New Zealand flock decline an opportunity for Australian sheep producers?

Key points

- NZ flock decline may provide an opportunity for Australia to capitalise on typical NZ markets.

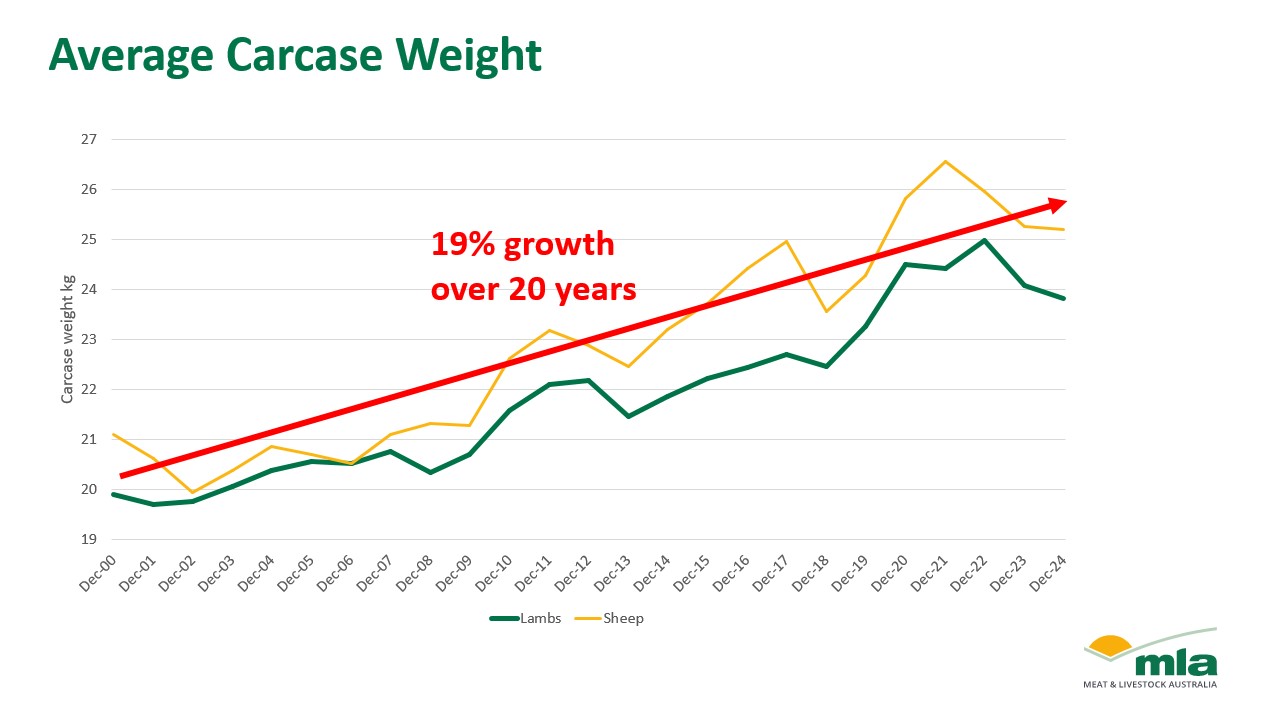

- Australian carcase weights have recorded a steady increase in lamb carcase weights driven by production systems, the expansion of feedlots and processor grids.

- Carcase weights have lifted by 19% in the past 20 years in Australia.

Australia have recorded a steady increase in lamb carcase weights, driven by improvements in genetics, feeding strategies, and evolving market signals. In Australia, the average sheep and lamb carcase weight has risen significantly. This upward trend is largely influenced by enhanced production systems, the expansion of feedlot finishing, and pricing grids that reward heavier animals.

In dry conditions, where feed availability is limited and turn-off decisions become more complex, this emphasis on weight can further encourage producers to push animals to finish at heavier weights, lifting average carcase weights. Without alternative signals, this feedback loop continues to reinforce a production pattern driven more by grid incentives than seasonal realities.

Australian carcase weights, for both sheep and lamb, have lifted by 19% in the last 20 years. The pursuit of heavier carcases has led Australian lamb carcase weights to continue to grow. This has been driven by the United States (US) market, which encourages carcases 30kg and above.

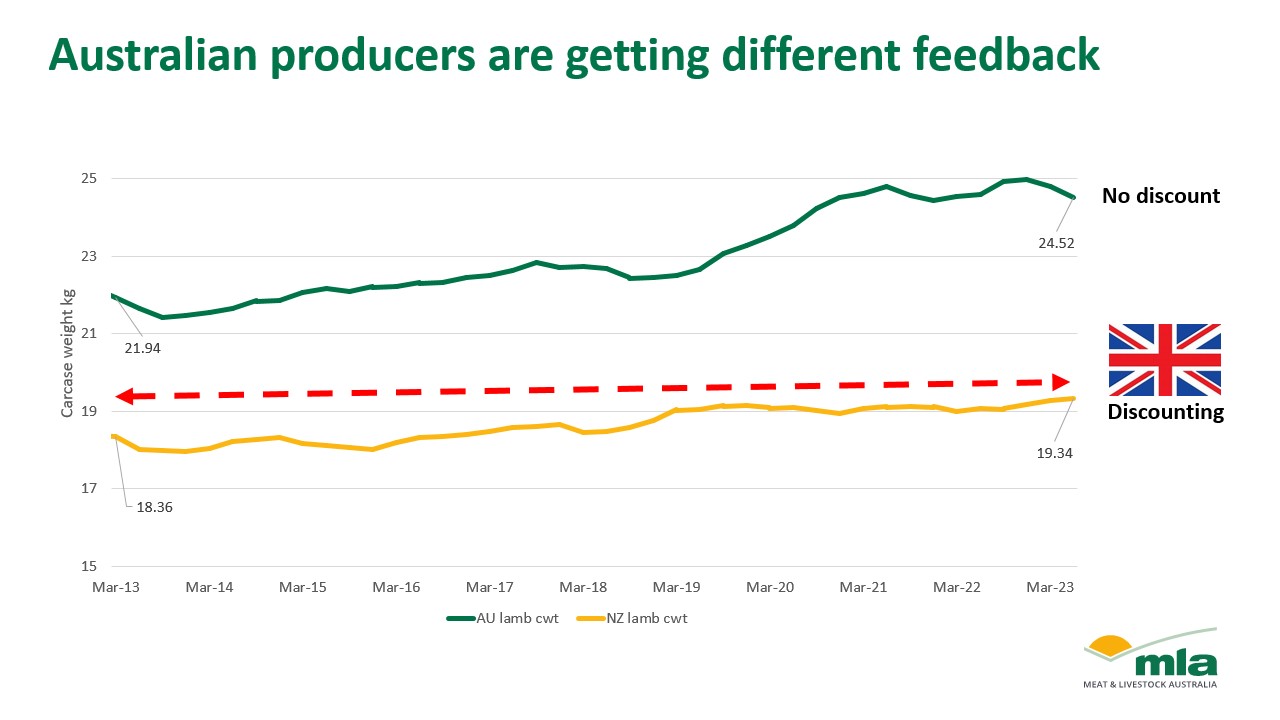

Carcase weights in New Zealand (NZ) have remained stable in the last 10 years. NZ processors have been discounting carcases over 20kg because of the markets that they typically export to. The United Kingdom (UK) typically prefer lighter carcases, resulting in the market behaviour witnessed from NZ processors.

In 2024, New Zealand sheepmeat exports fell 1.5% to 399,803 tonnes carcase weight equivalent (cwe). This decline is expected to continue in 2025 due to a smaller flock, reduced processing capacity and historically low lamb numbers.

Given the reductions in NZ processing capacity and reducing flock size, lower production and export volumes are expected in the medium term. This will provide an opportunity for Australia to capitalise on typical NZ markets, however, processors need to be effectively able to cater to both the US and UK markets and reward producers effectively.

Attribute content to Emily Tan, MLA Market Information Analyst