Steer prices converge as cattle market shifts

Key points

- The restocker yearling steer, heavy steer and feeder steer indicators are now within 8¢/kg lwt of each other.

- Young heifer prices are promising with restocker premiums the widest in recorded NLRS history.

- Stock that does not require additional inputs will outperform in an unstable and low-confidence market.

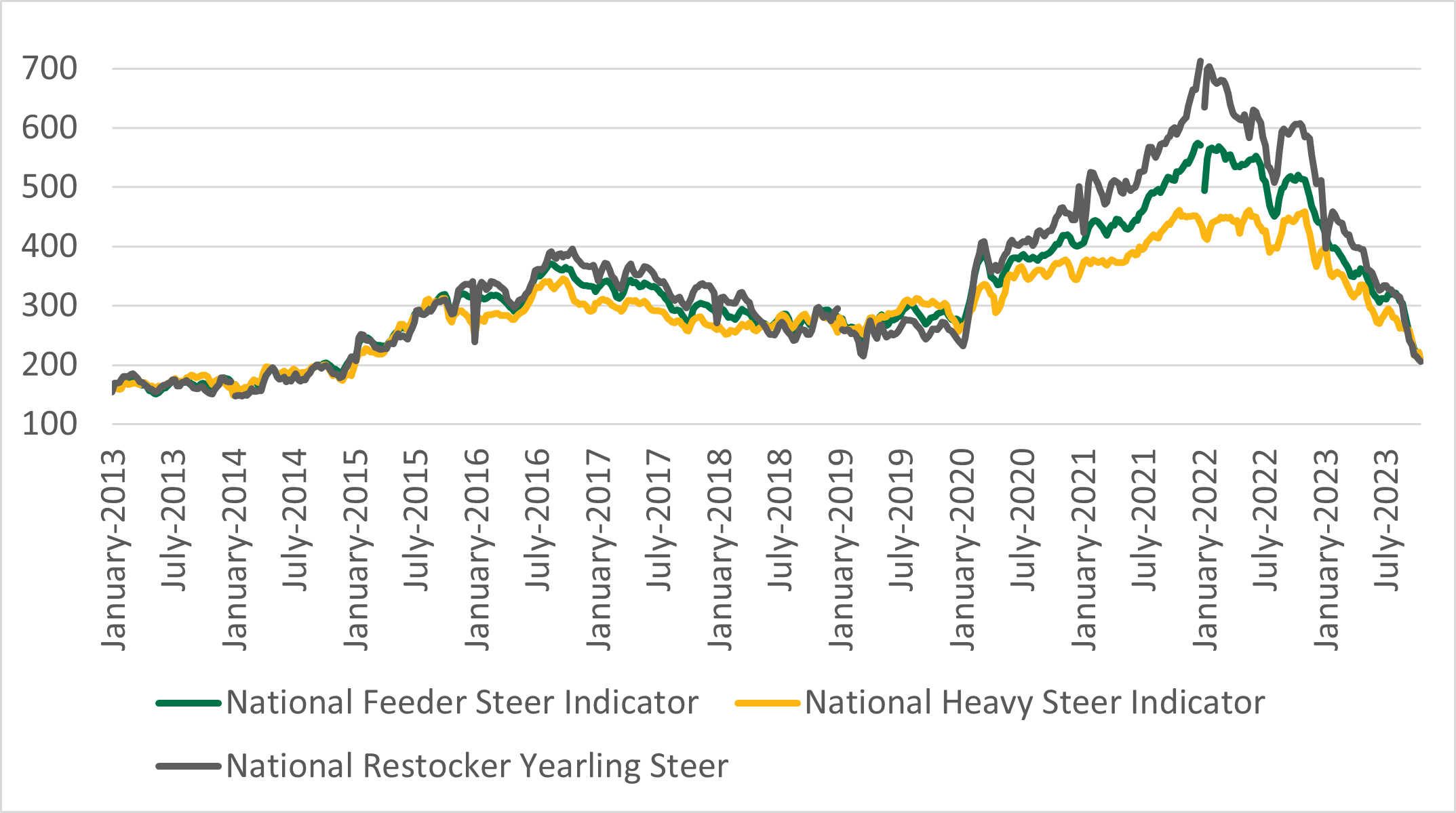

MLA’s National Livestock Reporting Service (NLRS) compiles three indicators for steers: the restocker yearling steer indicator, the feeder steer indicator, and the heavy steer indicator. Each differs by spec and buyer, and the relationship between the different indicators is helpful in understanding the market as a whole.

Steer prices come together

Weekly average steer prices have converged on a per kg live weight (lwt) basis. This week’s prices are within 8¢ of each other:

- the restocker yearling steer at 218¢/kg lwt

- the feeder steer at 210¢/kg lwt

- the heavy steer at 211¢/kg lwt.

Looking at the liveweight prices, it is important to understand the differences between the animals.

- A heavy steer is a grown steer between 400–750kg, purchased by a processor.

- A feeder steer is a yearling steer over 220kg or a grown steer under 600kg, purchased by a lot

- A restocker yearling steer is a yearling steer between 200–400kg, under 12 months, bought to be put back on land, predominantly purchased by producers looking to restock their herd or breeding stock.

Generally speaking, when seasonal conditions are good, restocker animals receive a premium over feeder steers, who in turn receive a premium over heavy steers. This trend was noticeable from early 2020 to mid-2022.

Beginning in 2020, recovery from drought created substantial demand from producers for restocker animals. Prices for restocker steers peaked at 713¢/kg lwt in December 2021, and the premium for restocker steers over heavy steers peaked in January 2022 at 287¢/kg lwt. High demand and low supply for young cattle pushed restocker prices up and created a substantial premium.

Australia's cattle herd stands at 28.7 million, marking its highest level since 2014. In conjunction with an unfavourable seasonal outlook, this dynamic has reversed, and producers are moving towards offloading the stock they have built up over the past three good seasons.

Looking forward

The closing of the restocker premium suggests that the widespread herd rebuilding may have ended for the next few months. This means that the market may move to mirror the pattern observed in 2019, where an inverse trend emerged. Heavy steers were fetching premiums, followed by feeder and then restockers. In an environment where cattle are more freely available and other input costs are expensive, stock that does not require additional inputs will outperform in an unstable and low-confidence market.

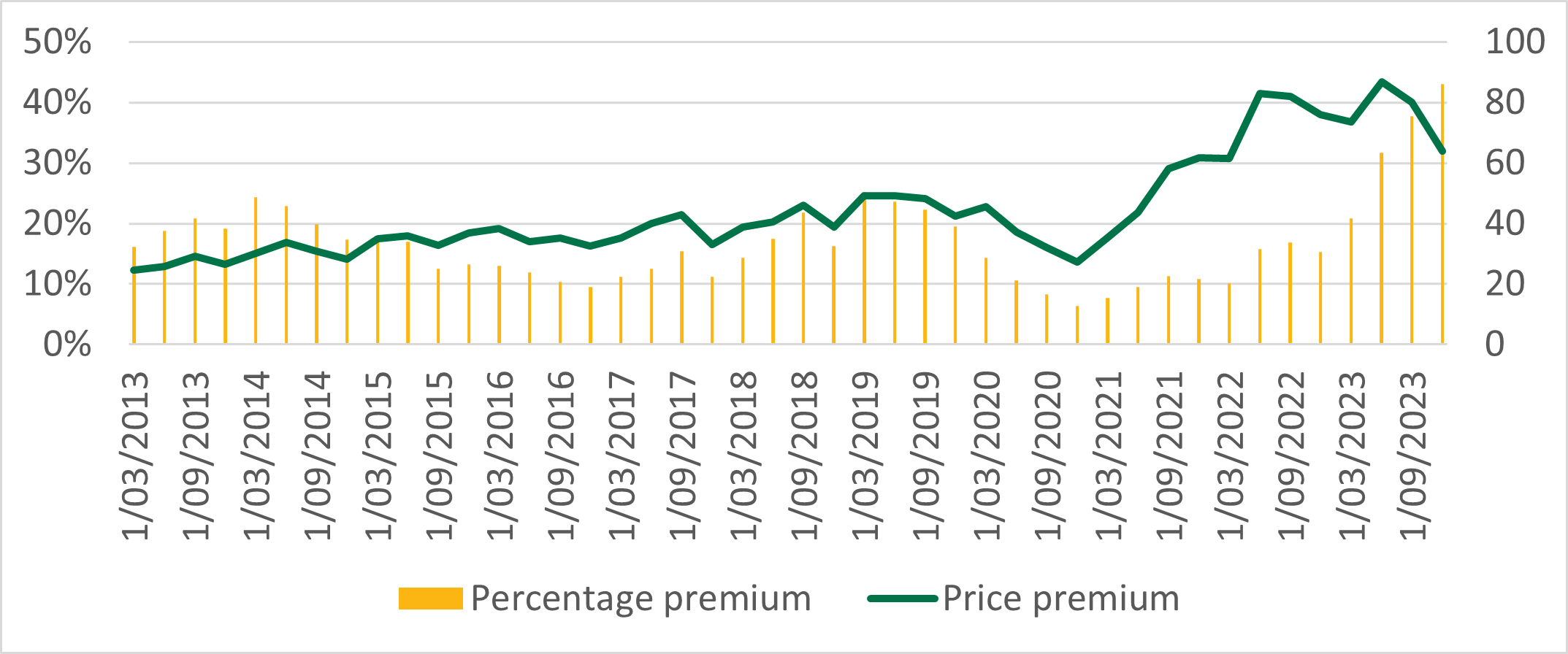

A glance at restocker yearling heifers

In April of this year, MLA reported that the ‘restocker steer to heifer’ premium had reached its highest level since 2019, with the expectation that this gap was likely to widen due to the accelerated pace of herd rebuilding. Quarterly data reveals that the premium percentage on steers has reached its highest point in the history of MLA NLRS (since 2000), steadily increasing since the last quarter of 2022.

Historical data suggests that the steer premium peaks when cattle numbers have been rebuilt or when drought-induced liquidation is most intense.

Forecasts for the current season indicate that this percentage premium may continue to expand. Saleyards might start to witness producers acquiring restocker heifers to replace older cows, capitalising on lower prices to reduce the age of their breeding herd.