Restocker lamb market indicates future sector confidence

Key points

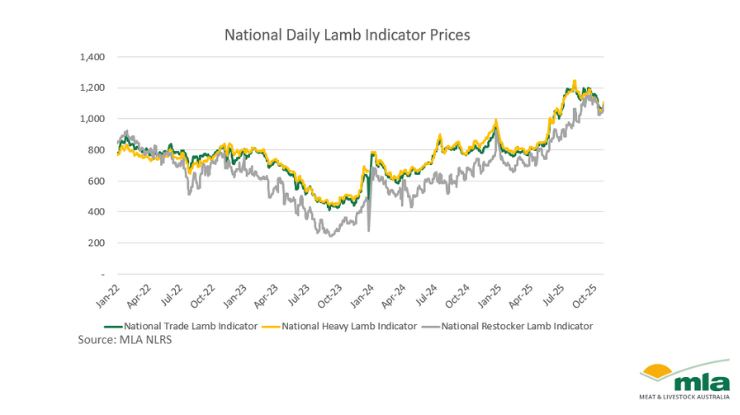

- National lamb market has lifted 25–82¢ across all indicators.

- Restocker demand is keeping up with finished stock, reflecting confidence.

- Price is the circular driver of the current restocker market.

This week, all lamb indicators have lifted between 25–82¢. A decent sprinkle of east coast rain, alongside processor competition on return from maintenance shutdowns, provided a boost to the finished market. Additionally, this market jump has exposed an optimistic restocker market, keeping strong alongside finished lambs.

For the past two months, restockers have consistently fetched similar prices to finished animals in the heavy and trade lamb categories. The National Restocker Lamb Indicator is currently 1,090¢/kg carcase weight (cwt), just 2% below the Heavy lambs Indicator at 1,110¢/kg cwt and in line with the Trade Lamb Indicator at 1,089¢/kg cwt. The last time the restocker price was above trade lambs was in April 2022. This was also the last time we saw a consistent trend with restockers aligning with finished lambs.

Back in 2022, the national flock was two years into a rebuild, conditions were strong across sheep-producing regions, and the market was relatively firm.

The current restocker highs are driven by something else.

The lamb market, over the past six months, has coped with numerous uncertainties. The full impact of conditions across southern sheep-producing regions over the last 18–24 months is relatively unknown. Without a national flock baseline for three years, the uncertainty of supply has flowed to the finished market.

The restocker market and its intention to keep up and compete with finished lambs, however, is driven by confidence and rainfall. Much of the southeast coast received some good spring falls, which would have lifted confidence. Additionally, midterm forecasts remain positive showing average rainfall.

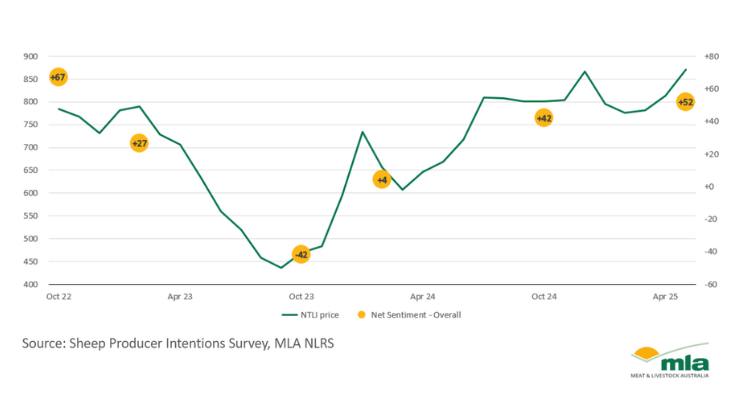

The most significant confidence driver, however, is price. Meat & Livestock Australia (MLA) analysts have been unpacking the record-high lamb market throughout much of 2025. The signals from these firm prices flow back through to producers, indicating demand consistency. This has encouraged producers to rebuild, or grow where they can, to capitalise on this consistent demand.

This link is evident in the MLA and Australian Wool Innovation Sheep Producer Intentions Survey. Livestock prices are heavily correlated with the sentiment of sheepmeat producers, which then flow through to production decisions. Results from the October Sheep Producer Intentions Survey, expected to be released within the month, will provide an update on industry sentiment.

The firm restocker market reflects renewed producer confidence, driven by price stability and improved conditions. The coming months will test whether this momentum can be maintained as the realities of current supply and seasonal outcomes are shown.

Attribute content to Erin Lukey, MLA Senior Market Information Analyst