What’s driving producers’ 2025 business decisions?

Key points

- The highest nett sentiment for cattle producers on record.

- Geopolitics and tariff-related market issues are more concerning for producers than price and weather.

- Calving rates remain stable despite reduced national join rate.

Producer sentiment and national calving rates are strengthening as seen in the most recent Beef Producers Intentions Survey (BPIS) results. The BPIS gathers a wide range of information across industry covering the herd, producer sentiment, intentions, breeding programs, sales expectations for the season ahead.

Producers are feeling more positive

National

BPIS results showed a significantly higher nett sentiment (+19 to 53) among producers in comparison to a year ago, indicating market stability for the next 12 months. Results show 6/10 producers have a positive outlook and only 1/10 reported a negative. Northern producers (+65) are more positive than southern (+52). For the first time ever, geopolitics and tariff-related market instability were top concerns for producers over price and weather concerns.

State

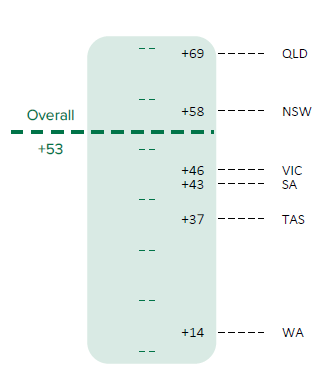

All states reported a positive increase in sentiment, with Queensland the highest increase (+69), followed by NSW (+58) and Victoria (+46). Confidence for WA producers improved (+14) but remains the lowest state result.

State Sentiment Comparison

National calving rates stable despite reduced join rate

The national breeding herd join rate reduced to 55% (6% lower than a year ago). Yearly calving rates remained stable at 79%, indicating less breeding cows were joined.

SA was the only state with a notable drop in join rate, dropping 37 points to 46%. However, SA’s calving rates were significantly higher than the national rate at 88%.

Tasmania experienced a 24 point join rate increase but calving rates dipped to 35% indicating fewer calves were delivered despite more cows joined.

For more insights, visit the Beef Producers Intentions Survey page

Attribute content to: Emily Tan, MLA Market Information Analyst

*Figures of Queensland producers significantly impacted by the floods were not included in these estimates