High mutton prices: what’s driving the spike?

Key points

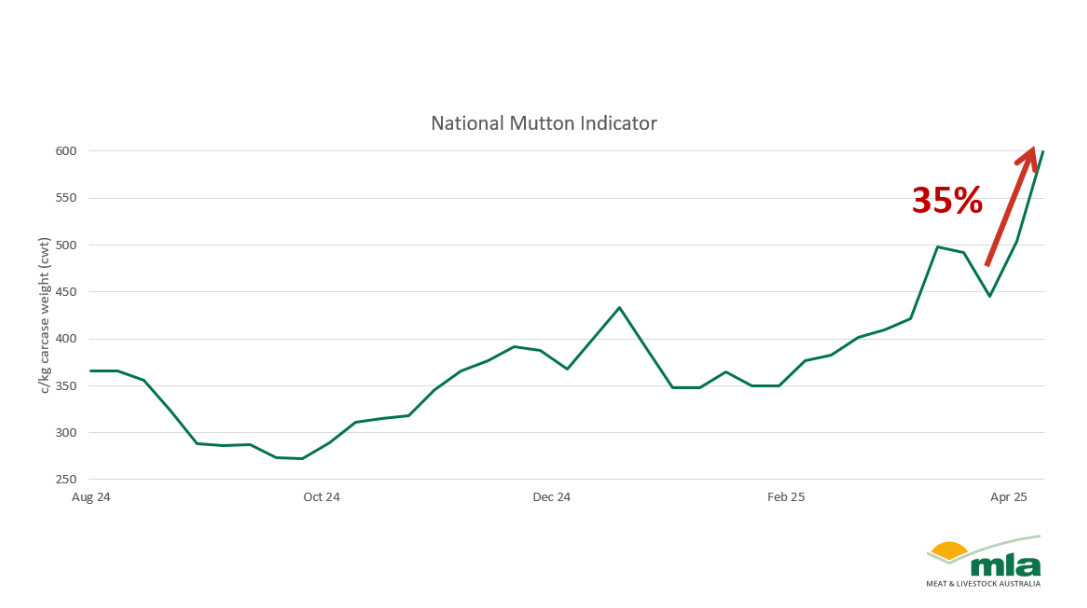

- Mutton prices have lifted 63¢ since the previous week.

- Prices are currently the highest they have been since June 2022.

- There continues to be volatility in the mutton market.

This week, the Mutton Indicator experienced a sudden rise in prices, likely driven by competitive bidding after the Easter break.

Last month, the mutton price surged by 112¢ to 550¢/kg carcase weight (cwt), however, the price was not maintained, leading to prices dropping to 430–450¢/kg cwt. This growing volatility may drive producers to sell more mutton and take advantage of the market.

Last week at Wagga, a long bidding war for heavy sheep resulted in an average of 577–622¢/kg cwt. In Bendigo, heavy sheep prices lifted from 680¢/kg to 720¢/kg cwt due to increased competition from a northern exporter, leading to certain buyers being unable to fill orders. This resulted in the national mutton prices lifting by 63¢ to 625¢/kg cwt, marking the largest lift in mutton prices on record in the past two weeks. Prices are currently the highest they have been since June 2022.

Processors are currently under pressure to fill kill space as lamb prices continue to rise and average 850¢/kg cwt, so certain buyers are being priced out of the market and are now looking for mutton to fill that space. However, this competition to fill processor space has driven the mutton price upwards.

Factors like climatic conditions and market confidence play the biggest role in producer decisions. For example, poor seasonal conditions in SA and Victoria resulted in producers offloading mutton, particularly heavy mutton, to saleyards due to the lack of feed available. As producers decide to offload more mutton at favourable prices, it is likely they will eat into the breeding flock.

With continued market volatility, producers will likely try to take advantage of the market and sell off any unproductive sheep or reduce stocking rates.

Attribute content to Emily Tan, MLA Market Information Analyst