Cattle prices narrowing gap on export unit values

Recent appreciations in the price of Australian cattle, both at saleyards and direct to works, have reduced the price spread between livestock prices and export beef prices, on a per kg basis.

Australian beef exports during the first four months of 2016 were valued at A$2.31 billion (FOB), back 17% year-on-year. The decline was purely driven by tonnage, with export unit values largely steady year-on-year over the same period.

The export value decline was led by the US (back 35%, to A$642 million), Japan (back 16%, to A$496 million) and China (back 23%, to A$198 million) – however exports to each market declined from a historically high point.

However, some markets have shown value growth in 2016, notably South Korea (up 22%, to $397 million), Indonesia (up 21%, to A$89 million) and Taiwan (up 10%, to A$59 million).

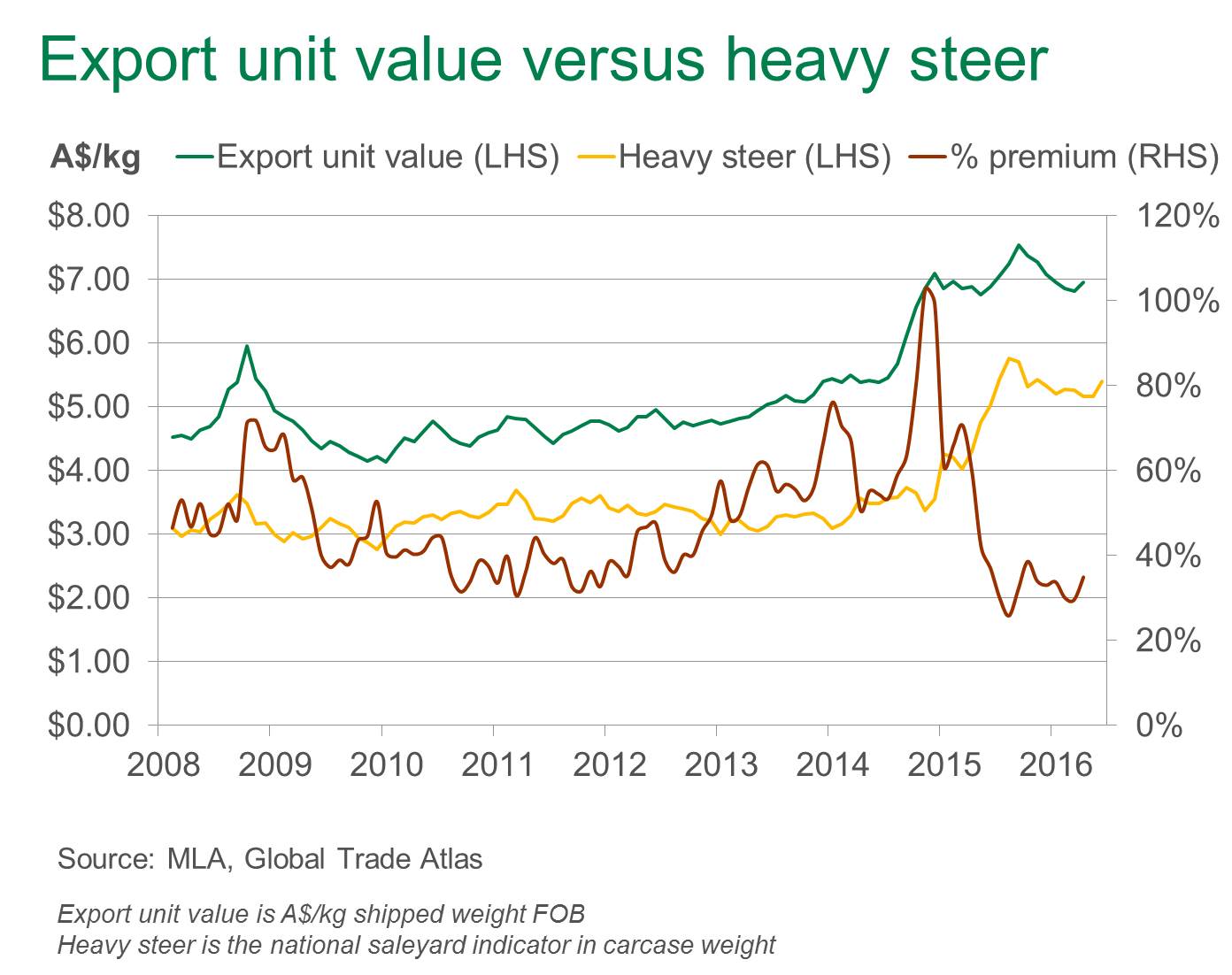

Unit export values have tracked mostly steady year-on-year, however at the same time Australian cattle prices have appreciated significantly over the past eighteen months. As illustrated below, this means the premium of the average unit export price over the national heavy steer indicator has halved from an average 64% during the first four months of 2015 to 32% so far this year. In fact, the last time the premium was so low was during the wet years of 2011 and 2012.

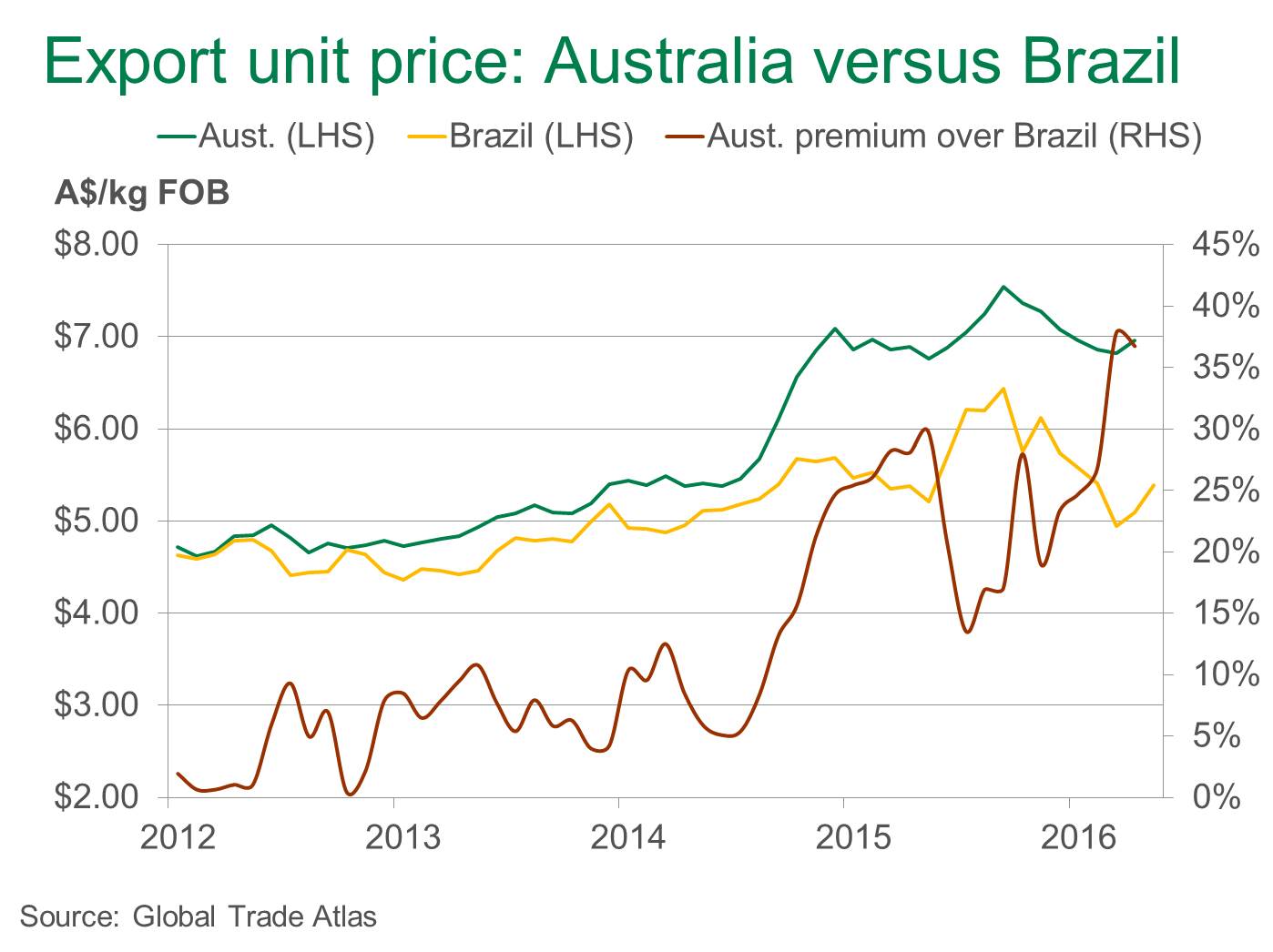

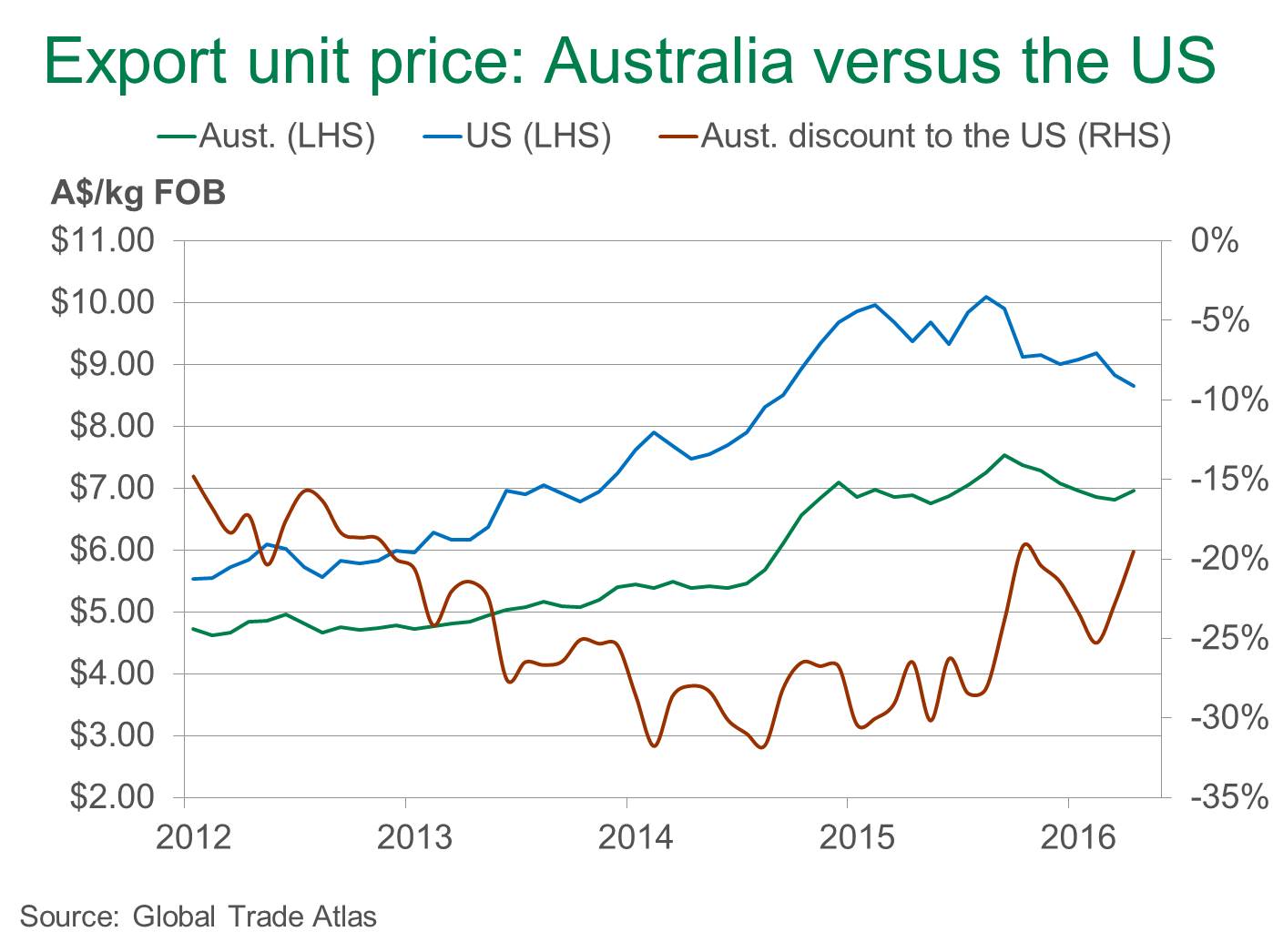

With increasing beef production in the US and greater exports from the likes of the Brazil, tight supplies out of Australia may play a limited role in supporting global export prices. As illustrated below, Australian unit export values are already tracking at a historically high premium to those of Brazil, while the discount relative to US product is as small as any time in the past four years.

How may this impact finished cattle prices in Australia? With the export unit value premium over the heavy steer indicator already at a five-year low, and increasing competition from the US and Brazil keeping a lid on global prices, further upward potential for finished cattle prices may be limited.

On the other hand, tightening slaughter cattle supplies – forecast to decrease to a 20-year low by 2017 – could see the premium of export unit values relative to finished cattle tested further. In addition, if the A$ falls below 70¢, as some banks are forecasting by the end of this year, export unit values may find more room to move in local terms.