Australian grainfed beef soars to global all-time demand high

Key points

- Australian grainfed beef exports reached a record high in FY2024–25.

- Asian markets, like Thailand, underpin the sector’s growth, with the product's diversity and versatility meeting various Asian cuisine needs.

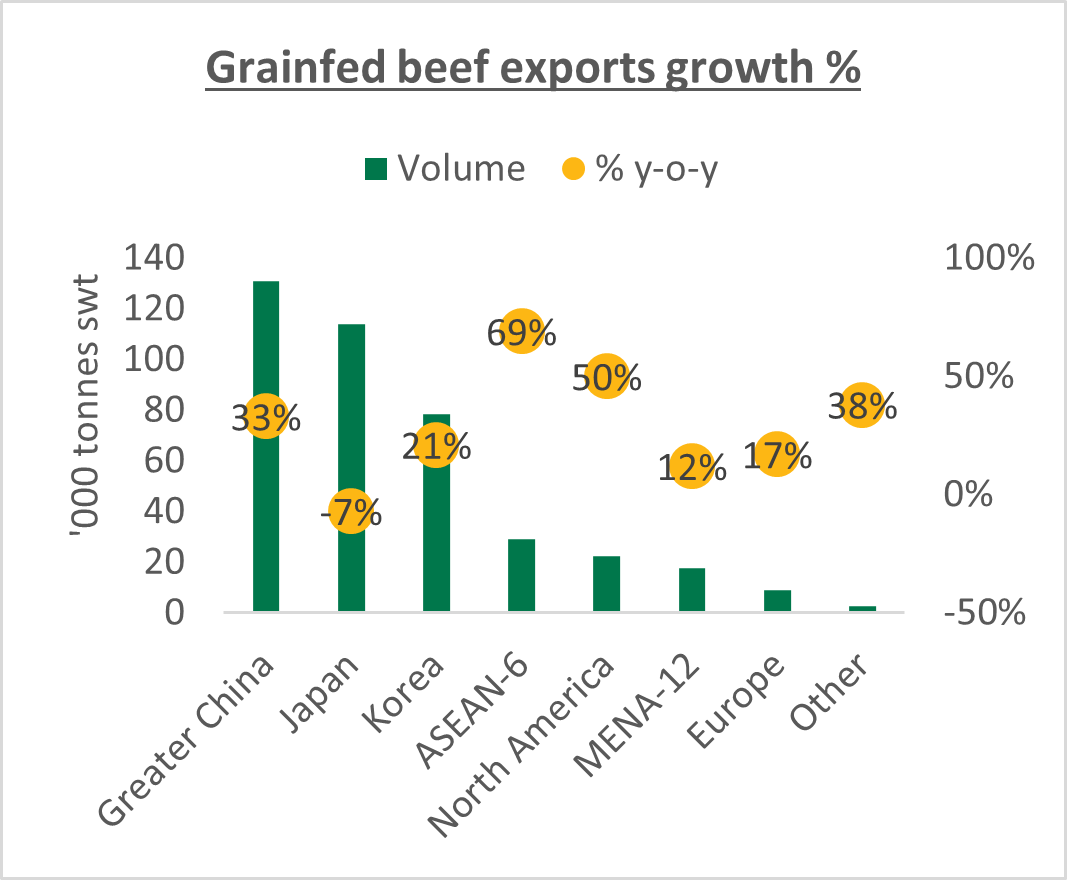

Australia exported 403,962 tonnes shipped weight (swt) of grainfed beef in the FY2024–25 - a 17% increase on the previous year. Larger markets continue to underpin the high volume, but Southeast Asia is fast emerging as a key driver of Australian export growth. Notably, exports to Thailand increased 105% year-on-year with 6,489 swt.

Source: DAFF

Global consumers demand Australian grainfed beef

Appetite for Australian grainfed beef continues to rise, likely due to increased affluence in markets like Greater China and Southeast Asia, along with interest from Japan and Korea.

The diversity of Australian products, which range from those with less than 100 feed days to highly marbled long-fed Wagyu, in addition to the product’s quality and safety credentials, is making Aussie beef a strong global competitor.

With the United States’ (US) beef supply remaining tight, Australian grainfed beef is able to meet demand from fast food chains to premium steakhouses across international markets.

Case study: ThailandThailand’s well-established foodservice sector drives high household spending on restaurants and hotels, despite the market’s small population. Thai consumers value Australian grainfed beef’s tenderness and consistent quality. This means cuts such as brisket and striploin can be found in dishes like guay teow ruea (wagyu boat noodle soup), laab nue (spicy beef salad), and Korean-style barbecue grilling, according to the Meat & Livestock Australia (MLA) international markets team. Thailand is also known as a ‘premium cut market’, with loin cuts contributing to 14% of total Australian exports – the second highest proportion in Southeast Asia after Singapore (33%). |

What’s next for Australian grainfed sector?

The Australian feedlot sector’s strong performance is evident in various data, including increased production in March, high feedlot utilisation in NSW and Queensland, and the re-introduced days-on-feed segmentation to the quarterly feedlot surveys.

Combined with unprecedented export records in FY2024–25, these figures demonstrate confidence for the sector to meet increased global consumer demand in FY2025–26.