Strong financial outlook for the agricultural industry

Key points

- Strong financial performance has allowed producers to pay down debt and increase equity over the past several years.

- Effective business management is necessary for financial planning.

- Maximising farm management deposits (FMD) can help businesses navigate challenging times.

The Financial performance of livestock farms from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) provides a valuable look into the financial position of producers around Australia. The main finding is that several strong years have put the industry in a good financial position despite recent challenges in the livestock market.

Sheep

Sheep producers have performed well over the past several years and have generally used the good years to improve their financial position.

Sheep producers have the highest equity ratio of any farm types surveyed at 95%, alongside the lowest farm business debt, at $329,000. This is important, as it can provide confidence in the industry that producers have financial buffers to remain solvent, even as lamb and sheep prices have eased significantly.

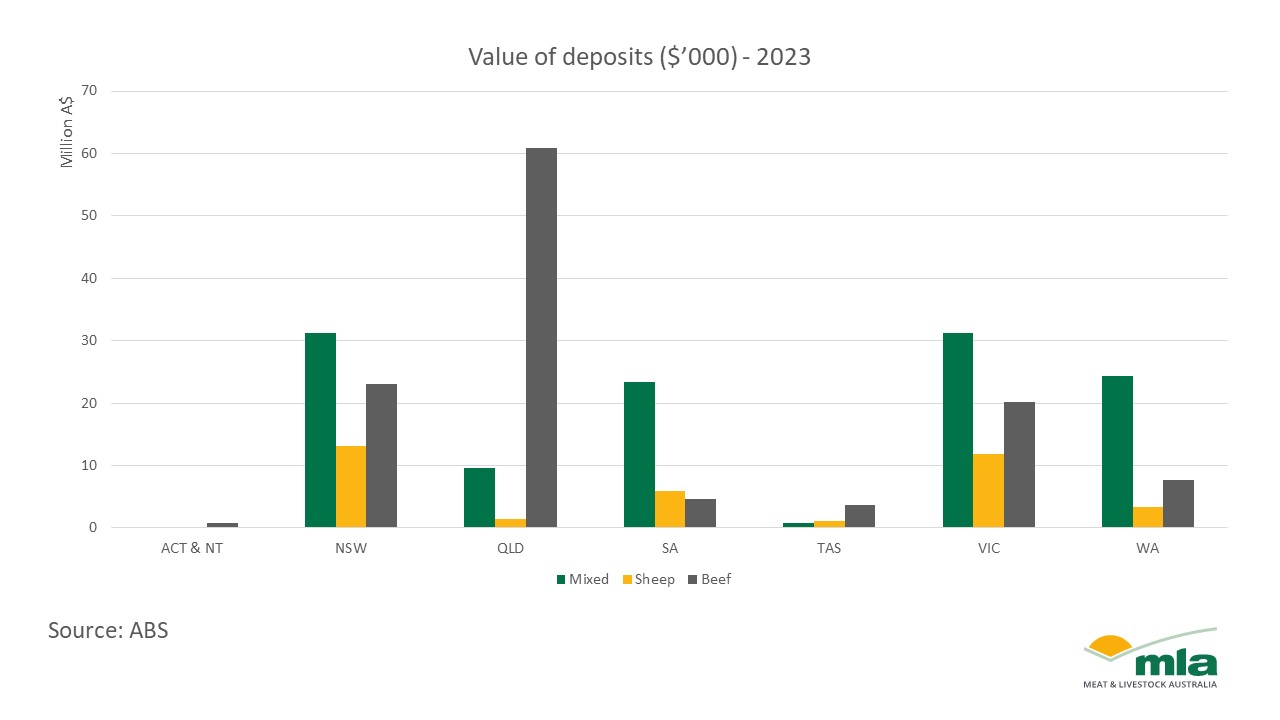

Farm management deposits (FMDs) reinforce this point. FMDs allow producers to set aside pre-tax income from their primary production activities during years of high income. Sheep producers have utilised this program over the past several years to build up financial buffers, with the sheep producer FMDs in NSW and Victoria holding an average of $100,000.

Source: ABS

Beef

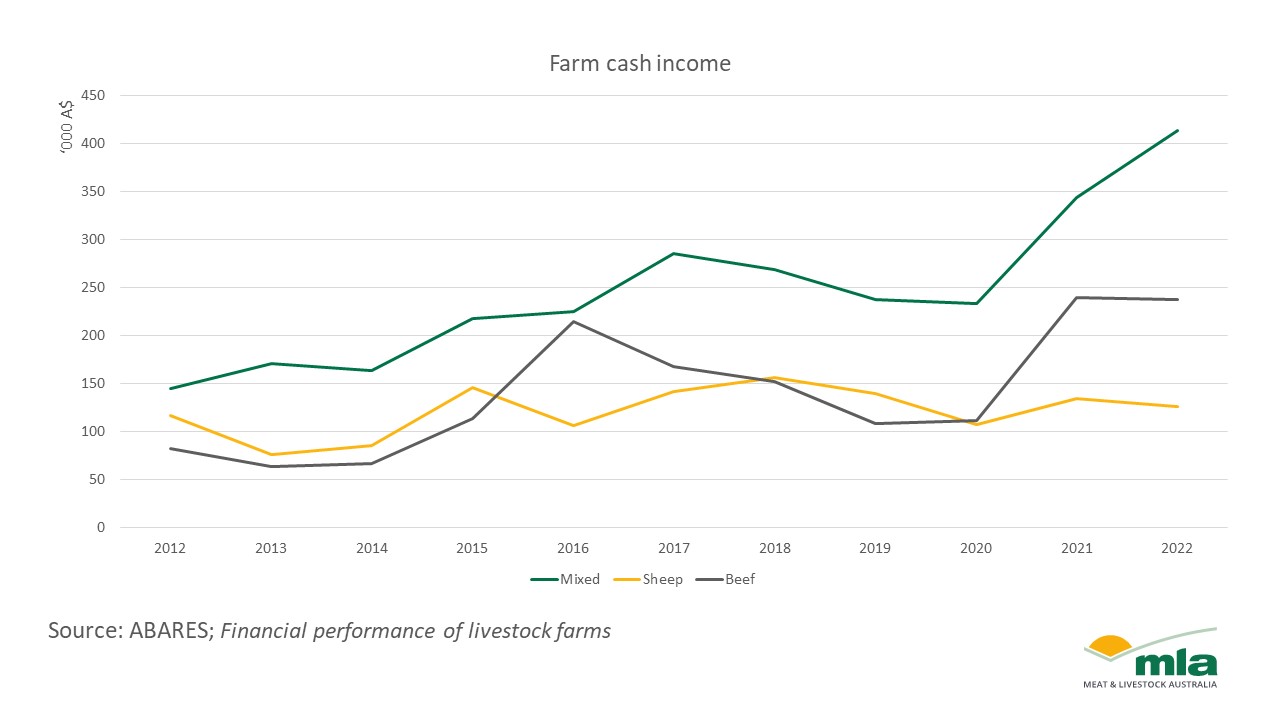

The average farm cash income for beef cattle producers in 2022–23 was $238,000 – the highest income in seven years.

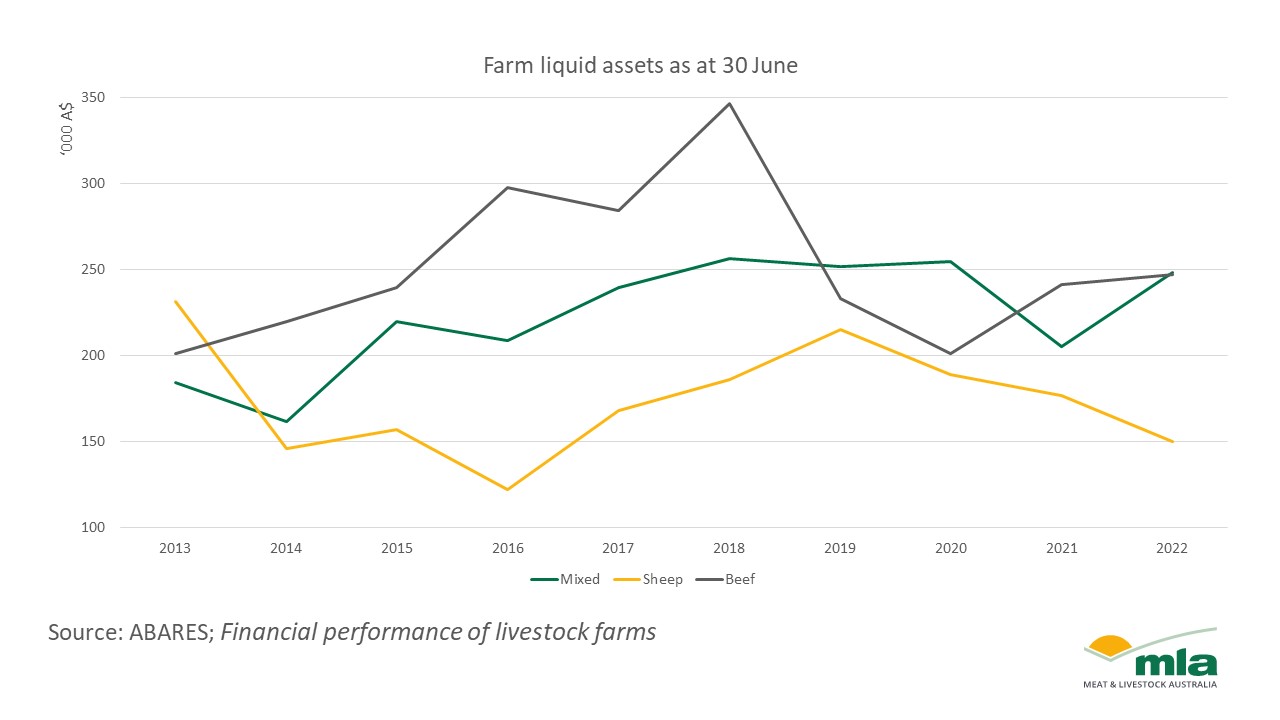

Although the average equity ratio for beef cattle producers is a solid 94%, absolute farm cash debt is $570,000 – a relatively high figure compared to average liquid assets of $247,000. This means that a higher-than-usual proportion of total assets is non-liquid, which might be an issue if producers face short-term issues that require asset liquidation.

Looking at FMD accounts provides a positive outlook, as beef producers have strong deposit rates. On average, the largest FMD accounts are found in Queensland ($178,000), with the second highest in NSW ($55,000) in 2023.

Source: ABARES; Financial performance of livestock farms

Mixed

Mixed farming systems performed relatively well over 2022–23, with a farm cash income of $400,000 and $248,700 of farm liquid assets in 2022. Cropping and mixed cropping-livestock farming operations are more exposed to input cost pressure, increasing farm business debt to a relatively high average of $1.3 million. If farm liquid assets are low, businesses will struggle with the repayment of non-current assets.

Source: ABARES; Financial performance of livestock farms

Looking forward

These figures show that producers have used the past several years to pay down debt and build up equity, which should provide financial resilience in the face of lower livestock prices and a turning weather cycle. The proportion of non-liquid equity remains a challenge, especially in the event of short-term cash shortfalls, but in general, producers are well-positioned for the next several years.