Some relief for lamb prices amid changing processor demand

Key points

- Lamb indicators have felt some form of relief over the month.

- Lamb and mutton prices show we are operating in a unique environment.

- Weekly mutton slaughter dips below 2022 numbers for the second time this year, noting a shift in processor demand away from mutton.

Prices

Looking at the past four weeks, all lamb indicators have felt some form of relief as weekly prices have increased over the month.

- Heavy lamb indicator is up 11%, at 504.69¢/kg cwt.

- Light lamb indicator is up 32%, at 386.09¢/kg cwt.

- Merino lamb indicator is up 35%, at 318.76¢/kg cwt.

- Restocker lamb indicator is up 20%, at 336.65¢/kg cwt.

- Trade lamb indicator is up 12%, at 486.52¢/kg cwt.

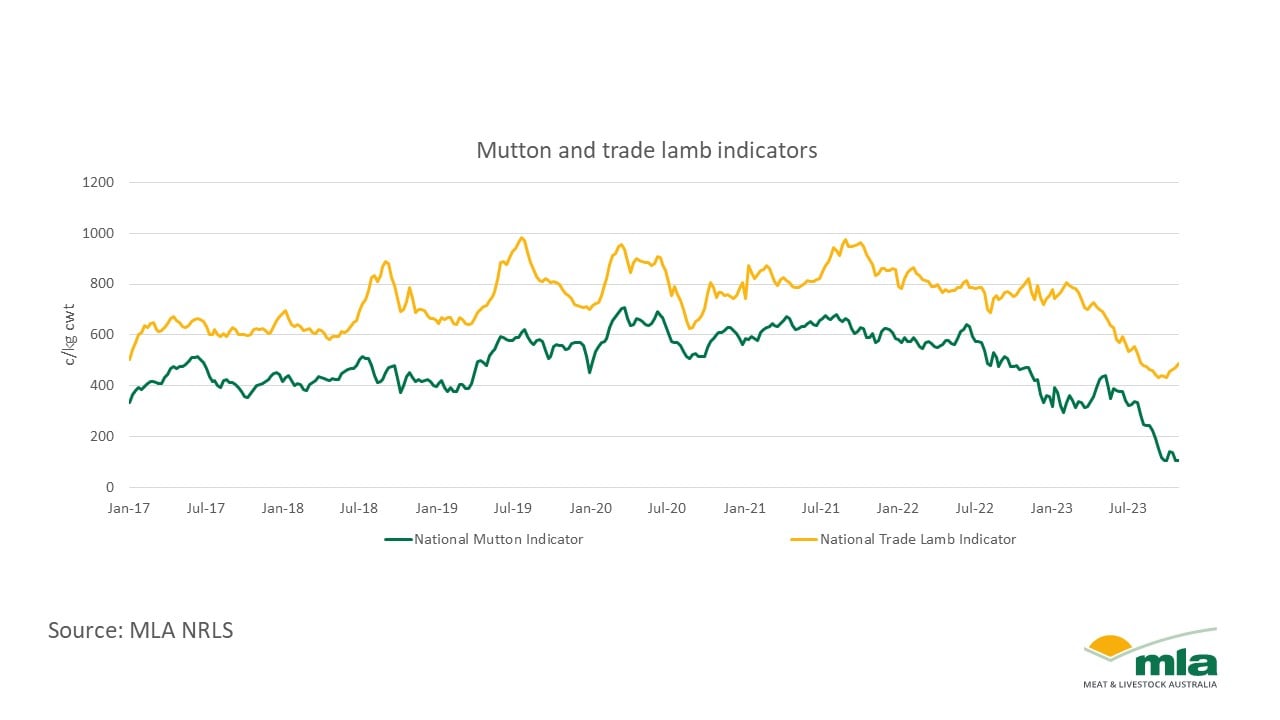

Mutton prices are not having the same small relief as the lamb indicators. The national trade lamb indicator and the national heavy lamb indicator have both experienced their fourth and fifth consecutive week of a price increase, respectively. Alternatively, after a small lift in prices through the month, the mutton indicator is back at 104¢/kg lwt with a 0% change to the weekly price from one month ago.

Slaughter

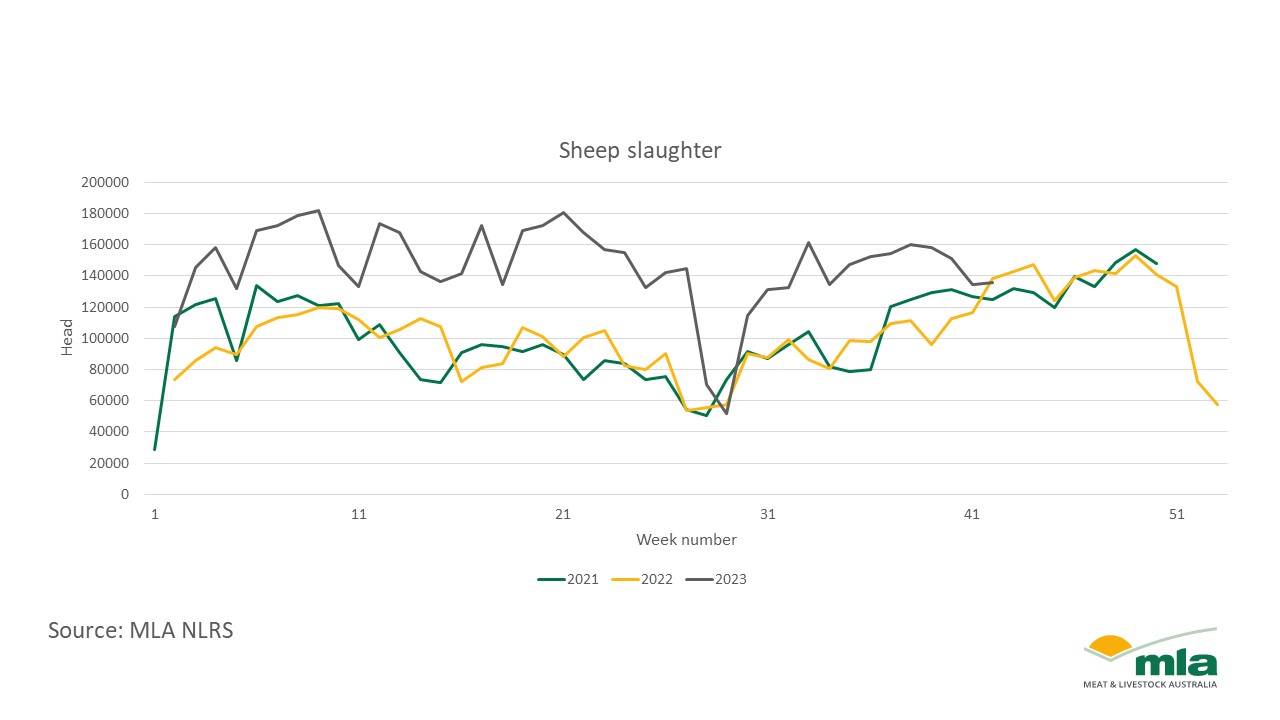

The National Livestock Reporting Service (NLRS) gathers weekly slaughter data voluntarily supplied by processors across the country. Looking at the slaughter figures, we can gain an understanding of processor demand for certain stock. Trade lambs represent a finished animal between 20–26kg cwt, acting as the best indicator to understand a processor product.

Week to week, there has been an 8% rise in lamb slaughter and a relatively unchanged (<1%) demand for mutton going through to processors. This difference in processor demand is translating through to prices.

Mutton slaughter has been regularly higher than 2021 and 2022 levels, however two weeks ago it dipped below 2022 numbers for only the second time this year, reinforcing this shift in processor demand away from mutton.

Operating in an irregular environment

The prices this year show that we are operating in a different environment. Generally, mutton prices peak in July when slaughter numbers drop. After this peak, mutton prices tend to fall quickly entering the spring season after lambing and weaning when dry or cull ewes enter the market. Trade lambs follow a similar cycle, peaking in July/August, easing over the spring flush period, and recovering towards the tail end of the year.

In a typical cycle, we would expect a recovery of the mutton price beginning in October. As we are not operating in a regular season, this price recovery has yet to be evident.

Prices continue to vary as the market remains unpredictable. However, after over a year of considerable and consistent price easing, this break could indicate a slight change in confidence in the market and a steadily increasing demand from processors for a finished product.

Please note: the data in this article is accurate as at 25 October 2023.