Australian red meat exports: 2022 in review

Australian red meat exports were faced with turbulent global conditions throughout 2022. While there were hugely positive developments, such as signing trade agreements with India and the UK, there was also a string of natural disasters, war and the onset of inflation, all of which have shaken consumer confidence in Australia’s major export markets.

Despite this, Australian red meat exports performed strongly in 2022, with record lamb exports offering a window into 2023 for beef producers and exporters.

Beef

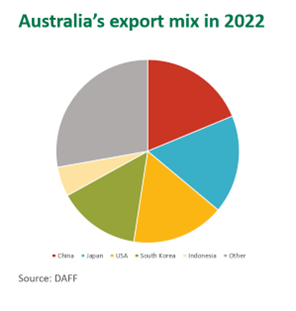

Beef exports totalled 854,596 tonnes for the year, down 4% from 2021 and the lowest total exports since 2003. Export volumes fell in most major markets, with Japan and the USA each falling 8%, South-East Asia and the Middle East North Africa (MENA) region falling 6%, and South Korea falling 3%. The exception was China, where beef exports rose by 7% to 158,000 tonnes for the year.

Despite this, high demand led to strong prices for beef exports. Prices peaked in June at A$12.07/kg and averaged A$11.09 for the year-to-October, meaning that in value terms, Australian exports had the biggest year since 2019, even as supply was substantially smaller.

These high prices came in the face of some of the strongest competition exporters have ever seen in our biggest markets. As the US herd liquidation deepened, cheap American beef flooded into Japan and South Korea, giving the US their largest market share in 20 years in both markets. At the same time, Brazilian exports ramped up massively to become the main supplier of beef in China, now solidly the world’s largest beef importer.

Australian exporters have responded by emphasising what makes Australian beef different, especially regarding traceability, product consistency and taste. This has allowed Australian beef to maintain a premium image in the global market, even with constrained supply.

Lamb

In contrast to beef, Australian lamb exports were up 7% from 2021 to 284,257 tonnes, the largest export figure on record. The US and China remained the two largest export markets, with exports to the US growing by 6% to 75,453 tonnes and China falling 6% to 52,151 tonnes. These two markets took 45% of total lamb exports and represent huge opportunities in the future, as lamb consumption is still relatively low, especially in the US.

Another key insight into Australian lamb exports in 2022 is the increasing diversity of export locations. South Korea and Papua New Guinea were the third and fourth largest export locations for the year, and exports grew by 60% and 68% respectively to 22,901 tonnes and 21,901 tonnes. At the same time, exports to smaller markets like Fiji, Switzerland and Ghana recorded +15% lamb export increases, and important beef markets like Japan are also getting a taste for Australian lamb.

Like beef, lamb prices were strong for the year, peaking at A$12.17 in June and averaging A$11.53 for the year-to-October.

Mutton

Mutton exports were similar to lamb, growing by 2% for the year to 144,005 tonnes. The main difference was that exports to the five largest markets fell by 4%, mostly due to US exports falling by 23%, while other exports rose by 25%, representing a major diversification of export markets. The top five markets still account for more than 75% of Australia’s exports, but growth in varied markets could make Australian exports more resilient to external shocks in the future.

Looking ahead

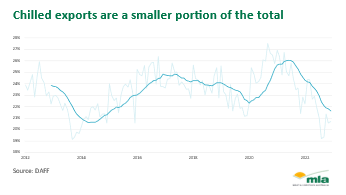

An interesting trend has been a shift in storage modes, with chilled exports making up the smallest share of exports since 2015. As supply chains’ reliability has improved over the past six months and is expected to continue to improve, we can expect that percentage to begin rising, which is likely to support higher values in our red meat exports.

The next year is looking positive for the red meat industry broadly, as herd liquidations in the northern hemisphere are likely to moderate or stop altogether as drought in livestock-producing regions begins to fall away. This would happen as Australian production ramps back up, supported by years of solid conditions on-farm, creating strong opportunities for exporters over the next year.