Aussie sheep and beef farms’ financial performance

This article explores the key drivers of profitability across Australia’s livestock sector, examining recent trends in farm income, cost of production, and strategies for long-term financial sustainability.

Profitability

Measuring the profitability of a business is one way of assessing its health. Critically, this evolves around the quality and quantity of the product, and the cost of production. Although the price received for livestock influences revenue, industry performance data indicates the most profitable operations consistently demonstrate higher stocking and weaning rates, superior growth performance, and lower cost of production.

Beef

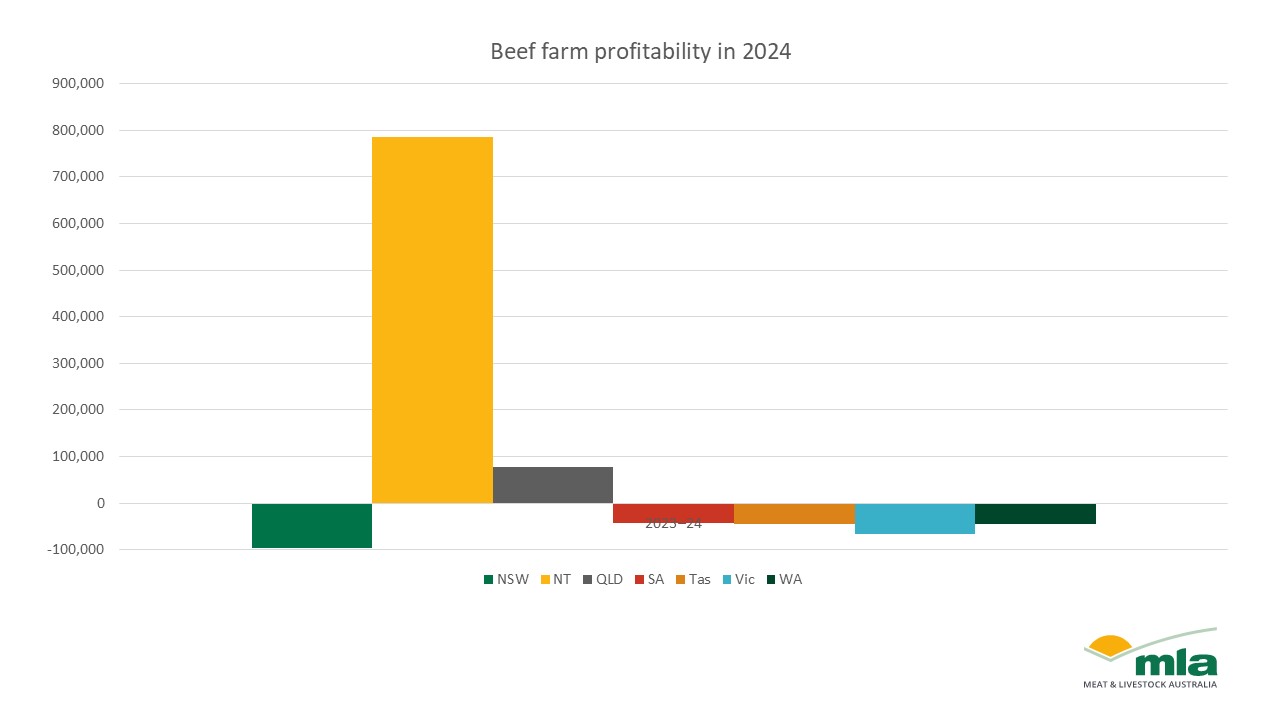

Beef farm businesses in FY2023–24 eased to -$16,000 after the third largest average profit in FY2022–23 at $113,700. Profitability was the highest in FY2021–22 at $205,000/per farm after record market prices subsequently lifted farm-level profits. In FY2023–24 the NT was the top-performing state, with profitability at $786,000, followed by Queensland at $78,000. State-by-state profitability was subdued, leading to losses for the average beef farm businesses in Australia.

Figure 1: Beef farm profitability in 2024

Sheep

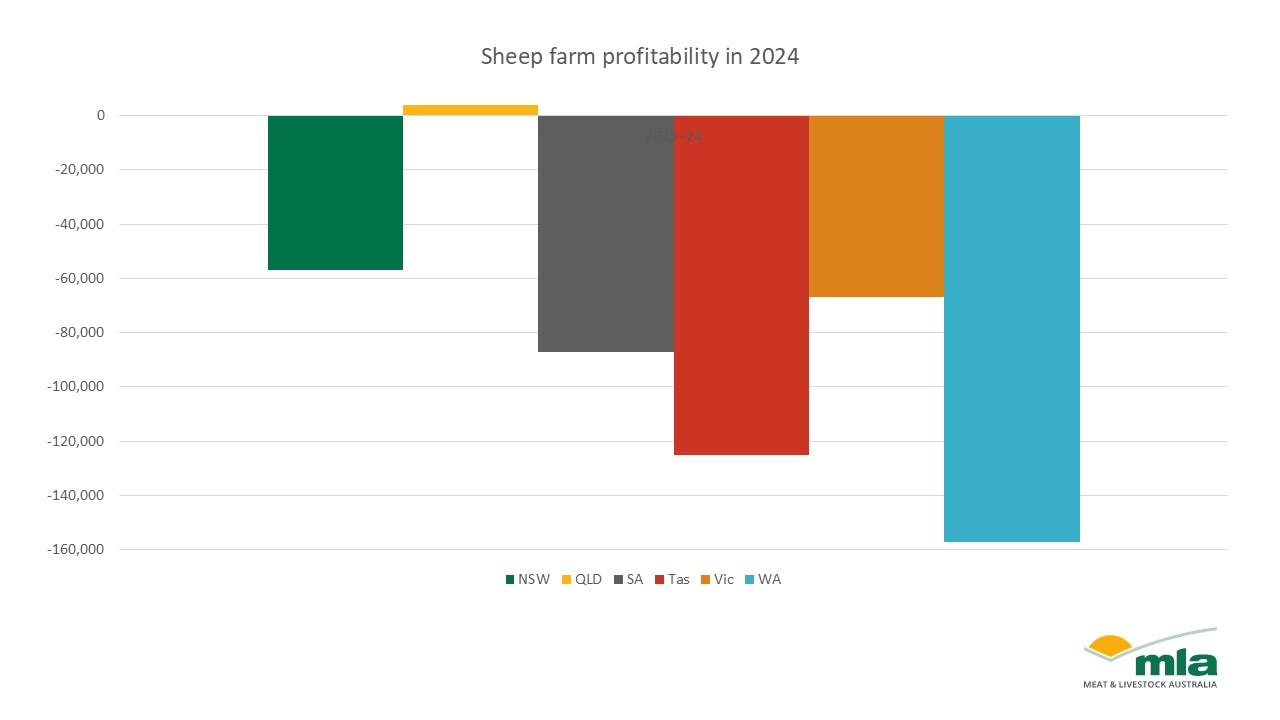

National sheep farm business profitability sat at -$80,000 in FY2023–24, with average profitability easing from -$9,200 on the average farm from FY2022–23. Sheep farm profitability has reached its lowest level since FY2005−06, indicating the challenge in maintaining a business as the cost of production continues to rise. Queensland sheep farms remain profitable, with an average income of $4,000/farm.

Figure 2: Sheep farm profitability in 2024

Cost of production

Cost of production is essential for the financial performance assessment of agricultural businesses. It enables producers to benchmark against industry standards, identify key profit drivers and make informed decisions on resource allocation to improve business outcomes.

Table 1: Beef farm cost of production

|

NSW, VIC, SA, TAS and southern WA |

QLD, NT and northern WA |

|

|

Margin over all costs |

↓ from $1.7 to -$7.3 (↓143%) |

↓ from $7.9 to -$2.7 (↓134%) |

|

Beef price change |

↓ 12% |

↓ 32% |

|

Cash cost reduction |

↓ ~9% |

↓ ~17% |

|

Fodder cost trend |

↑ 7% |

↑ 15% |

|

Livestock material cost |

↓ 25% |

↑ 20% |

In FY2023–24, beef enterprises across both northern and southern Australia experienced a sharp decline in margin over all costs, turning negative after two relatively stronger years. In the southern region, margins fell from $1.7/ha in FY2021–22 to -$7.3/ha, while the northern region saw a drop from $7.9/ha to -$2.7/ha over the same period. While it maintains a cost advantage, the northern region experienced a sharper decline in revenue, with prices declining by 32% – outweighing any benefit from lower input costs. Conversely, the southern region successfully reduced key costs such as fertiliser, fuel and administration, with total cash costs dropping by 17% in the north and 9% in the south. These reductions were insufficient to counteract the decline in returns. As a result, both regions recorded negative margins over all costs in FY2023–24, underscoring the dominant influence of market prices on enterprise performance.

Sheep farm cost of production

In FY2023–24, input costs for sheep enterprises remained a key pressure on profitability despite a partial recovery in lamb and wool prices. Shearing and crutching remained the largest and most consistent cost at $6.6/ha, reflecting the non-negotiable and labour-intensive nature of flock management. Fodder and livestock material costs spiked significantly, pointing to seasonal feed shortages and increased animal health requirements. Meanwhile, other cash costs rose steadily to $3.3/ha, suggesting potential hidden cost creep from areas like insurance, memberships and farm technology. Some costs such as repairs and wages remained stable. The combination of high fixed costs and rising variable expenses continued to tighten margins across the sector. This reinforced the broader trend in the livestock industry.

More information: https://www.agriculture.gov.au/abares/research-topics/surveys/cropping

Attribute content to Emily Tan, MLA Market Information Analyst