 foodservice sales will decline around 13% globally, and early predictions suggest that fine dining impacts will last the longest, probably up to 18 months.

To date, since the outbreak of the pandemic, increased demand from retailers partially absorbed reduced usage of Australian red meat in foodservice – but in-market trade are also noting slowed interest in higher value cuts, as many consumers feel insecure about their economic future.

Those able to pivot performing stronger

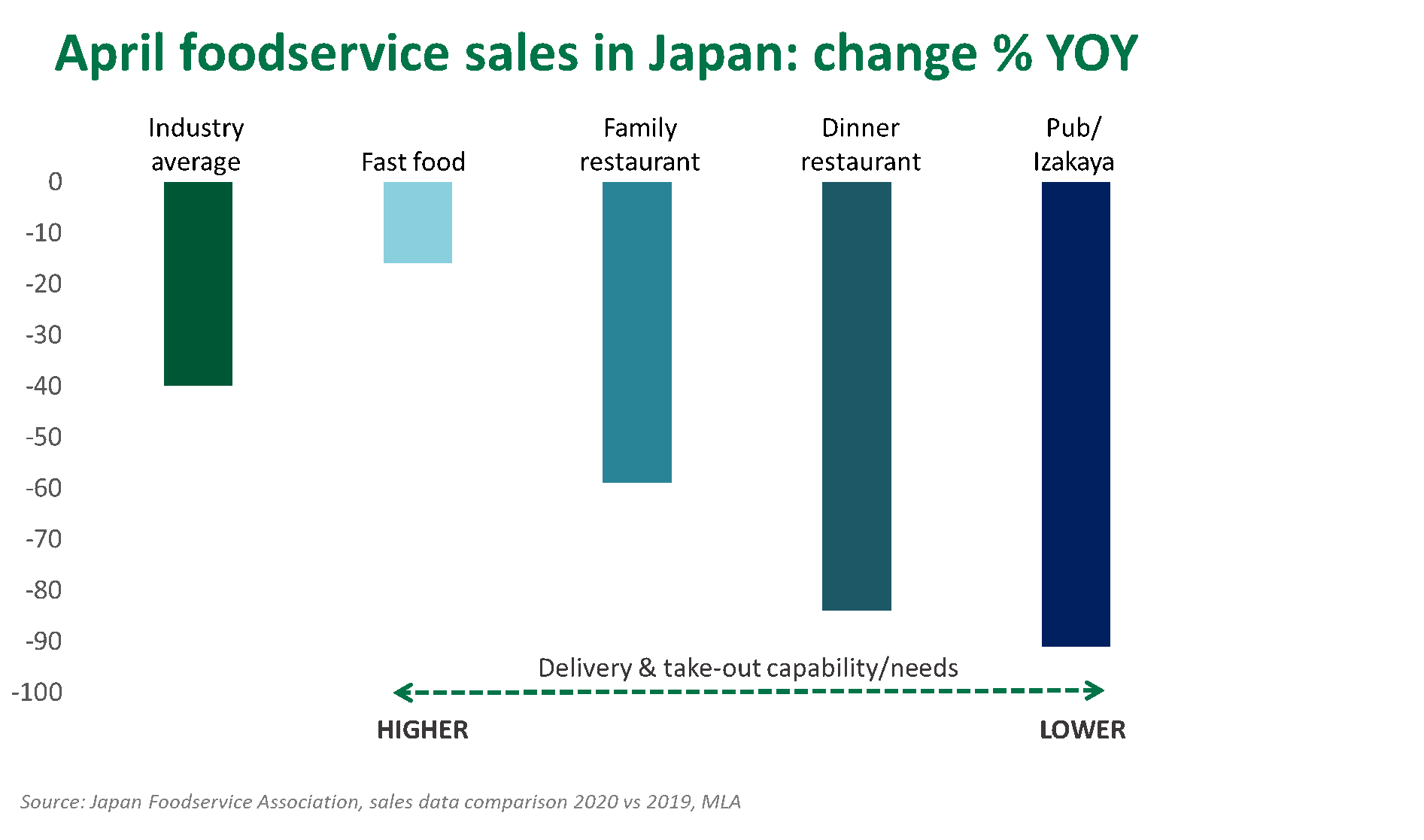

The performance of operators within the foodservice sector has varied quite significantly, but generally there is a consistent theme of those that can pivot to delivery/take out easily performing better as people are also chasing quick, easy and convenient options.

Typically QSRs, and casual to mid-tier restaurants have been the best at responding to these consumer needs, due to their ability to:

- switch from on-premises to off-premises quickly

- serving dishes that travel well, and

- minimal touch points when ordering and at the time of delivery

Changes to the way foodservice operates

There is no doubt that with the changes that have been imposed upon the foodservice industry, and the shifts in consumer behaviour caused by COVID-19, that in the future we will see an acceleration or emergence of certain trends. Some of the main ones that are expected include:

- Further shift to cashless/contactless systems (such as app based payment systems, remote ordering/pick ups)

- More ‘Ghost’ kitchens (cooking facility set up for delivery only meals)

- Increase automation in food preparation

- Hybrid operations – restaurants offering grocery, cooking meal kits and subscriptions

Consumers are the key for recovery

Looking ahead, there are a number of factors that will influence consumer sentiment towards foodservice, and subsequently its recovery. They include:

- Health concerns relating to the pandemic’s containment, easing of social distancing measures, and how safe/unsafe consumers would feel to visit dine-in venues

- Economic recovery – this will particularly be important for mid to high-end restaurants

- Experience during the pandemic (i.e. more cooking at home, trial of new offerings such as ready meals from retailers or meal kit delivery services)

Additionally, consumers’ choice of supplier, or perception towards Country of Origin (COO) in the post-pandemic normality will be an important indicator to watch for the Australian red meat industry, particularly in North Asia markets. There have been indications that the spread of COVID-19 reinforced consumers’ focuses on food safety and localism. This will mean there are opportunities for Australian industry to collaborate with local partners and support the recovery of the foodservice sector, underpinned by Australian beef’s reputation as a safe and quality protein among consumers.

For more on information on the foodservice channel and what is happening in Australian red meat markets, check out MLA’s latest ‘on the ground’ podcast here.

© Meat & Livestock Australia Limited, 2020