Know the numbers: State of the Industry Report 2018

28 September 2018

The Australian red meat and livestock industry State of the Industry Report 2018 was launched last week (Wednesday 19 September) by Red Meat Advisory Council (RMAC) at a special event at Parliament House, Canberra.

The report, compiled by MLA on behalf of the red meat industry, is an informative reference document on Australia’s red meat and livestock industry, including consumption, production, exports, as well as the economic significance of the industry.

Here we take a look at some of the key findings from the report.

Exports

Although Australia accounts for a small proportion of global beef and sheepmeat production, 3% and 7% respectively, Australia is one of the largest red meat exporters (ABS, FAO, DAWR, IHS Markit, Global Trade Atlas, Comtrade).

- In 2017, Australia was the third largest beef and veal exporter, after India and Brazil.

- In 2017, Australia was the largest sheepmeat exporter, followed by New Zealand.

- In 2016, Australia was the largest goatmeat exporter globally.

In recent years, Australia has grown and diversified its exports, shifting from a heavy reliance on a handful of key destinations to a more varied customer base, with the top three markets accounting for just 55% of Australia’s red meat export volumes in 2017 compared with 72% in 2007 (DAWR).

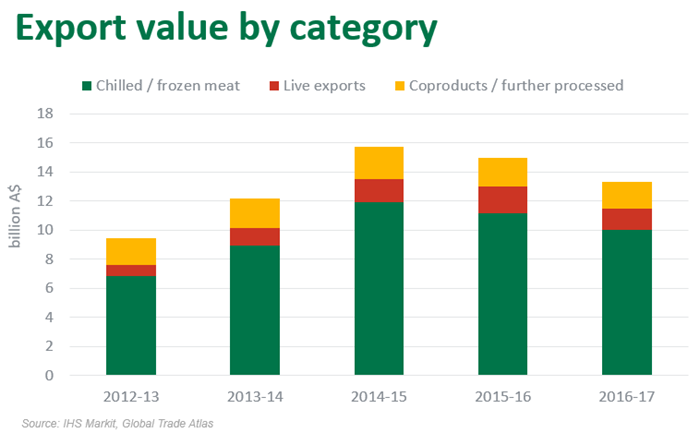

Red meat and livestock exports (including co-products) totalled approximately $13.3 billion in 2016–17, down 11% year-on-year, but approximately 41% above 2012–13 levels ($9.4 billion) (IHS Markit, Global Trade Atlas).

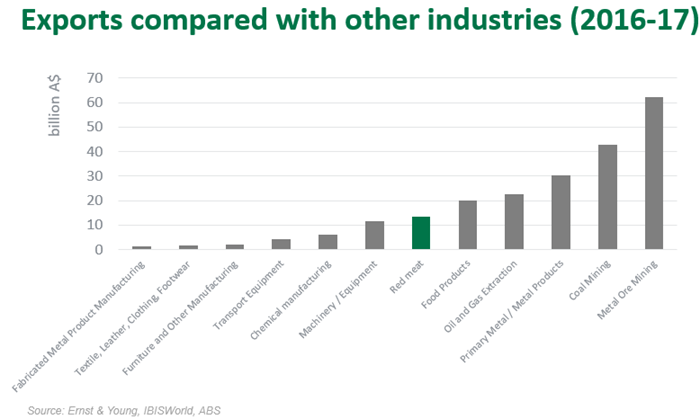

Red meat and livestock exports accounted for approximately 5.6% of Australia’s key industry exports in 2016–17 (IHS Markit, Global Trade Atlas, Ernst & Young, IBISWorld, ABS)

Global consumption

- Total world meat consumption continues to increase on the back of growing populations and expanding household incomes.

- Over the last two decades, total global consumption increased at an average of 2% per year for sheepmeat, 1% for beef, 4% for poultry and 2% for pork (OECD-FAO).

- In 2017, sheepmeat accounted for 5% of global meat consumption (excluding seafood), while beef and veal accounted for 21%. Chicken and pork each accounted for 37% (OECD-FAO).

The economic importance of the industry

- Australia’s red meat and livestock industry turnover was $65 billion in 2016–17 (Ernst & Young, IBISWorld).

- Red meat and livestock exports (including co-products) totalled approximately $13.3 billion in 2016–17 (IHS Markit, Global Trade Atlas).

- Australia's red meat and livestock industry total value add was $18.4 billion in 2016-17, an increase of 61% since 2012-13.

- In 2016–17, the Australian red meat and livestock industry created employment for around 438,100 people. Of these, just over 191,800 people were directly employed in the industry, and a further 246,300 people were employed in businesses servicing the red meat and livestock industry (Ernst & Young, IBISWorld).

You can find the full report here.