Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Mixed bag for sheepmeat exports in June

09 July 2020

Key points:

- Sheepmeat exports are back on year-ago levels for the fifth month in a row

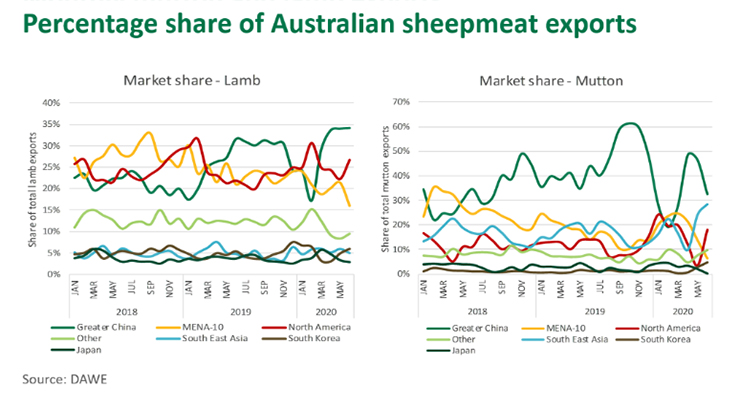

- China is the prominent growth market for lamb exports, up 2% for the year-to-June

- Exports of mutton to the US are up 26% for the year-to-June

COVID-19 has been unfavourable for red meat destined for foodservice channels, with wide-scale shutdowns and operation restrictions across almost all countries this year. While sheepmeat exports dropped 41% below year-ago levels in May, shipments in June were more positive. However, mixed demand factors and tighter Australian supplies will continue to limit the volume of exports this year.

Lamb exports uptick after downturn in May

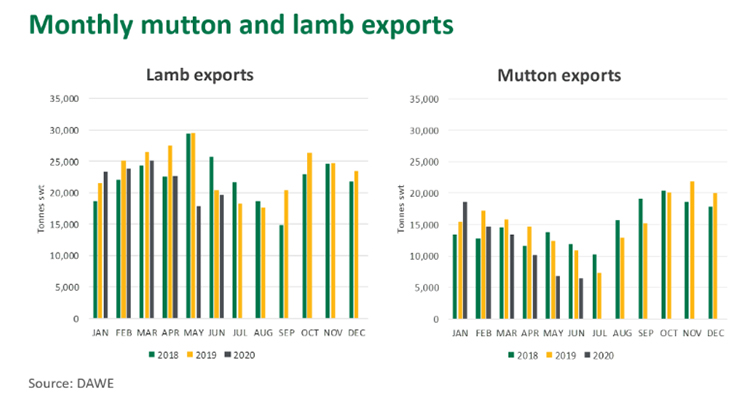

June lamb exports were reflective of a more stable international market compared to May, reaching 19,700 tonnes swt, back 4% on June last year. Lamb exports for the year-to-June are now back 12% on year-ago volumes. June lamb slaughter was back 10% on 2019 levels, which is sizeable considering the two extra workdays in June this year, highlighting the impact of tightening supply.

China continues to track well for lamb exports this year, up 2% for the year-to-date, and was the top destination in June, taking 6,300 tonnes swt. New Zealand lamb exports are expected to tighten through winter as a result of a seasonal decline in supply, which should bolster demand for Australian lamb.

The grounding of international flights has disrupted the Middle Eastern lamb carcase trade, which is dominated by product freighted on passenger flights to the Arabian Gulf. Lamb exports to destinations such as the United Arab Emirates and Kuwait have dropped 19% and 41% below year-ago volumes, and to a lesser extent, Qatar is back 7%, having benefited from the International Freight Trade Mechanism implemented to maintain trade volumes.

In addition, a myriad of issues are undermining sheepmeat demand across the Middle East, from subdued oil revenue to the downturn in tourism and business travel.

Tight sheep supplies restricting mutton exports

Exports of mutton were back 55% compared to June last year, with low sheep slaughter a key factor limiting the availability of product for export. Exports of mutton have declined 19% for the year-to-June, with further contraction likely in the coming months.

Demand from China has been particularly volatile, dropping away in June after showing some signs of resurgence through April. The majority of frozen mutton exported to China is processed into hot pot rolls and sold via foodservice channels, however, a series of new COVID-19 outbreaks has dampened eating out numbers.

The collective South East Asian markets accounted for 28% of all mutton exports in June, led by steady volumes to Malaysia and Singapore, albeit still back on 2019 levels. The US was the third largest destination for mutton in June, and encouragingly, is tracking 26% ahead of 2019 levels.