What past heavy lamb trends tell us about the current market

Key points

- Demand drives heavy lamb prices to a record 1,005¢/kg cwt.

- Year on year supply of heavy lambs down 26%, due to dry driven lighter turnoff.

- Constrained availability of heavy lambs is likely to remain a key market driver.

The National Heavy Lamb Indicator (NHLI) surged to an all-time high of 1,005¢/kg carcase weight this week, reflecting tightening supply conditions and heightened processor competition. This marks the strongest market performance for heavy lambs on record, driven by restricted turnoff, interstate transport limitations and diminishing feed availability across key producing regions.

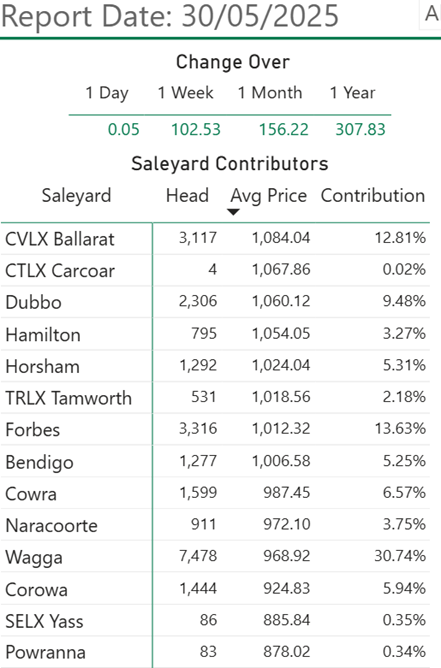

Figure 1: Saleyard throughput and prices for the National Heavy Lamb Indicator

The NHLI tracks saleyard prices for lambs exceeding 26kg carcase weight purchased by processors. These lambs are destined primarily for high-value export markets, including the United States and China.

As discussed in last week’s Quarter 1 production summary, early 2025 lamb throughput remained robust on the back of a stronger-than-expected 2024 lamb cohort. However, current dry conditions are altering the timing and weight class of turnoff, limiting the availability of heavy lambs. While overall lamb yardings are up 2% year-to-date, the supply of heavy lambs specifically is down 26% compared to the same period in 2024.

This divergence reflects the impact of dry conditions impacting many sheep-producing regions. With pasture deficits and higher input costs for supplementary feed, many producers are opting to sell lambs earlier and at lighter weights. As a result, supply in the heavy and trade-weight categories has fallen significantly, intensifying buyer competition.

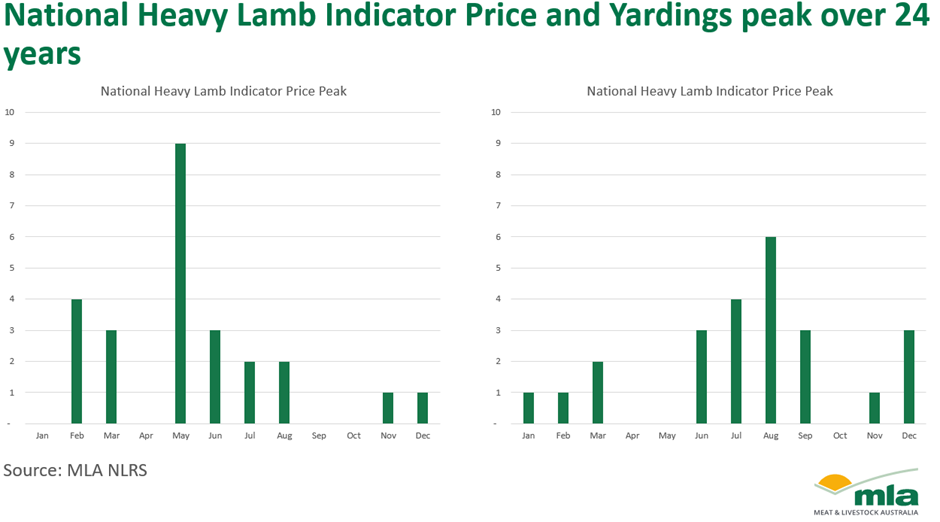

Historical supply patterns

Seasonal variation continues to shape heavy lamb supply patterns. Saleyard volumes traditionally peak in May as producers utilise residual summer and autumn feed. In stronger seasons, such as 2023, peak supply extended into August as pasture conditions allowed longer finishing periods. In contrast, in the drier year of 2019, supply peaked earlier.

Export-focused producers typically aim to maximise weight gain over autumn and winter, when returns for heavy carcases rise. However, the lack of feed this year has impacted this process for many.

Demand consistency

Competition for heavy lambs tends to strengthen over winter, when processor demand remains stable and supply starts to ease. Moving to spring, buyer interest transitions to the new season lamb market, creating a competitive overlap period.

Outlook

Southern producers continue to face tough conditions, with an increasing area of sheep-producing regions impacted by failed seasons. With limited relief to date, the sector faces mounting pressure on the availability of heavy and trade-weight lambs heading into winter and spring.

As we enter the seasonal dip in lamb supply, constrained availability of heavy lambs is likely to remain a key market driver. Looking further ahead, processor capacity has expanded significantly over the past three years to accommodate elevated national lamb production. However, with early indicators pointing to a lower turnoff into the 2025–26 season, managing this infrastructure may present a challenge for the industry.

Attribute to: Erin Lukey, MLA Senior Market Information Analyst