Beef trade expansion - but not immune to risk

October beef exports finished the month just shy of 99,000 tonnes swt, up 15% year-on-year, and were encouraged by strong global trading conditions and elevated slaughter.

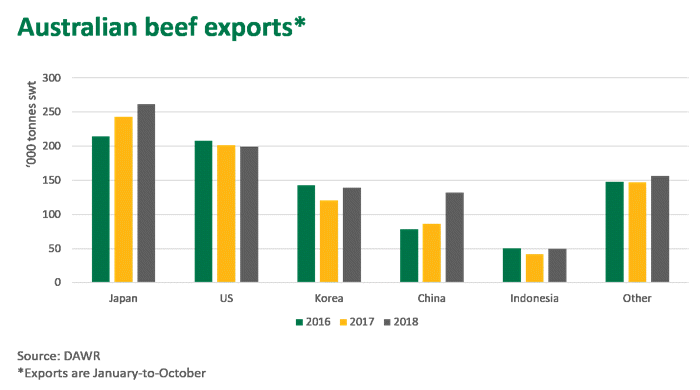

Year-to-October exports were 939,000 tonnes swt, 12% above last year but still below the drought-induced peaks of 2014 and 2015. Despite export growth in 2018, some markets host headwinds while the global economy remains exposed to trade war-related risk.

Increased supplies flowing onto global market

Part of the reason for increased exports has been record numbers of cattle on feed and ongoing drought resulting in greater female turn-off.

September quarter numbers on feed will be released next week and are anticipated to remain at record highs. Fed cattle have continued to flow through supply chains and have boosted grainfed beef exports, which were up 20% year-on-year in October at 27,000 tonnes swt.

Meanwhile drought has continued to bite into the breeding herd, with female slaughter trending higher since February. Grassfed beef exports, up 13% in October at 72,000 tonnes swt, have been supported by increased female turn-off but export tonnages have been nowhere near as great as 2014–2015 as the herd did not go through the same expansion in the lead-up to drought.

![]()

Positive global conditions but risks abound

Exports this year have been supported by strong global conditions. Despite a small recovery since the start of November, the Australian dollar has tracked lower against the greenback throughout 2018, making exports more competitive against US beef.

Increased demand has been led by China, where Australian exports were up 53% year-on-year between January and October, and other major suppliers, namely Brazil and Argentina, have recorded similar growth. In fact, on the current trajectory, China may overtake Korea as Australia third largest export market by volume at the close of 2018.

Australia faces temporary headwinds in Korea, following it triggering safeguard volumes last month, leading to higher tariffs on product cleared before the New Year. Subsequently, Australian beef exports to Korea in October declined 10% on the previous month (exports to all markets increased 8%) but were still up 25% year-on-year. Meanwhile, US beef exports into Korea have been strong, up 39% between January and September, benefitting from unhindered trade due to a higher safeguard.

Fortunately, favourable access into Japan has seen Australia defend its strong market share from growing US competition. The US exports to Japan within the shared non-EPA (Economic Partnership Agreement) chilled and frozen beef safeguards, which have been close to full utilisation in recent quarters. The frozen non-EPA beef safeguard, previously triggered in 2017, sat at 97% utilisation on a cumulative basis at the end of the September quarter. Non-EPA frozen safeguard volumes are scheduled to contract this quarter and next – from 44,000 tonnes swt and 45,000 tonnes swt in the June and September quarters respectively, to 29,000 tonnes swt and 18,000 tonnes swt in the December and March quarters – and will keep pressure off expanding US beef supplies.

However, while trading conditions have been positive, risks remain. Particularly, the US-China trade war continues and, while beef is yet to be directly affected (China did apply tariffs to US beef but it reflected little trade), major stock market corrections in both countries this year may reflect a broader base risk that could spread to the rest of each respective economy. An economic slowdown in either or both countries would hurt Australia on a number of fronts:

- Australian exports have benefitted from a strong US economy and appreciating US dollar.

- Strong domestic US demand has kept meat consumption elevated, preventing expanding supplies from entering export markets.

- China has drawn in record amounts of beef this year, largely thanks to the success of its ongoing economic expansion and burgeoning urban middle-class.