US cattle slaughter decline offers Aussie beef opportunity

Key points

- Cow slaughter in the United States (US) fell to 5 million in 2025 − the lowest figure in 20 years.

- US carcase weights hit all-time highs at 398kg in 2025.

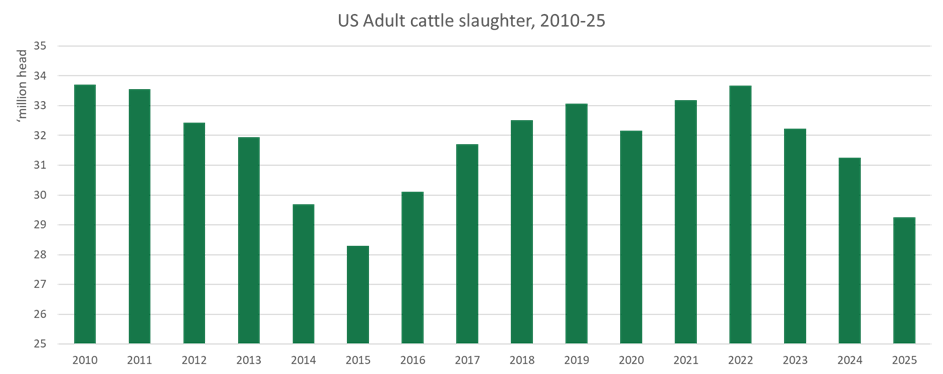

US cattle slaughter fell by 6.4% in 2025 to 29.3 million head − the lowest volume since 2015. This was the third consecutive year of declining slaughter, with total numbers down 13% since 2022.

The US cattle herd has been in a technical destock since 2019, with herd numbers declining each year as high rates of cow and heifer slaughter reduce the number of cattle available for calving. While this initially led to an increase in production, slaughter numbers have been falling since 2022 as the reduced herd size means there are fewer cattle available for slaughter.

Source: USDA, MLA

Cow slaughter fell by 11% to just under 5 million − the lowest figure since 2005. The low cow slaughter number is important for Australian producers because it means the amount of lean, manufacturing beef produced domestically in the US is lower than before, creating space for imported product.

Heifer slaughter fell by 7% over 2025 to 9.3 million head, while steer slaughter fell by 7% to 14.5 million head. The combined steer and heifer slaughter number is important as most steers and heifers go into feedlots, meaning that total slaughter dictates the amount of ‘fed beef’ production, including most United States Department of Agriculture (USDA) graded steaks. The lower slaughter numbers have created an opening for Australian exporters to market grainfed beef into the US market, building familiarity among end users with Australian beef’s unique qualities.

The low slaughter numbers were partially counterbalanced by higher carcase weights, which hit a new record of 398kg over 2025. As a result of the higher weights, actual production was only down by 3.6% to 11.2 million tonnes. This is still, however, the lowest total production volume since 2016.

Despite the overall decline in slaughter, the female slaughter rate ended 2025 at 48.8%. This is well above the normal baseline of 47% and suggests the US cattle herd remains in a technical destock.

Looking ahead, US production is unlikely to substantially increase until the herd has significantly rebuilt. While the rate of decline has slowed substantially, there are still no signs of meaningful herd rebuilding, meaning the number of cattle available for slaughter continues to fall, despite higher carcase weights.

Attribute content to: Tim Jackson, MLA Global Supply Analyst.

Information is correct at time of publication on 29 January 2026.