Wool is back in vogue

Key points

- The (Eastern Market Indicator) EMI has outperformed all lamb and sheep indicators this year

- The difference between the EMI and Merino lamb price is growing

- Expect to see sheep producers pivoting back towards wool production.

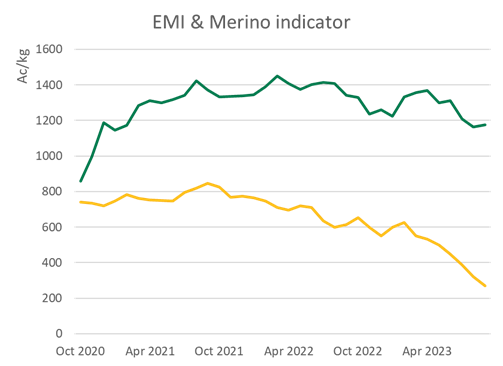

The Australian wool market, measured by the Eastern Market Indicator (EMI), is outperforming all sheep and lamb indicators this year. The EMI has fallen 12% over the last 12 months; in comparison, the heavy lamb (the best-performing ovine indicator) has fallen 38%.

Source: AWI/AWEX

Source: AWI/AWEX, MLA

This means Australian sheep producers are more likely to pursue wool production over meat production. At present, provided producers can secure shearers, Merino wool production is possibly more lucrative than meat production.

Over the last three years, the proportion of breeding ewes that are Merino has fallen from 77% in June 2020 to only 69% in May this year – a drop of 8%. This reduction in Merino ewe numbers has been driven by better prices for lambs over the last few years, lower wool prices, access to shearers, amongst other factors. This trend is expected to change as the price for lambs remains subdued.

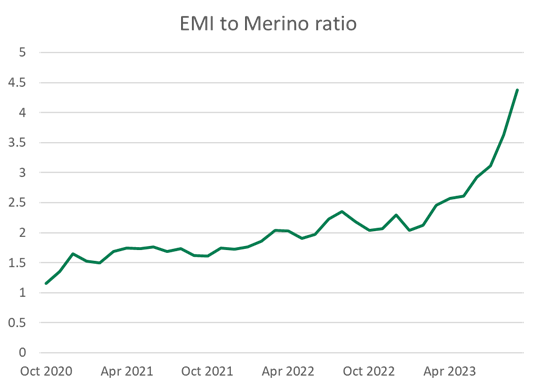

The ratio comparing the EMI to the Merino lamb indicator is shown below.

Source: AWI/AWEX, MLA

This graph shows that the wool price is nearly 4.5 times higher than the price for Merino lambs on a per-kilo basis. This is the highest the EMI to Merino lamb ratio has been in the last three years.

This means that those producers with Merino lambs are less likely to sell them for slaughter, especially wethers. Provided weather conditions allow, there is an increasing incentive for producers to retain Merino lambs on farm and to shear a fleece from them.

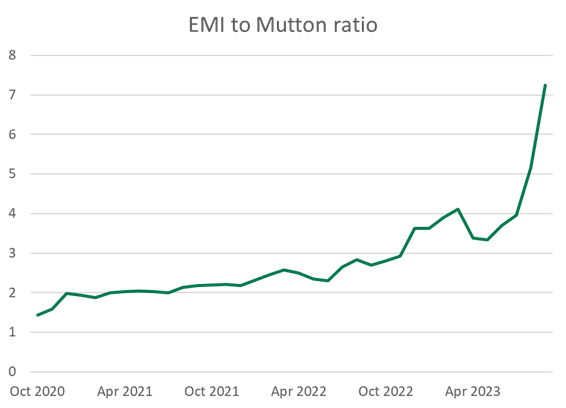

This year, mutton slaughter is extremely high and could possibly reach 10 million. The mutton supply is being driven by the sell-off of ewes retained for breeding purposes during the rebuild. Therefore, it is clear that producers are choosing to turn off mutton – some due to changing weather conditions.

Producers with grass will be incentivised to hold them back from sale into current market conditions and shear fleece from them. At present, the EMI to mutton ratio is above seven – the highest level in over three years.

Source: AWI/AWEX, MLA

Going forward, expect a reversal in the flock demographics. For the last three years, the demographics have seen the proportion of Merino sheep fall. Expect the number of Merinos to start increasing.