Producers plan flock reductions. Why?

27 June 2025

Key points:

- Survey reveals 41% of producers plan to reduce breeding ewe numbers.

- Sheepmeat sector sentiment moves positively across all states, driven by market over climate.

- Weather and seasonal conditions are the top off-farm decision-making drivers.

Producers plan significant flock reductions

The Meat & Livestock Australia (MLA) and Australian Wool Innovation (AWI) May 2025 Sheep Producers Intentions Survey (SPIS) revealed 41% of surveyed producers plan to reduce their breeding ewe flocks. Additionally, 20% of that group intend a 25% reduction.

These adjustments are due to pressures brought by persistent drought conditions in SA, Victoria and southern NSW. Reduced pasture availability and higher feed costs make it increasingly difficult for producers to maintain larger flocks.

In WA, uncertainty around future market access and the looming live sheep export ban have made producers cautious about flock expansion. This has led to most producers (58%) indicating breeding ewe flock reductions. This regional concern underscores the broader need for adaptability and strategic planning across the sector.

Nationwide positive sentiment movement

Despite intended flock reductions, responses show a national net sentiment score of +52 for the sheepmeat industry. This is the first time since October 2022 where all states have reported non-negative sentiment. WA has moved from a -64 net sentiment in May 2024 to a current 0 net sentiment.

Key on- and off-farm decision drivers

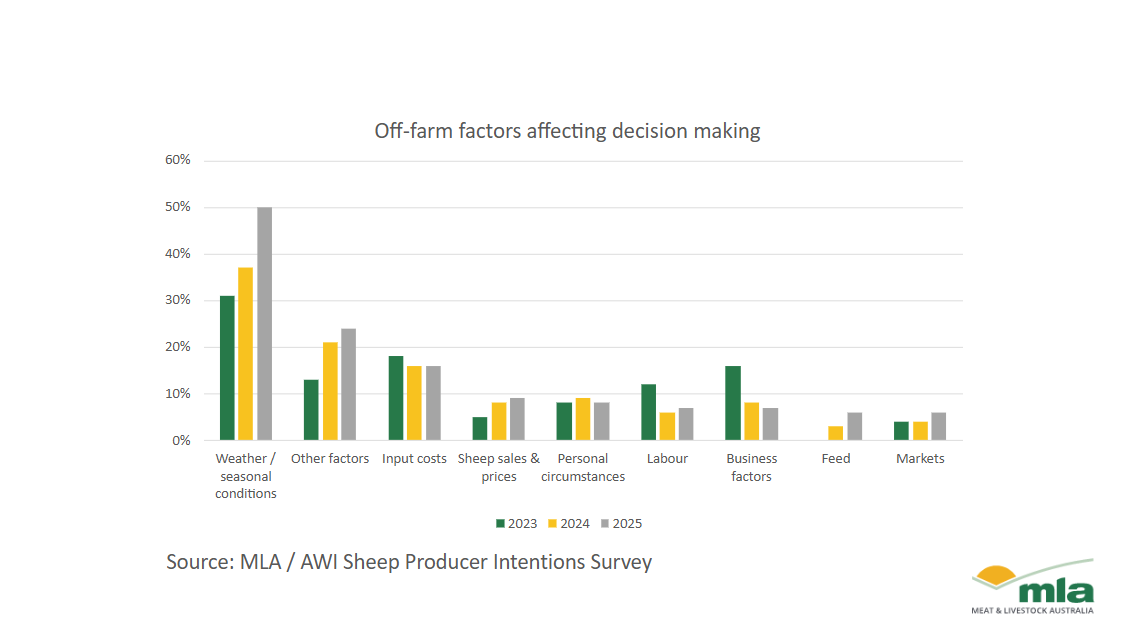

The SPIS gathers information about the drivers of producers’ on- and off-farm production decisions. It revealed, again, weather and seasonal conditions remain the most significant off-farm concern. Additionally, the percentage of producers highlighting them has dramatically increased from 31% in 2023, to 50% in 2025.

Other increasing producer concerns included government policy/regulations/taxes/levies/election, live export trade/ban and abattoir/processor issues. These increased from 13% in 2023 to 24% in 2025. This shift in concerns has reduced the decision-making drivers related to labour issues and business factors.

The complete May SPIS report offers a comprehensive data overview to help stakeholders understand the industry’s direction and what is required to support producers through transitional periods. This makes it an essential resource for producers, processors and policymakers.

Read the Sheep Producers Intentions Survey May 2025.

Attribute to: Erin Lukey, MLA Senior Market Information Analyst