What’s driving Australia’s feedlot momentum?

Key points

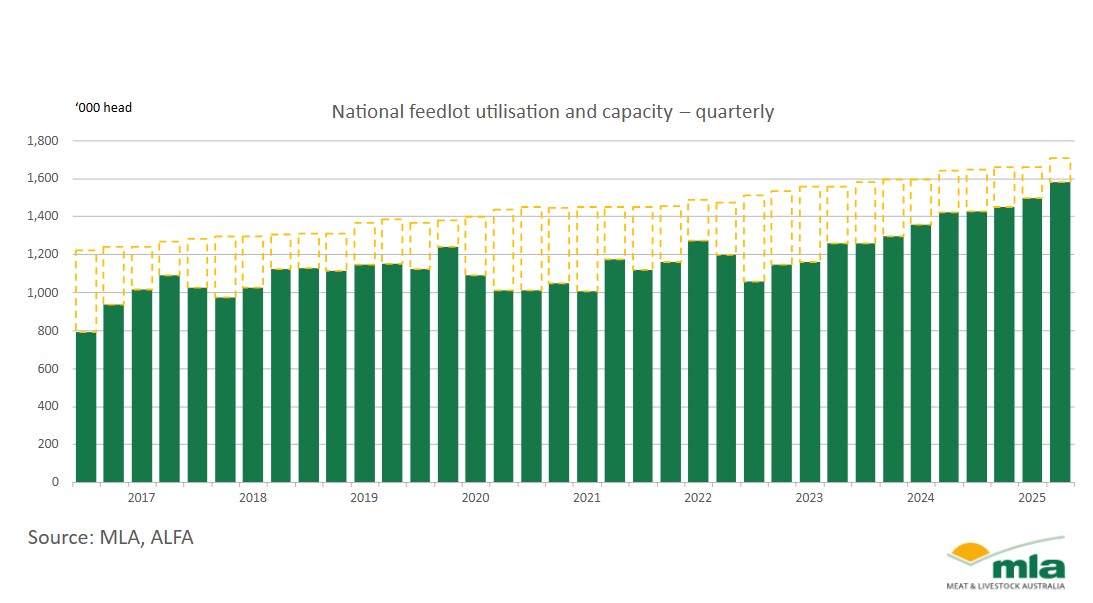

- Feedlot capacity hits 1.7m head, utilisation at 93% and a record quarterly turnoff of 894,000 head.

- Stable grain prices and firm feeder demand keep lot feeder programs profitable despite seasonal variability.

- Grainfed beef exports climb 25% both from the previous quarter and year, with the broadest market mix since the fourth quarter of 2017.

Australia’s feedlot sector has entered the second half of the 2025 calendar year with record levels across capacity, numbers on feed and utilisation. This was underpinned by steady demand from both domestic and international markets.

National feedlot capacity has now reached 1.7 million head – up 3% for the quarter – while cattle on feed climbed 5% to 1.58 million head, placing utilisation at 93%. Feedlot turnoff followed record trends, with 894,000 grainfed cattle processed over the quarter.

The increase reflects the dual role of feedlots. In a year of varying climate outcomes, producers and lot feeders have utilised the sector to maintain high-value product delivery, i.e. long-fed wagyu programs, while also finishing stock from areas impacted by dry conditions.

Queensland and NSW accounted for the bulk of the growth. Queensland set state records across capacity (957,000 head), numbers on feed (893,000 head) and utilisation (93%), with turnoff up 18% year-on-year. NSW also achieved state records for capacity (494,000 head) and utilisation (95%), supported by excess feeder supply from the north and dry conditions in the south.

Input costs support margins

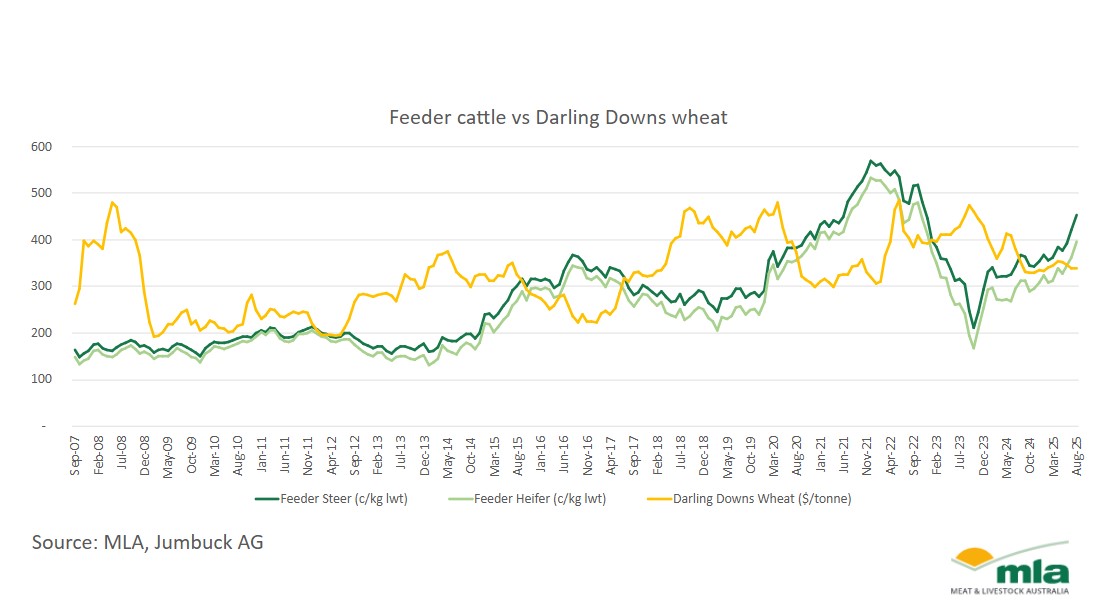

Cattle supply competition lifted as prices for feeder stock firmed. Meat & Livestock Australia’s (MLA) two feeder indicators, the National Feeder Heifer Indicator (-6%) and the National Feeder Steer Indicator (-11%) saw yarding reductions over the quarter, while prices lifted 22¢ and 21¢/kg liveweight (lwt).

A relatively stable grain price of $350/tonne (Darling Downs Wheat) has meant margins have remained positive. These pricing dynamics could result in an increase of long-fed programs as lot feeders invest more feed into profiting from an elevated cattle input price.

Program lengths have stayed relatively stable in the short term, despite a slight decrease in 300+day animals over the past three quarters. Assessing dynamics over the longer term, however, revealed capacity growth coincided with general growth outside of the short-fed (0–100-day) program - a domestic product. This suggests feedlots are responding to strong global demand for grainfed beef.

Maintaining and expanding export markets

As a predominantly exported product, record turnoff translated into record exports. Grainfed beef shipments reached 113,000 tonnes – up 25% on both the previous quarter and financial year.

China remained the largest market in the second quarter, taking 35% of exports (39,000 tonnes) as an increased demand for high-quality beef continues. Japan was the second-largest destination with 26% of exports (30,000 tonnes), though volumes remain below Q2 2024 levels due to constrained household spending.

The ‘Other Market’ category remained at 21% of exports for the quarter, absorbing 23,912 tonnes. Australia exported beef to 51 countries over the quarter – the largest mix since the 2017 December quarter – reinforcing an expanding market.

Outlook

Over the past five years, cattle on feed has risen 38%, capacity increased 23% and turnoff is up 13%. Grainfed exports are also up 42%, showing long-term structural growth. With global markets maintaining strong interest in grainfed beef, producers can expect continued competition in the feeder market, even as seasonal conditions remain mixed.

For further details on the results from the Australian Lot Feeders Association Survey, find the Lot feeding brief here.

Information in this article is correct at the time of publishing on 28 August 2025.

Attribute to: Erin Lukey, MLA Senior Market Information Analyst