Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

New Zealand red meat exports remain robust

03 December 2020

Key points:

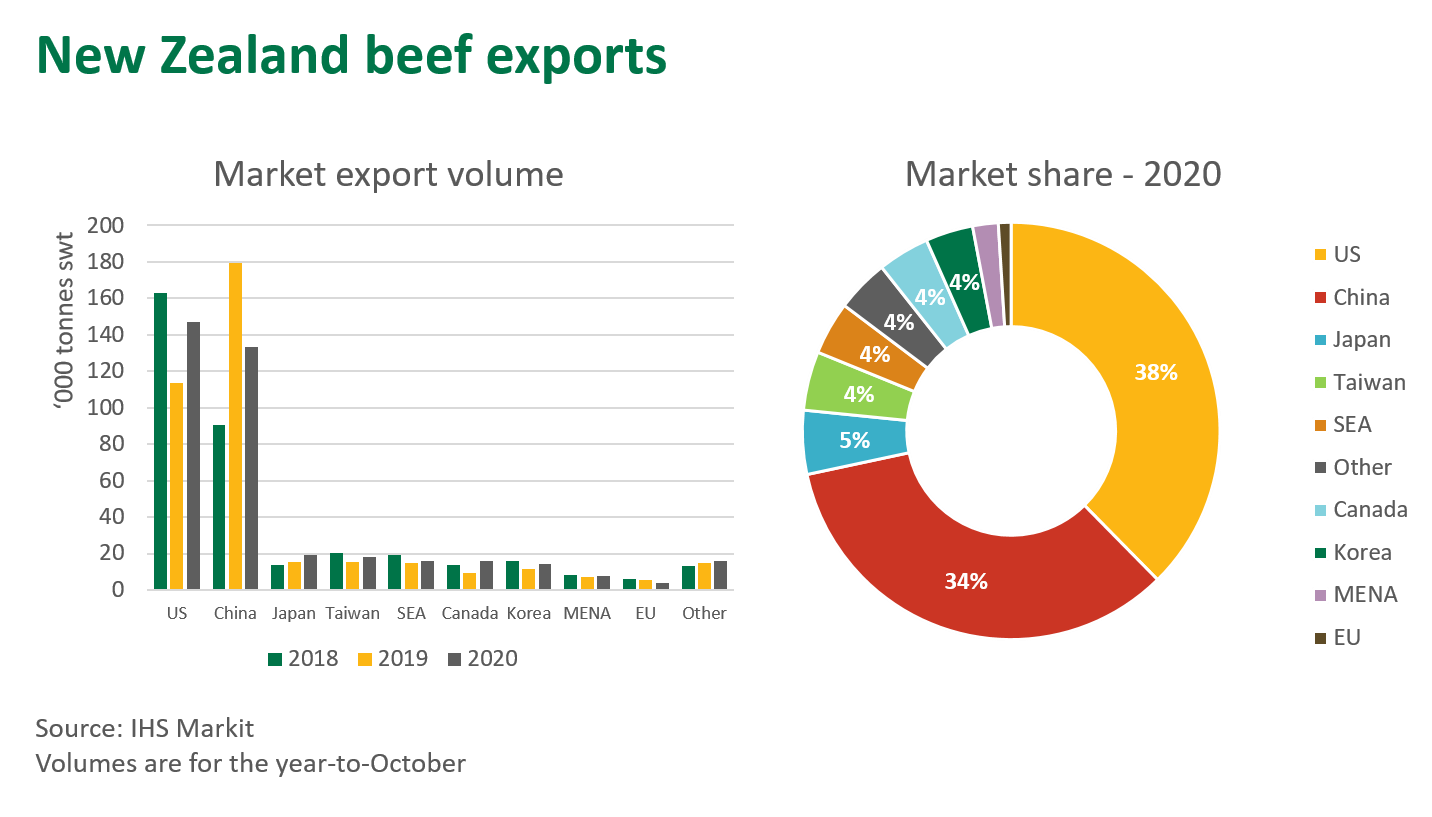

- 2019–20 beef exports were stable on the previous year at 453,000 tonnes swt

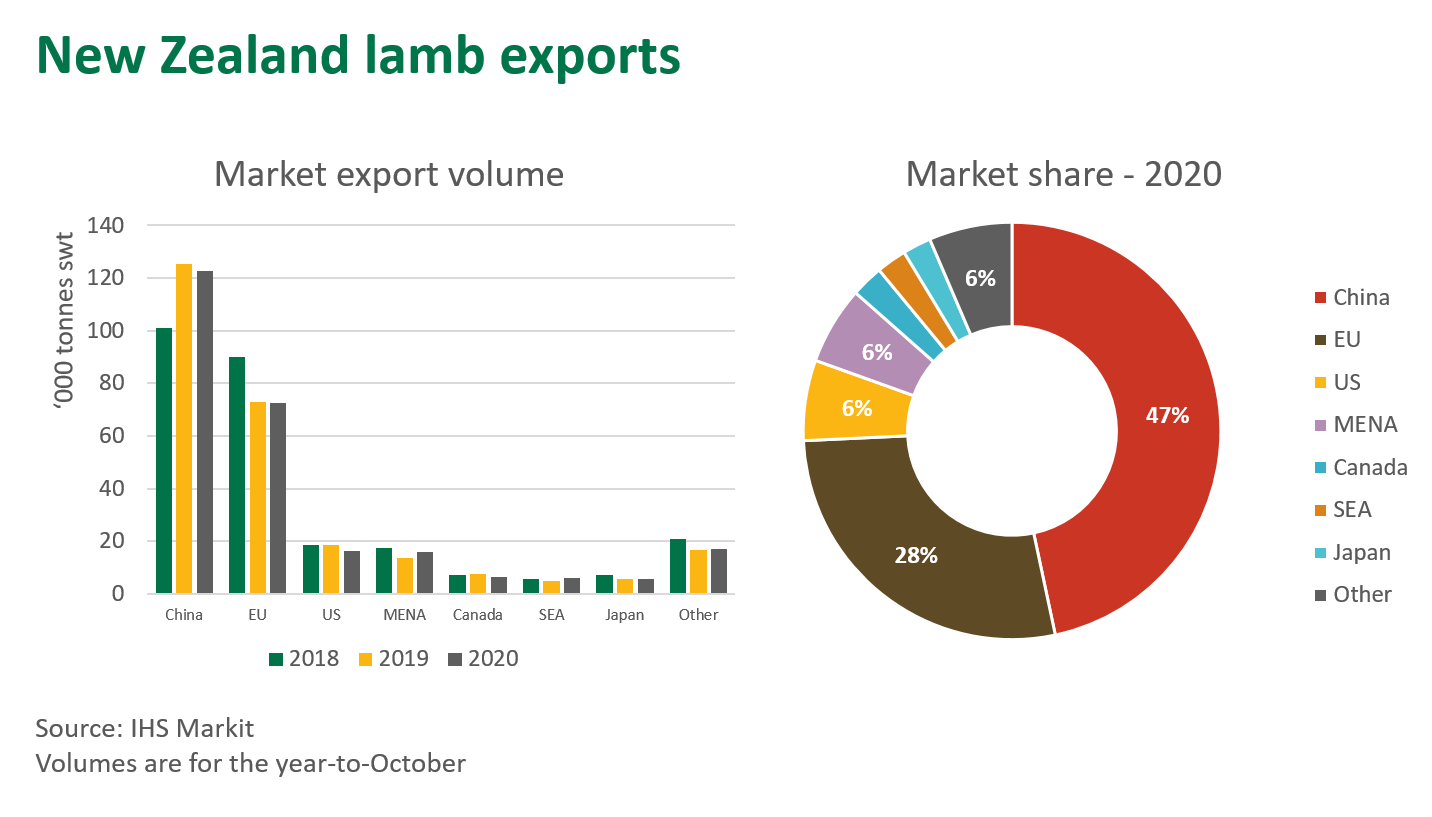

- Lamb exports also steady but expected to contract in 2021

- Amid drought, COVID-19 and volatile livestock prices, NZ meat industry proving robust

Back in October, Beef & Lamb NZ published their new season outlook, providing context and insights regarding the performance of the NZ red meat industry. COVID-19 and widespread drought were quoted as key challenges throughout the year, with the decline in foodservice demand a significant dampener on the value of high-end exports, particularly lamb. Following record high farm-gate prices earlier in the year, livestock prices eased significantly as international pressures flowed back through the NZ supply chain.

NZ beef exports to hold firm through the year

As is the case with Australia, NZ beef leverages strong quality and safety credentials to promote their product around the world and have effectively managed many of the challenges associated with COVID-19. For the year-to-October, NZ beef exports had a 1% increase on 2019 to reach 391,000 tonnes shipped weight (swt). While NZ has been confronted by dry conditions through much of 2020, cattle numbers remain consistent and beef production is forecast to remain steady for 2021.

As with most of China’s key suppliers, New Zealand red meat exports to China boomed in 2019 in response to the African Swine Fever (ASF) outbreak. However, in 2020 NZ beef exports to China are back 26%, largely a result of increasing competition from South America. Beef & Lamb NZ note that Chinese beef consumption is expected to continue growing next year, as the shortage of pork across the country has improved the perceived price point of beef, encouraging a shift in consumption habits. Beef has integrated into Chinese retail channels relatively well, which should support long-term beef consumption beyond the recovery of domestic pork supply.

In response to the decline in demand from China, NZ has managed to pivot and diversify its beef exports to other key markets. Year-to-October export volumes were up on 2019 to several destinations: 30% to the US, 25% to Japan, 17% to Taiwan and 71% to Canada.

In the latest Beef & Lamb NZ outlook, beef exports for the 2020–21 season (November through October) are forecast to remain level with the previous season at 453,000 tonnes swt. However, export revenue is forecast to decline 9%, largely due to global market uncertainty and COVID-19 disruptions to foodservice, combined with weakened consumer spending. Growing international competition and geopolitical risks were also mentioned as potential headwinds.

Lamb exports steady in 2020 but a decline on the horizon

For the year-to-September, NZ lamb exports were up 1% on 2019 despite the global demand challenges, with a rise in retail sales of lamb offsetting some of the decline in foodservice demand.

In 2020, NZ lamb exports have increased to the UK, Germany, Jordan and Saudi Arabia, as demand from China has been soft compared to other proteins and cooled further in the second half of the year.

For 2020–21, NZ lamb exports are forecast to be back 6.5% on the previous season to sit at 280,000 tonnes swt, due to a smaller 2019-20 lamb crop. With NZ lamb supplies expected to tighten next year, Australian lamb may achieve greater penetration across key markets, with exports forecast to grow 14% on 2020 to reach 307,000 tonnes swt – as noted in MLA’s recent sheep projections update.

© Meat & Livestock Australia Limited, 2020