US 90CL indicator reaches record high in A$

Key points

- US 90CL indicator reaches record high in A$

- Competition amongst international buyers heating up

- Lean beef market suggests upside potential for cow prices if season improves.

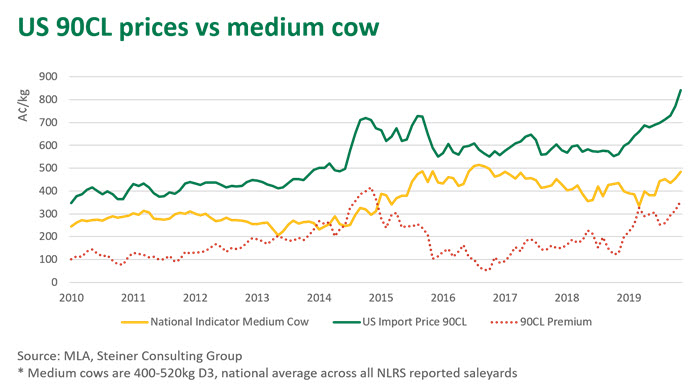

The 90CL (Chemical Lean) US imported beef indicator (a benchmark price for frozen manufacturing beef into the US) has continued to rise, fuelled by supply uncertainty over coming quarters and strong global demand. US imported 90CL beef prices are now at a record high of 840 A¢/kg. A weakened Australian dollar, currently hovering around 68US¢, has further complemented the supportive export environment.

Typically, the Australian medium cow indicator responds to movements in the lean manufacturing beef market. As global demand bids up the price of US imported beef, the Australian market has found support despite challenging seasonal conditions and elevated female slaughter. In times of high cow turnoff, strong 90CL prices add value which would likely be missing otherwise.

As detailed by MLA last week, Chinese demand for meat is having a significant impact upon supply and demand dynamics around the world. Through 2019, China has quickly accumulated much market share for key global exporters. This buying power is likely to continue, maintaining pressure on traditional markets, such as the US.

US cow slaughter for Q1 2020 is expected to sit 5% below 2019 levels, as decent calf prices combined with excellent dairy prices (Chinese dairy demand driving increases) keeps cow culling in check. With question marks regarding US domestic supply and the seemingly ever-growing demand from China, buyers are using forward sales tactics to secure supply and purchasing lean primal cuts, such as knuckles and insides, driving import prices higher.

The 90CL premium (spread between the saleyard medium cow indicator and US imported 90CL indicator) is now at 356 A¢/kg – the highest spread since December 2014. With the Australian herd still in a liquidation phase, high 90CL prices provide reassurance that demand shouldn’t recede any time soon. If a decent break in the weather was to occur, reinvigorated restocker interest would compete with the slaughter market, causing the medium cow indicator to rise sharply, again closing the spread on the 90CL indicator.

© Meat & Livestock Australia Limited, 2019