Saleyard throughput weighs on the EYCI

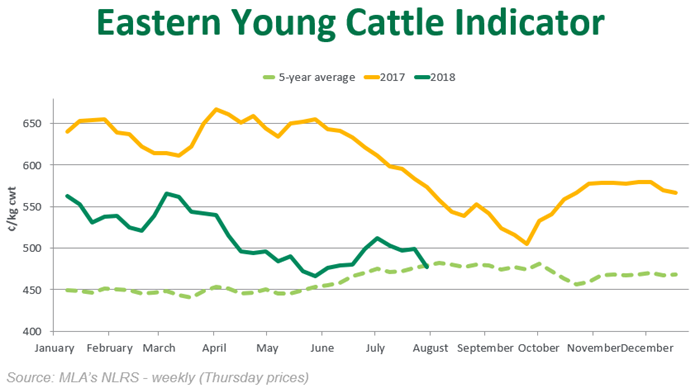

Increased yardings saw the Eastern Young Cattle Indicator (EYCI) fall 42¢/kg between 9 July and 6 August, to 475¢/kg cwt.

After a brief upswing in June, saleyard cattle prices have eased in recent weeks. Factors including increased saleyard throughput, limited restocker interest and low stockfeed availability continue to affect market sentiment.

Indicative of the season, saleyard throughput increased during July, as many producers now face the real prospect of running out of stockfeed and water. Eastern states saleyard throughput for the four weeks ending 2 August surpassed 250,000 head, which was 37% higher than the previous four weeks and 28% higher than the same period in 2017.

Increased yardings over the past four weeks were driven by NSW and QLD, up 35% and 25% year-on-year, respectively. If the poor weather outlook recently issued by the Bureau of Meteorology holds true, yardings are likely to remain elevated for the remainder of winter. In the absence of decent rain in early spring, some producers will have little option but to offload the majority of their remaining livestock.

In the first half of 2018, demand for finished and feeder cattle remained relatively stable, driven by a growing lot feeding sector and solid export demand. This trend now appears to have abated somewhat, with eastern states indicators drifting lower since mid-July. Between 19 July and 6 August, feeder steers fell 5% to 276¢/kg live weight (lwt), while heavy steers fell 11% to 266¢/kg lwt.

Cow prices, which found some support for a short time in July, have started to decline across eastern saleyards. Largely due to rising supply, the medium cow indicator fell 18% between 19 July and 6 August, to 179¢/kg lwt. Australian manufacturing beef has found strong demand in Asia this year, however, enlarged US production is beginning to increase the global supply of beef – which will inevitably impact saleyard cow prices.

Although the severity of the current situation should not be undermined, prices have shown a degree of resilience, especially when compared to previous drought periods. On Monday, the EYCI was down 5% on the five-year August average, while medium cows were down 9%. Prices for feeder steers, which are currently in limited supply, remain in line with the five-year August average.

On another brighter note, although rainfall is the key factor that will break the current pricing trajectory, other influences are providing some degree of support in the face of rising turn off. The Australian dollar remains low, keeping Australian product competitive overseas, while Asian demand continues to absorb some of the increased global supplies of beef.