Cattle supply’s state of play

Key points

- Lowest saleyard throughput for young cattle and cows in four years due to rebuilding on farms

- EYCI prices have risen enough to bring gross value to highest level in that time

- Feeder cattle remain consistent year-on-year, with the gross price paid far outweighing previous years.

Supply has often been touted as the main driver of high prices, which remains largely the case. However, analysis shows that supply differs greatly based on category given the different dynamics of the beef supply chain.

This analysis looks at saleyard numbers captured by the NLRS, focusing on January to September levels over the past four years. It must be noted that ‘gross value’ is merely a calculation on NLRS recorded data, not actual transaction data.

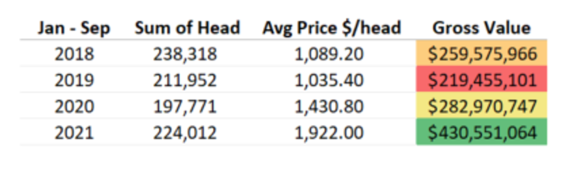

EYCI

Eastern Young Cattle Indicator (EYCI) eligible cattle have experienced continued downward supply year-on-year since 2018, however, still on par with 2020 levels. Despite having the lowest throughput in four years, prices of EYCI cattle have doubled in that time, revealing the total gross value spend of EYCI cattle was actually highest in 2021. This further accentuates the strength of the young cattle market.

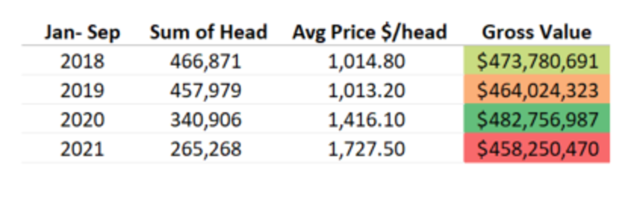

Feeder steers

Feeder steer throughput has remained relatively steady across the four years, with 2021 still above 2019 and 2020 levels, highlighting the consistency of feedlots to secure cattle. This sentiment is furthered by feedlots’ continued demand for young cattle at the saleyard, evidenced by lot feeders buying more EYCI cattle currently. Similarly with the EYCI, prices for feeder steers have risen high enough to propel the 2021 gross value to the highest level in four years.

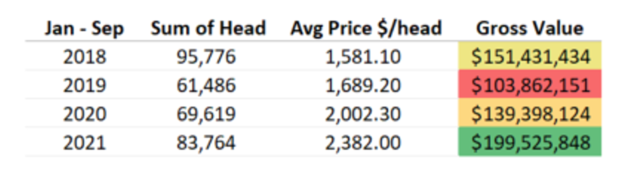

Cows

Cow (420kg+) throughput has declined dramatically in 2021 where historically this category features heavily at the saleyard, due to rebuilding on-farm. Throughput has nearly halved since 2018 on the back of culling of productive cows during the drought. While prices have lifted significantly, the decline in throughput hasn’t been enough to offset gross value, leaving 2021 as the lowest in four years.

Heavy steers

Heavy steers (500kg+) have seen higher throughput this year than in 2019 and 2020, similar to that of feeder steers. Prices have also risen enough for the gross value to be the highest of the four years in 2021, highlighting the dependency on the feedlot sector to produce heavy animals.

In summary, throughput across the whole supply chain isn’t down in 2021, but the low supply is being fuelled by animals on grass – mainly young cattle and cows, which go hand in hand for producers.