Australia’s position in the global beef trade

Key points

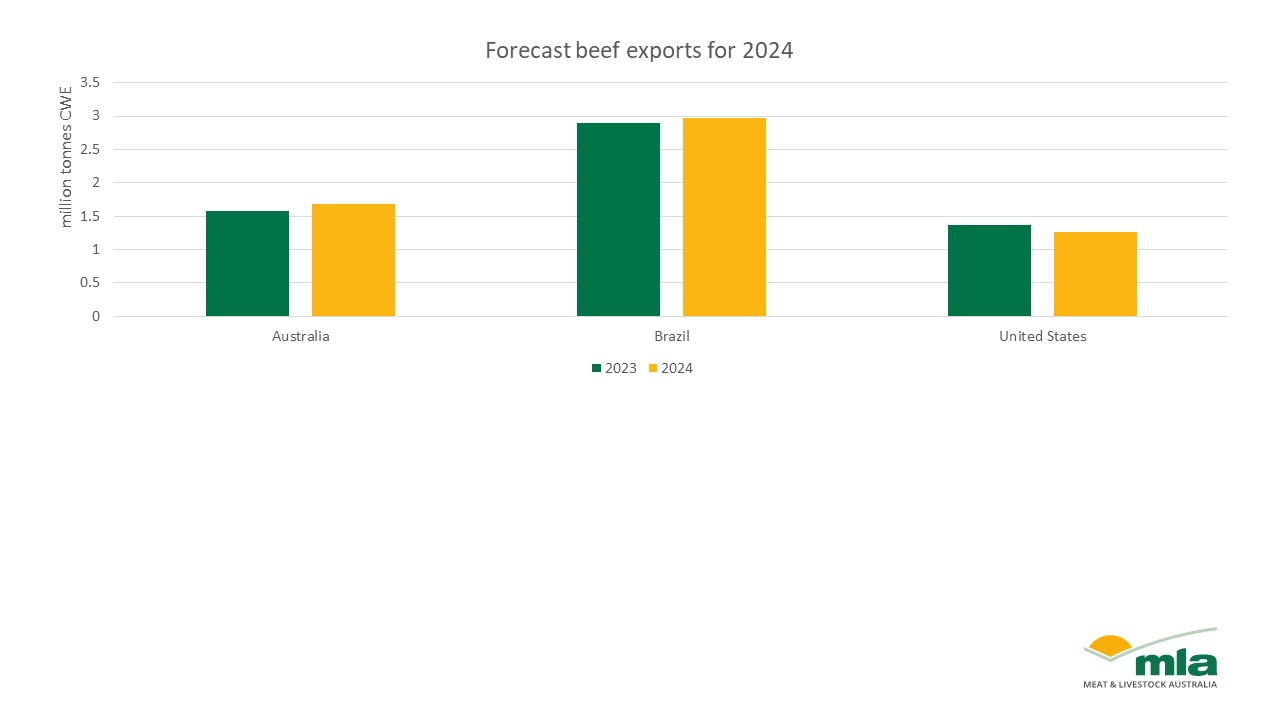

- USDA figures forecast an increase in Australian beef production and exports.

- American production is forecast to decline, though less than initially expected.

- South American exports are expected to rise as Brazilian production lifts and Argentina makes changes to its trading policy.

Last week the United States Department of Agriculture (USDA) released its forecasts for global beef production in its quarterly Livestock Products and Trade publication. These releases offer a useful insight into both the current state of play in beef production and the factors affecting the future outlook for global trade.

Global production is forecast to remain stable at just under 59.5 million tonnes (mt). The forecast attributes this almost entirely to the upward revisions to American beef production, with expectations that it would now decline only 3% in 2024, instead of the 6% previously forecast.

This points to a continued decline in the American cattle herd, and a much longer herd liquidation than previously expected. Although the USDA has not yet released their January herd number it is likely to be the lowest in several decades, while the female slaughter rate remains well above 50%.

Outside the US, changes are likely to be less drastic. Brazilian production is expected to lift by 3% from last year to 10.8mt in 2024. This is partially due to an uptick in female slaughter and a marginal potential destock, but the increase is mostly due to a long-running increase in the Brazilian herd, as land use patterns over the past several years have effectively increased the livestock carrying capacity of Brazil as a whole.

Source: Livestock and Poultry: World Markets and Trade, USDA FAS (Jan 2024)

Production in Argentina is expected to decline by 6% to 3mt in 2024, as continued dry conditions have caused multiple years of smaller-than-expected calf crops. Additionally, the dry conditions, alongside an exceptionally weak Argentinian peso, have substantially impacted the availability of stock feed, making supplementary feeding considerably more difficult and pushing down carcase weights.

Despite this decline in production, it is entirely possible that Argentinian beef exports could lift in the new year, as Argentina’s new federal government has lifted several restrictions on beef exports implemented by the previous administration.

Australia is forecast to see the largest increase in production, with USDA numbers pointing to an 8% lift in production to 2.35mt. Once again, this points to the fact that Australia is a major player in beef exports while being a relatively small beef producer. With exports forecast to rise by 10% to 1.69mt in 2024 according to the USDA, Australia will be the second largest beef exporter after Brazil. MLA’s upcoming Cattle Industry Projections (set for release on 26 February) will provide additional information around the current situation in Australia specifically, but the USDA release shows that Australia is in a good position to compete internationally, especially with the continued decline in the American herd.