What’s driving the Australian dollar?

Despite heightened supply, weakness in the Australian dollar supported red meat exports in 2018. Here Prices & Markets covers the key drivers that could influence currency movements in 2019.

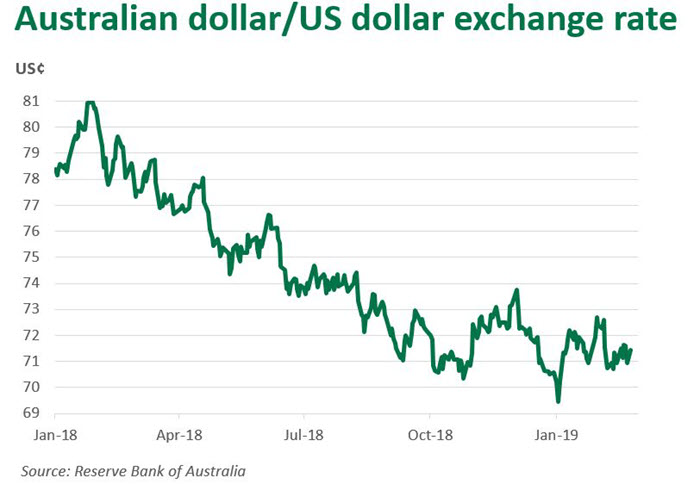

During 2018, the Australian dollar fell almost 10% against the US dollar, supporting livestock prices despite an extremely challenging season.

In recent months, speculation surrounding interest rate movements, commodity prices and trade wars have seen the Australian dollar become increasingly volatile.

Interest rates

In the long run, one of the strongest influences on the Australian dollar is interest rate differentials, particularly with the US.

Over the past year the yield gap has widened, with US Federal Reserve rates rising on the back of improving economic conditions. On the other hand, the Reserve Bank of Australia has left the cash rate unchanged at 1.5% for 27 consecutive months.

Key factors the Reserve Bank of Australia Board has highlighted as being behind the decision to leave rates on hold are:

- uncertainty surrounding household consumption growth

- historically large house price falls

- disappointing wages growth.

Some economists now suggest recent weakness in the economy has increased the likelihood of an interest rate cut in 2019.

Commodity prices

Looking to Australia’s major export commodities, price levels have generally been stronger this year. Iron ore has experienced gains; however, coal indicators have been volatile.

As 2019 progresses, demand for key Australian commodities will be driven by the level of global economic growth and investment, particularly in Asia.

In terms of the Australian dollar, rising commodity indicators have gone some way to offsetting poorer domestic economic data.

China

The strength of the Chinese economy, by far Australia’s largest trading partner, has a strong correlation with the Australian dollar. Speculation regarding the outcome of trade talks between the US and China plays a huge role in driving currency movements.

At present, many traders have identified both upside and downside risks for the Australian dollar, depending largely on the outcome of current negotiations.

Where to for the Australian dollar?

Considering the myriad of factors that may influence the currency, predicting movements for 2019 will be difficult. Of the big four banks, 2019 forecasts for the Australian dollar range from the high-60s to the mid-70s (US¢).

Many economists suggest the best method of predicting an exchange rate at any point in the future is simply using today’s rate. On 27 February, one Australian dollar was buying 71.83US¢.