Help track sentiment and shape 2026 forecasts

Meat & Livestock Australia (MLA) is calling for grassfed beef producers to complete the Beef Producers Intentions Survey (BPIS) throughout November.

The BPIS is an MLA initiative to gain insights on the Australian beef herd and, importantly, understand the future intentions of producers who play roles in the grassfed beef sector.

Coming into its third year, survey data has supported improvements to analysis and industry forecasts, is used as a tool when developing MLA programs, and has helped ensure adoption and communication efforts are matching industry sentiment.

Insights gained from responses are an essential input into MLA’s beef industry forecasting models for the national cattle herd, slaughter, production and exports.

The survey is conducted three times a year. In April, the survey provides feedback on producers’ plans for the upcoming breeding program and other related issues including branding percentage, age of spring calving, turn-off program, and weight and expected sales. In July a PULSE is conducted for updated estimates on producer intentions, calve estimates and an updated sales figure.

The November survey, now open to all grassfed beef producers, aims to provide an overview of the herd profile, producer sentiment, breed demographics, producer intentions and sales to date.

What has been found?

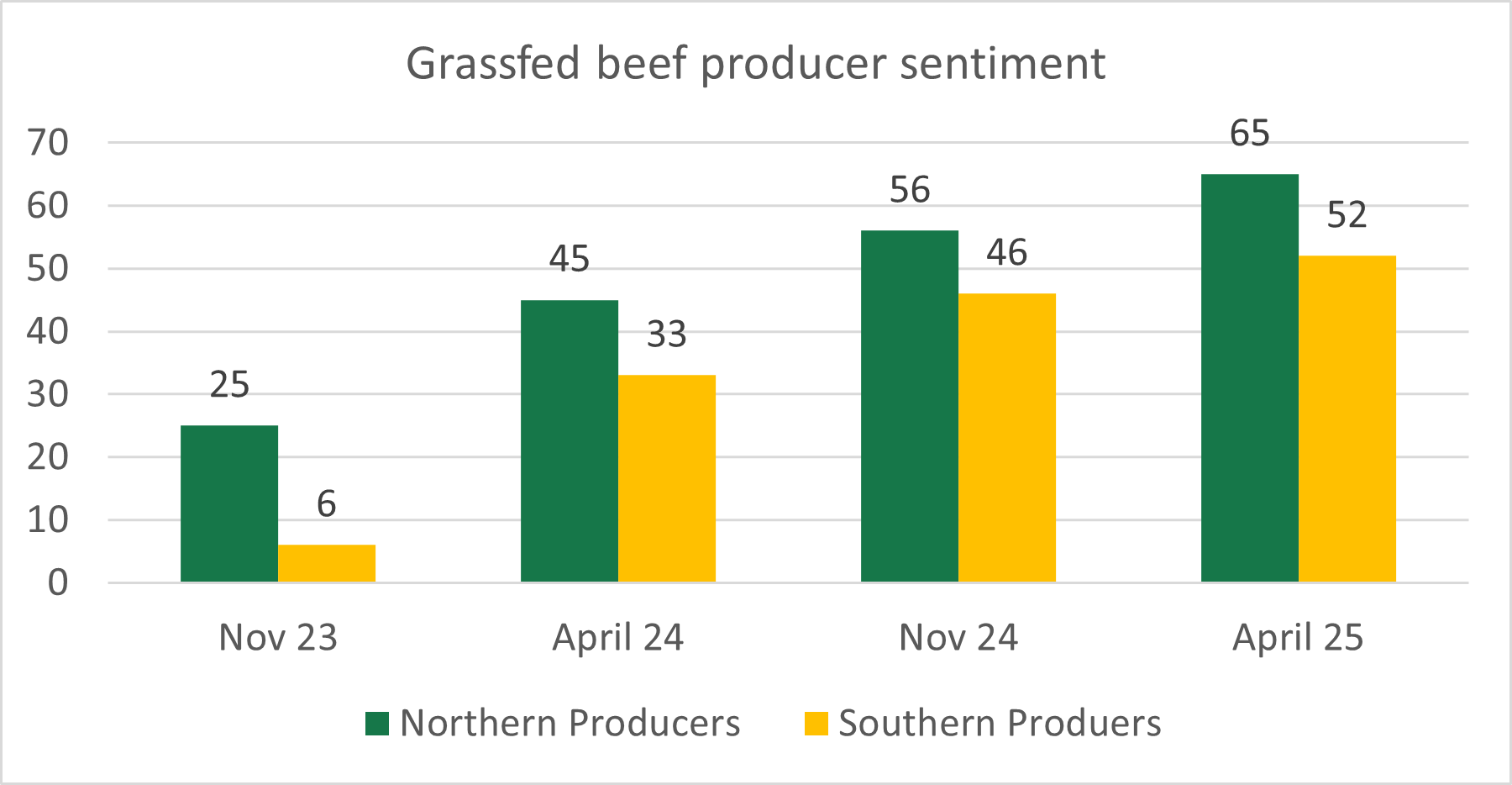

Looking at historical insights, we can see how industry remains resilient across volatile markets, shifting supply dynamics and continues to recover from the market crash in 2022. While responses were collected post-market crash, we can see how industry sentiment trends have followed the market recovery. These movements were underpinned by growing confidence, driven by price improvement, better seasonal conditions and stability of input costs.

The more sector confidence producers have, the greater their intentions to expand operations. Responses from November 2024 surveys indicated strong sentiment, alongside a 7% lift in producers expecting to have more beef cattle in 2025. This has supported MLA’s projections of a continued increase in beef production and industry is expected to reach a new record in 2025, producing 2.79m tonnes.

|

|

November 2023 |

November 2024 |

|

Fewer beef cattle expected in 2025 than in 2024 |

47% |

39% |

|

Same number of beef cattle expected in 2025 than in 2024 |

14% |

16% |

|

More beef cattle expected in 2025 than in 2024 |

38% |

45% |

What is expected?

Historically, we have seen sentiment and intentions track alongside price. Looking to results this year, year-on-year cattle markets have lifted significantly across all indications, with the average price so far in November being between 117¢/kg liveweight (lwt) and 135¢/kg lwt (36-60%%) above average November 2024 prices.

Analysts are interested to see if these prices will drive sentiment to new heights, encourage further retention and increase turnoff capability.

Once available, aggregated survey data is published in public reports, accessible to everyone. Additionally, participants can opt-in to receive a report card comparing their responses to aggregated regional data.

Complete the BPIS November survey today.

Attribute content to Erin Lukey, MLA Market Information Manager.