Turn-off methods for Queensland steers shift

Key points

- Average monthly feeder steer yardings in Queensland have increased 220% (in linear terms) since January 2010.

- Heavy steer yardings have declined during this period, demonstrating a structural change in the turn-off points of steers in Queensland.

- Queensland heavy steer prices have been operating at a monthly average discount of 17% to feeder steer prices since January 2020.

Recent analysis conducted by MLA’s Market Information Team reveals an interesting shift over the past decade in turn-off points for Queensland steers.

Analysis of yarding volumes across all Queensland saleyards for heavy steers shows a decline in overall throughput since January 2010 to March 20221. Meanwhile, feeder steer throughput has increased substantially, with increased capacity and demand for consistent product from consumers driving the sectors’ growth.

Supply

Throughput for heavy steers during March was 30% below the long-term average, despite reaching its highest level since September 2021. Conversely, the total throughput for feeder steers during the month of March was 6% under the long-term average, despite reaching its highest level since November 2021. Both throughputs demonstrate the tighter than average cattle supply operating in Queensland saleyards at present but also the first increase these categories have seen since spring 2021.

In linear terms, Queensland feeder steer yardings over the long term have increased on average from 5,000 head/month in January 2010 to an average of 16,000 head/month – an increase of 220%. Meanwhile, heavy steer volumes have declined in linear terms from around 1,000 head/month to just over 500 head/month.

Since April 2021, supply of feeder steers has remained stubbornly tight, averaging 8,500 head/month as producers opt to sell cattle directly or higher paying restockers purchase traditional feeder cattle at the saleyards. While heavy steer yardings since October 2019 have not risen above 1,000/head per month since October 2019, since this time, throughput has averaged 334 head/month, 55% below the long-term average.

Price

As expected, both the feeder steer and heavy steer prices have appreciated since January 2010. Both categories have experienced strong, sustained growth since March 2019, with the average feeder steer price per month rising by 132% or 320¢/kg lwt while the average monthly price of heavy steers has risen by 70% or 132¢/kg lwt since March 2019.

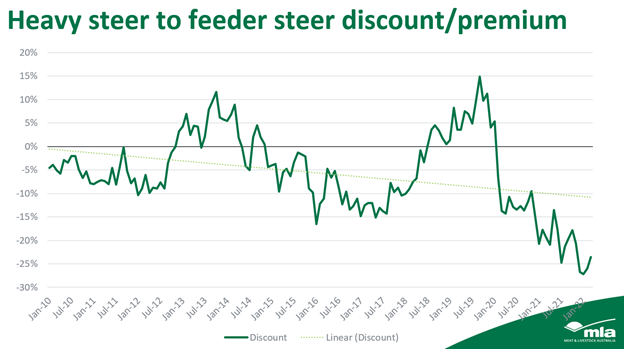

For the most part of the decade, heavy steer prices have operated at a discount to feeder prices. The exceptions to this are:

- between October 2012 and May 2014, when the Queensland heavy steer price operated at an average monthly premium of 4% to the feeder steer price

- between July 2018 and January 2020, when the Queensland heavy steer price operated at an average monthly premium of 5% to the feeder steer price.

Since January 2020, the heavy steer price has operated at a monthly average discount of 17% to feeder steer prices.

The favourable prices on offer for younger, lighter cattle can be attributed to lower supply of heavy steers, as well as significant demand for feeder cattle in Queensland as lot feeders increase capacity and utilisation to meet growing customer and consumer demand for a consistent product.

These prices mean producers can run more cattle on-farm due to the lighter turnoff weights of feeder steers while continuing to generate favourable returns, with the buoyant feeder market outperforming its heavy steer counterpart.

This is particularly relevant during favourable seasons, when turnoff weights for feeder steers are heavier due to the strength of the season.

Notes

- April 2022 data was not included due to shortened selling weeks.