Sheep and lamb production poised for growth

Key points

- The national flock sits at 74.2 million head after two tough seasons.

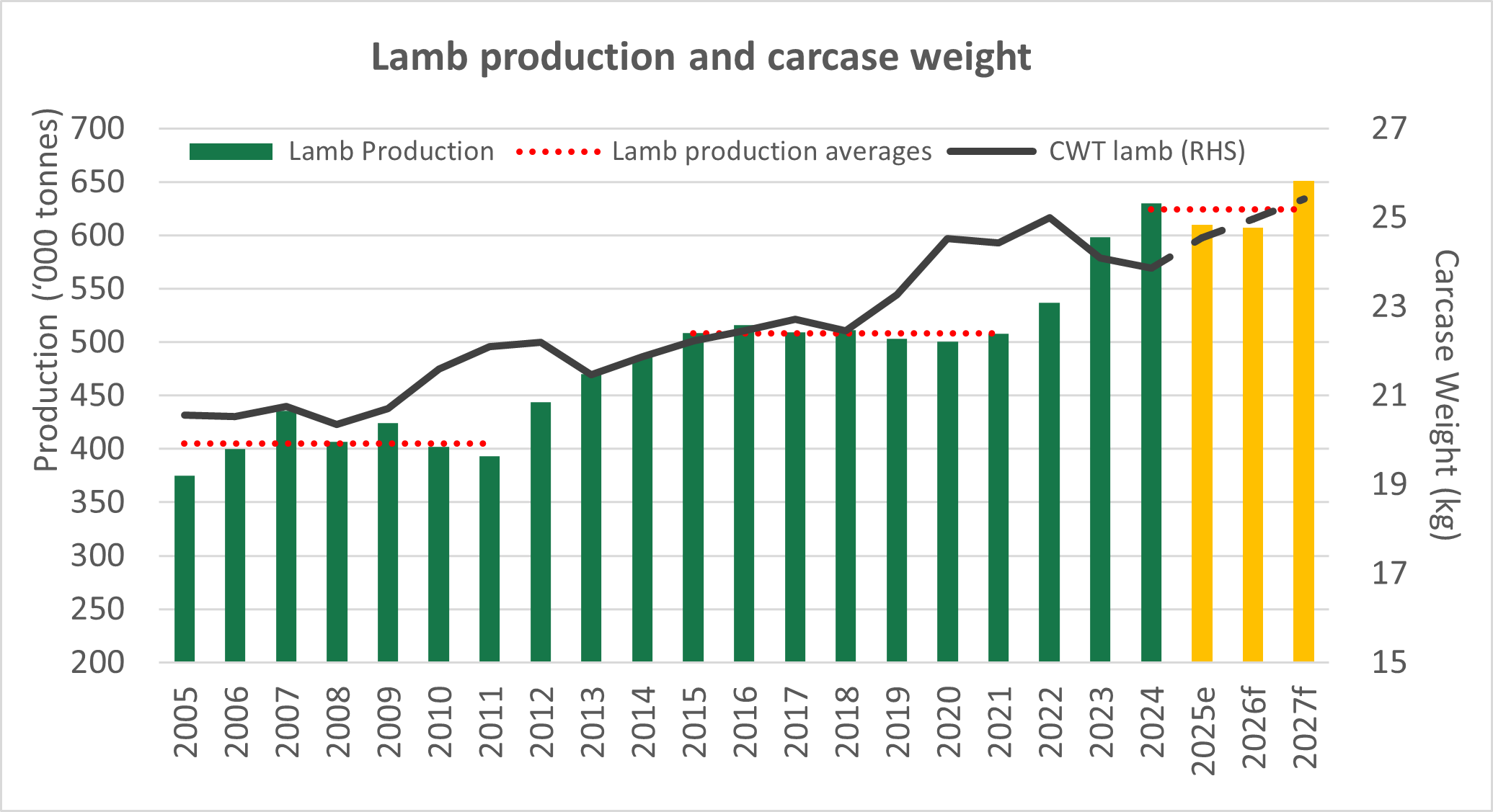

- Lamb production for 2026 is expected to be 4% below the peak of 2024. A new high, however, is forecast for 2027.

- Improved genetics and finishing systems are delivering heavier carcases and sustaining output from a smaller flock.

The national flock is estimated at 74.2 million head as of June 2025. Consecutive below-average seasonal conditions across SA, Victoria and southern NSW have elevated lamb slaughter and a sharp mutton turn-off increase. With conditions expected to improve, ewe retention is anticipated to rise through 2026, laying groundwork for a considered rebuild.

Structural productivity gains underpin lamb production

History shows lamb production resilience after tough periods. After liquidation phases, output averages tend to increase as flocks become more efficient. Lower-performing animals are culled, while producers retain and multiply the genetics that deliver higher marking rates, faster growth and better feed conversion.

This pattern was clear after the 2000s drought, when the subsequent rebuild settled at an average production level approximately 25% higher than before. Meat & Livestock Australia’s (MLA) forecast shows a consolidation of a similar lift (around 23%) in the years after the dry conditions that ended in 2019. MLA expects a cautious rebuild in 2026, with lamb production dipping roughly 4% from the 2024 record. New highs are expected in 2027 as numbers and weights recover.

Source: ABS, MLA forecast

Carcase weight is the quiet engine behind this resilience. Over the past two decades, a structural shift from wool-dominant merino systems towards sheepmeat-oriented breeds has supported heavier turn-off.

Average lamb carcase weights have lifted from roughly 20kg in the early 2000s to about 25kg today. The dip recorded in 2023–24 reflected poor feed quality in parts of the south, which pushed more unfinished lambs to market. As seasonal conditions stabilise, the projections anticipate a recovery in weights through 2026 and 2027.

What’s driving the weight rebound?

Several drivers sit behind the expected rebound. Improved pasture growth and better energy in diets will allow producers to hold lambs longer, finishing them to tighter specifications. The steady adoption of supplementary and grain feeding – whether in on-farm systems or dedicated finishing programs – gives producers more options to manage seasonal variability while meeting processor grids.

Weight-based pricing provides a strong commercial incentive to target heavier turn-off when feed allows, while ongoing investment in genetics continues to lift growth potential and dressing percentages.

Together, these settings explain why lamb production is expected to be the least affected component of the supply mix during the forecasted 2026 rebuild. Mutton will remain more volatile as producers prioritise ewe retention. Lamb tonnage, however, should hold relatively firm in 2025–26 before supply and carcase weights align to deliver a new production record in 2027.

Full report here: MLA’s September 2025 Australian Sheep Industry Projections

Attribute to: Emiliano Diaz, MLA Market Information Analyst

Information correct at time of publishing on 2 October 2025