Goatmeat exports to China increase 4,053%

Key points

- Goat slaughter has risen by 50% since last year.

- Carcase weights have fallen by 1kg since last year.

- Goatmeat exports to China are up a remarkable 4,053%.

Australia is the largest exporter of goatmeat in the world, and in the July–September quarter of 2023 goat slaughter, production and exports all lifted markedly from already high levels compared to the past several years.

Slaughter and production

Goat slaughter lifted 49% year-on-year (YoY) to 698,424 head, making the July–September quarter the largest quarter for goat slaughter since 2017. At the same time, goat carcase weights have fallen by 1kg YoY to 15.5kg, which is below the five-year average of 16.6kg. The decrease in carcase weights is likely partially driven by the increase in slaughter. Elevated slaughter is more likely to come from rangeland systems than managed systems, who tend to turn-off at heavier weights.

As such, production lifted 39% to 10,805 tonnes, the highest quarterly production figure since March 2023. Given almost all Australian goat is exported, increases in production are usually absorbed in overseas markets.

Exports

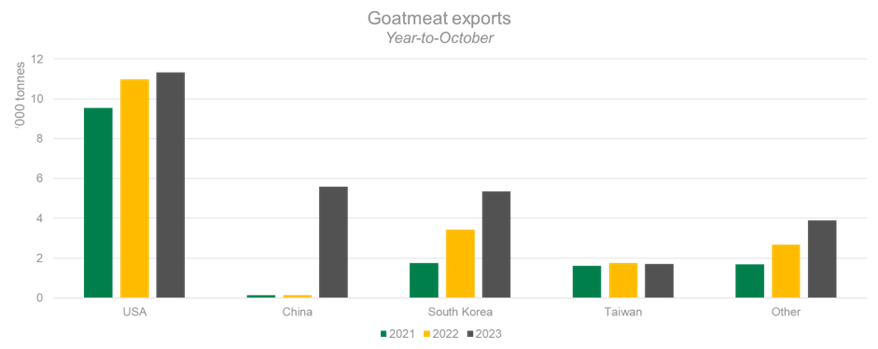

So far in 2023, goat exports have lifted by 47% YoY to 27,816 tonnes, which is the second-highest export volume on record. Importantly, Australia’s goatmeat export mix has also shifted markedly as supply has improved.

In 2022, the United States was Australia’s largest goatmeat market, accounting for 57% of Australia’s exports. So far in 2023, the United States only accounts for 41% of exports, even as total volumes have lifted 3% YoY.

The main change this year has been a huge increase in exports to China, from almost nothing to Australia’s second largest market. In 2022, Australia exported 289 tonnes of goatmeat to China, 1% of our total exports. This year, exports have lifted 4,053% YoY to 5,587 tonnes, or 20% of our total export volume.

In periods of high supply, a diverse range of export markets is useful to drive demand for our exports. In this case, a big boost in export volumes to China shows that demand can be found for Australian red meat, even for products that had not been in high demand in the past.