What impact does production have on retail prices?

Key points

- High production volumes have little impact on retail prices.

- Retailers are willing to pay more for a consistent product.

- Both the cattle herd and the sheep flock have gone through significant periods of change over the past 10 years, boosting carcase weights.

Cattle

Cattle production in 2024 reached 2.57 million tonnes, returning to 2014 levels of production. Despite this, the cattle landscape has evolved substantially over the past decade:

- In 2024, only 8.3 million head were slaughtered – 1.1 million head fewer than 2014.

- Improvements in genetics and growth in the lot feeding sector have resulted in carcase weights lifting by 33kg over 10 years, to 309.8kg (Figure 1).

Figure 1: Production and carcase weights for cattle from 2005 to 2024

When examining the impact of domestic production volumes on retail prices, there is a positive trend in price – retail prices have lifted by 36% to $25.95/kg according to the Australian Bureau of Statistics (ABS). Reduced volatility provides certainty for the market, so the challenge lies in maintaining a consistent supply amid continually shifting seasonal conditions.

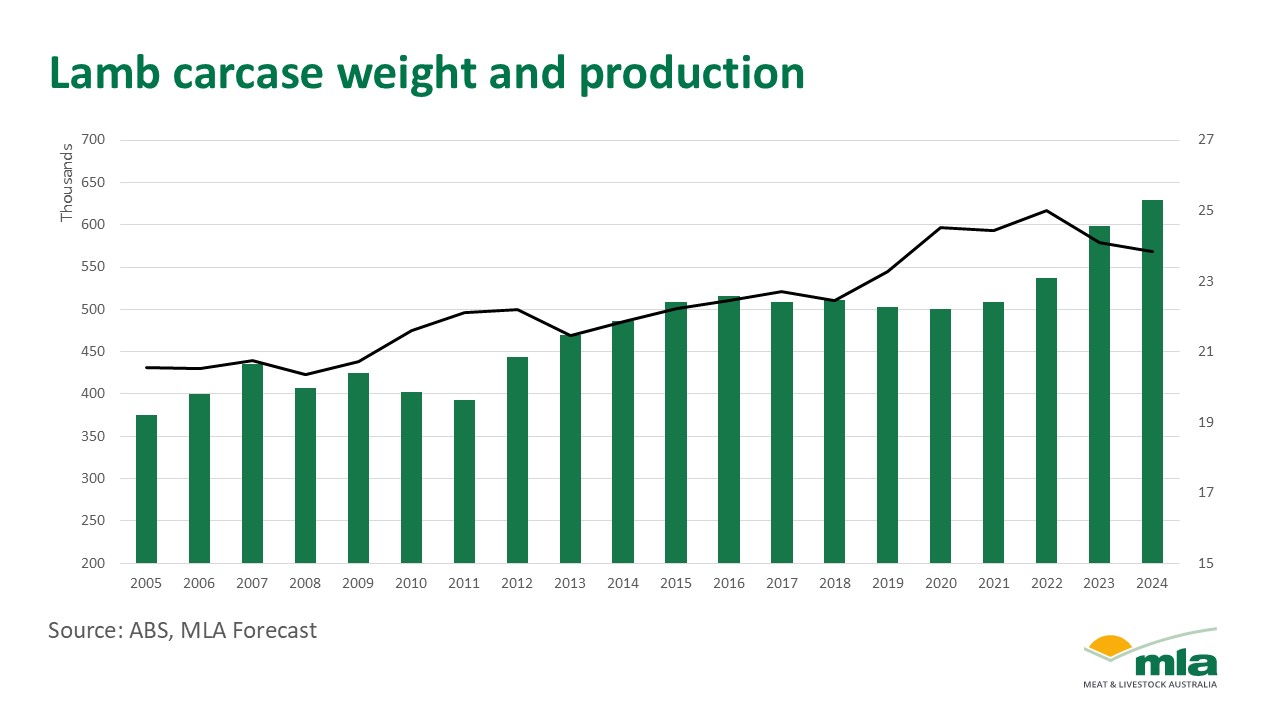

Lamb and sheep

Lamb production in 2024 entered uncharted territory, reaching its highest point on record at 629,385 tonnes.

According to basic economic theory, more supply will put downward pressure on prices, assuming demand remains stable. Despite record production volumes in 2024, both retail and saleyard prices remained steady. This stability is largely due to most lamb not being intended for the domestic market. Differences in carcase specifications between domestic and international markets mean that much of the additional supply is better suited to export.

Figure 2: Lamb carcase weight and production from 2005 to 2024

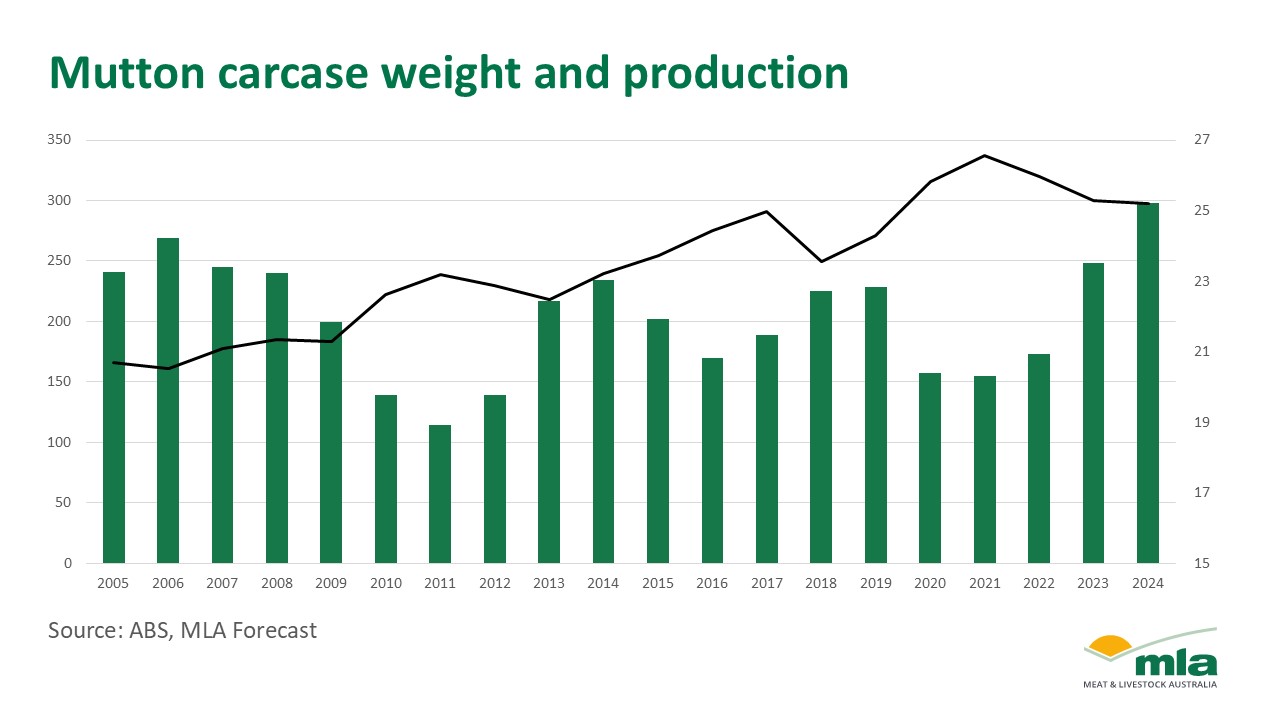

Mutton followed a similar trend to lamb in 2024, with production reaching 269,415 tonnes. Over the past 10 years, there’s been a fundamental shift in the sheep flock that has improved fertility and productivity – the mass move from Merinos to shedding breeds. When compared to its previous production peak in 2006, the sheep flock experienced a reduction in slaughter by 1.4 million head.

Figure 3: Mutton carcase weight and production from 2005 to 2024

In the same period, retail prices lifted by 50% to $19.28/kg (ABS). Retail prices are largely unaffected by domestic production levels, as major Australian supermarkets have very different carcase specifications compared to the global market. However, in late 2023, growing cost-of-living pressures and fluctuating saleyard prices prompted public scrutiny, leading supermarkets to temporarily reduce retail prices in response to consumer expectations rather than supply-side dynamics.

Overall, retail prices have little impact on production volumes as the domestic market is a small part of a larger pie in Australia.

Attribute content to Emily Tan, MLA Market Information Analyst.