Indonesia drives highest cattle exports since 2021

Key points

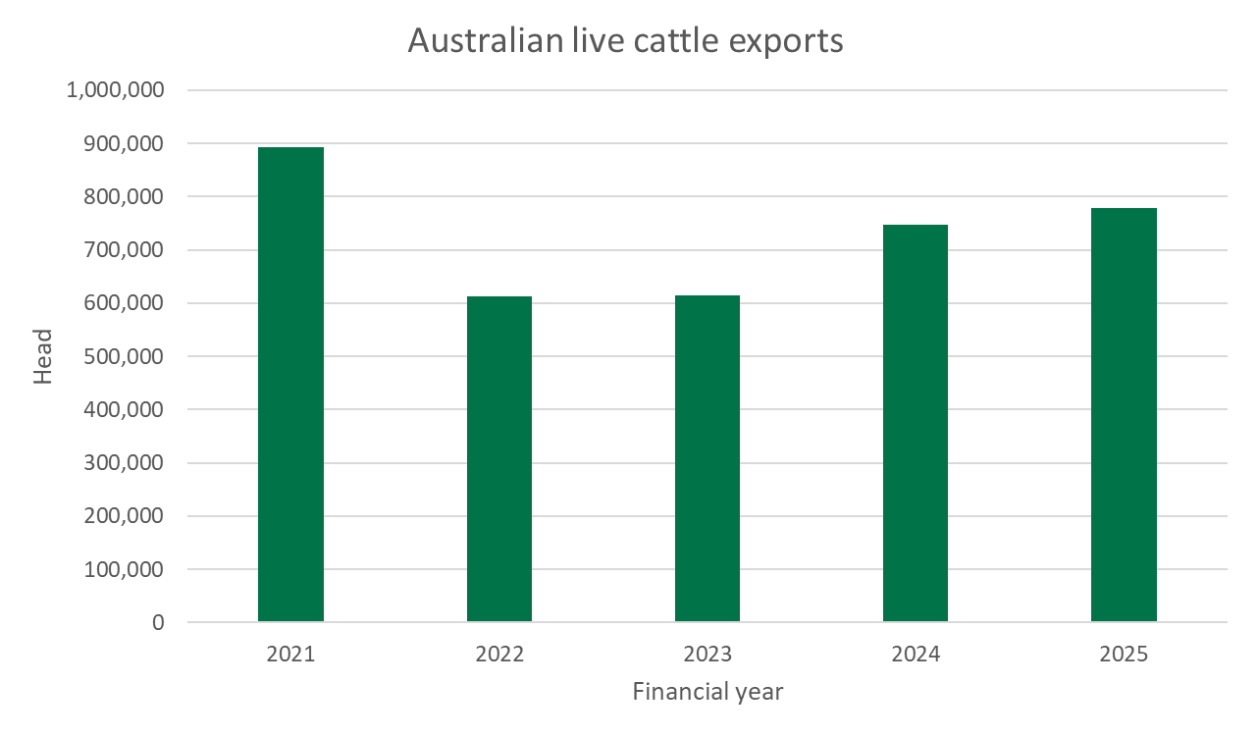

- Live cattle exports lifted last financial year to 779,541 head.

- Indonesia remained the largest market for Australian cattle, followed by Vietnam and China.

Australia’s live cattle trade strengthened in FY2024–25, lifting 4% from FY2023–24 to 779,541 head. This represents the highest export figure since 2021 and signifies both a consistent supply of northern Australian cattle and solid export market demand.

The export lift was spread evenly over the 12 months. In July–December 2024, exports rose 5% year-on-year (YoY) to 405,730 head, while in January–June this year, exports lifted 4% YoY to 373,811 head. The stability of the increase and its even spread over the financial year is important in demonstrating supply consistency and stability.

Source: DAFF, MLA

The results also reaffirm Indonesia’s position as Australia’s largest cattle export market.

Overall Indonesian exports in FY2024–25 lifted 32% to 561,734 head - making up 72% of Australia’s live cattle exports. This was significantly more than the FY2023–24 Indonesian export market share when breeder cattle exports to China and slaughter cattle to Vietnam were markedly higher.

The consistent strength of the Indonesian market for Australian cattle demonstrates its continued importance to producers in northern Australia and the role Australian cattle play in ensuring food security.

Outside of Indonesia, cattle exports were generally below FY2023–24 levels. Exports to Vietnam fell 23% YoY to 109,676 head but remained the second largest market for Australian cattle.

Cattle exports to China fell from 85,077 head in FY2023–24 to 29,077 head. Demand was likely lower due to Chinese domestic cattle prices affecting demand.

The Middle East and North Africa (MENA) region saw a 64% YoY decrease in cattle exports, down to 20,216 head - mostly due to a substantial Israelian export decline. However, exports to the rest of the region lifted 86% YoY as Jordan and Kuwait took cattle that would have otherwise gone to Israel.

Looking ahead, the relative Australian dollar weakness is providing a cost advantage and successive good northern seasons point to strong cattle supply over future months and years.

Attribute content to Tim Jackson, MLA Global Supply Analyst