Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Stalling market demand impacts live cattle export prices

30 April 2020

Key points:

- The price of export cattle from Darwin to Indonesia has fallen to $2.80/kg.

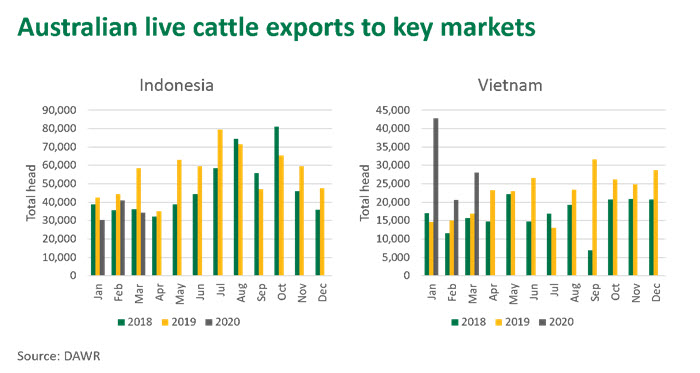

- Australian cattle exports in March totalled 82,500 head, down 16% on March 2019.

- Demand for top cuts of fresh beef through Indonesian festive period is expected to be restrained.

COVID-19 is hampering beef demand in Australia’s largest cattle export market, Indonesia. While Indonesia has strong fundamentals for increased beef consumption, short term massive social restrictive measures have suppressed sales and demand and the threat of a recession has flowed through to live export prices. Meanwhile, Vietnam, Australia’s second largest cattle export market, has been able to manage the COVID-19 outbreak reasonably well and Australia posted the highest first-quarter export numbers on record.

As Indonesia enters the month-long season of Ramadan (24 April – 23 May), the impact of COVID-19 measures will continue to hamper demand for meat across the country. Shutdown of foodservice outlets, reduced consumer spending and a nationwide restrictive measures have caused a demand shock that could not have been foreseen just two months ago. As the government has banned city dwellers from going back to their hometowns or villages this Eid Fitr, it is anticipated that beef demand – both fresh and frozen – would be more concentrated in major urban cities like Greater Jakarta.

Following the record $3.85/kg set in March, export cattle prices from Darwin to Indonesia have dropped to $2.80/kg, while quotes out of Townsville have ceased altogether.

It is not uncommon to see prices ease during April, with first round muster resulting in large numbers of cattle being made available for the export market. However, the continued uncertainty surrounding the socioeconomic implications of COVID-19 in Indonesia has contributed additional downward price pressure on export cattle. This has led the normally aligned Australian steer prices to become disjointed, with Darwin and Queensland prices falling out of sync with NSW, which has been more strongly supported by restocker demand following solid rainfall in the New Year.

COVID-19 restrictions expected to slow Indonesian beef demand through the festive period

Reports indicate Indonesia is facing challenges in containingCOVID-19 so far, with concern the economy could enter a recession. Given its very dense population, slow initial response and testing delays, Indonesia faces a multitude of headwinds in coming months and could be dealt a much slower recovery than other South East Asian nations.

March live cattle exports to Indonesia were just 34,000 head, back 16% on last month and down 41% on March last year. A combination of high Australian cattle prices earlier in the year and a weak Indonesian exchange rate against the USD have contributed to the decline. Additionally, feeder cattle demand from Indonesian feedlots is sluggish, attributed to a COVID-19 slowdown in abattoir activity – slaughter is running 30-50% below typical levels – and an uncertain consumer outlook. As a result of reduced slaughter, ample supplies of cattle are currently in Indonesian feedlots, likely sufficient to meet requirements through the Ramadan and Eid Fitr period, provided the downstream supply chain can function appropriately.

Understandably, this demand uncertainty has importers feeling cautious. With COVID-19 movement restrictions, business closures and reduced consumer purchasing power, demand for beef through the festive period will likely remain subdued relative to typical years.

A recent McKinsey Global Institute study on Indonesian consumer sentiment highlighted that job security is a big point for concern and people are now being very careful with their spending. At the same time, about half of consumers surveyed remain optimistic about a speedy economic recovery, particularly as social-restrictive measures ease. Food remains a core expenditure and with the pandemic, consumers are educating themselves and being more particular about what they are consuming. Food safety, quality control and traceability (origin) discussions have been prominent in the digital channels, particularly as some businesses, including wet market traders and supermarkets, have taken to sell fresh produce – including beef – online. While this online channel currently represents only a very small portion of the trade, it offers a potential opportunity for businesses to put more investment into cold chain, quality assurance and control initiatives within their supply chain processes – and therefore offer a better differentiated product – from their competitors.

While softer demand and logistic disruption has led to some short-term price instability, there remain strong fundamentals for increased red meat consumption in Indonesia. If Indonesia can weather this initial COVID-19 shock and move into a recovery stage, export prices should improve as slaughter levels normalise.

Vietnam’s rapid response appears to be controlling COVID-19

Vietnam was very proactive in their response to COVID-19, taking cautious measures to supress the spread of the virus. While tighter regulations may temporarily slow demand, if Vietnam continues with its diligent approach, the economic impact will likely be lessened and typical purchasing behaviour may return more promptly.

Vietnam demand for cattle continues to drive ahead, taking 28,000 head in March, with first quarter exports up 97% on 2019 to a record 91,500 head. Vietnam continues to struggle with outbreaks of African Swine Fever (ASF), which has impacted local meat supplies and supported demand for imported cattle. Vietnam continues to build its supply of feeder cattle, with 10,000 head being exported from Australia in March.

Vietnam is heavily reliant on regional movement of livestock from as far as Myanmar through Thailand, Cambodia and Laos. Restrictions in movement of people and goods across land borders in the region will be having an impact on the movement of all livestock throughout the whole region. The full impact of this is yet to be seen and difficult to quantify as the trade is largely unofficial.

With low levels of infection so far, Vietnam appears poised to return to more normal business conditions fairly soon, barring a significant COVID-19 outbreak. With a growing gap between local production and consumption (led by a young and urbanising population and the impact of ASF), Vietnam will remain an important market in supporting live export cattle prices.

© Meat & Livestock Australia Limited, 2020