Weekly cattle, sheep and goat market wrap

Key points

- Cattle and sheep prices rebounded this week as buyer confidence returns across most markets.

- Larger restocker presence has supported increased buyer competition among sales.

- National slaughter rates across all species outperform year-ago levels.

Cattle market

Strong confidence returned to the cattle markets this week, with buyers recognising opportunity in the market dynamics and driving increased demand, heightening competition for a tighter supply pool.

The benchmark Eastern Young Cattle Indicator (EYCI) recovered some of its recent losses and rose by 31¢ or 3.4% to 918¢/kg cwt this week. Smaller yardings in north-east NSW at Tamworth and Gunnedah, as well as Carcoar in the Central Tablelands, saw prices lift strongly across most categories.

Increased restocker activity has driven heightened demand, with confidence evidently returning in the market as rains fell across supply regions and buyers recognised the opportunities available.

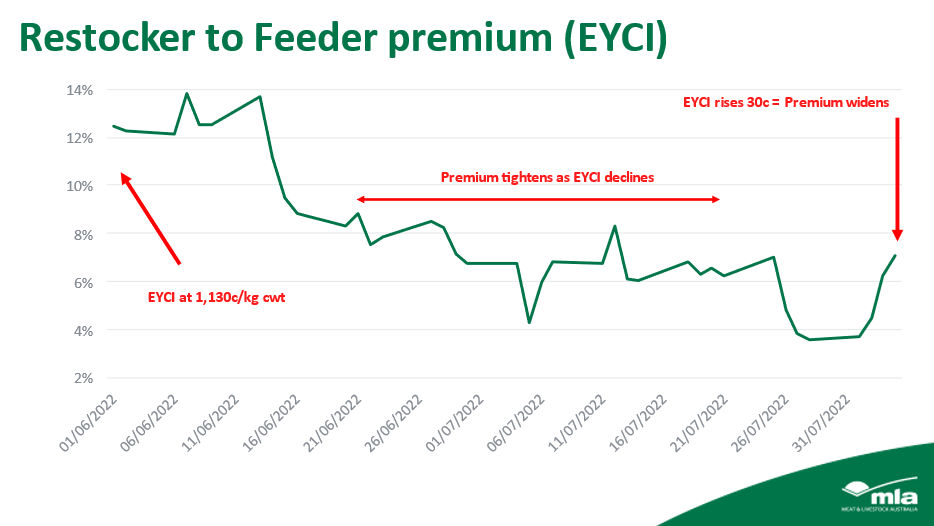

A key indicator of market confidence closely followed by MLA’s Market Information team is the restocker to feeder buyer premium in the EYCI.

The graph below demonstrates that as the EYCI declined from 1,130¢/kg cwt in early June, the premium between restockers and feeder buyers tightened to 3.7% on Monday 1 August. Since then, it’s recovered a further 4% as the EYCI price rose 30¢ to finish this week at 918¢/kg cwt. This premium increasing demonstrates the strong demand from restockers at the saleyards to put cattle back on grass and continue their herd rebuilds.

In the west, the Western Young Cattle Indicator (WYCI) also experienced gains, rising 11¢ week-on-week to reach 920¢/kg cwt.

Sheep and lamb markets

A recovery in market prices was not exclusive to cattle this week, with all sheep and lamb indicator prices higher than week-ago levels. Confidence returning the market amid tighter supply aided this rise, with:

- merino lambs lifting 85¢ or 17% week-on-week

- heavy lambs lifting 41¢ or 6% week-on-week

- trade lambs lifted 57¢ or 9% week-on-week.

While all other sheep and lamb indicators also experienced gains, the three listed above were most significant. These are positive signs for the industry.

In the processing sector, the continued strength of lamb volumes and robust export demands also demonstrate the strength of the current flock’s position in both on-farm and export terms.

Slaughter volumes

Across all species for the week ending Friday 29 July, slaughter volumes outperformed year ago levels.

Cattle slaughter is currently operating 3.6% higher than year ago levels at 102,215 head per week. This is now the second consecutive week cattle slaughter has sat above 100,000 head – and only the second time this has happened in 2022.

Meanwhile, lamb slaughter is performing strongly at 368,000 head per week, up 9% on 2021 levels. This demonstrates the significant supply of 2021 lambs that are continuing to be made available in the processing sector.

Sheep slaughter is firm on 2021 volumes, although it has risen by 10% week-on-week. National sheep slaughter throughput last week was 96,107.

Finally, goat slaughter is the strongest performing of all species. Last week, goat slaughter was 93% higher than year ago levels, reaching 27,994 head. This shows the outstanding on-farm production conditions goat producers are experiencing, as well as the significant uptake in the species as a managed enterprise option and the growth in the national goat herd.

Sales that did not operate this week were Cootamundra Sheep, Bairnsdale and Blackall cattle.