Foodservice in key Australian markets

Key points

- The foodservice sector across markets continues to be impacted by the pandemic

- Restaurant sales in China, Taiwan and Japan are seeing gradual improvements

- Foodservice landscape in the US remains uncertain, affected by ongoing cases and subsequent restrictions

Since the start of COVID-19 global pandemic, the foodservice sector has been one of the worst affected industries, with wide-scale shutdowns and operation restrictions across almost all countries. The performance of this sector is critical to the Australian red meat industry, as it encompasses a diverse range of occasions and products, ranging from offal, to manufacturing meat, to high end Wagyu.

There has been a range of recent developments in the foodservice sector across key Australian markets, as the pandemic shapes a ‘new reality’ unique to each country.

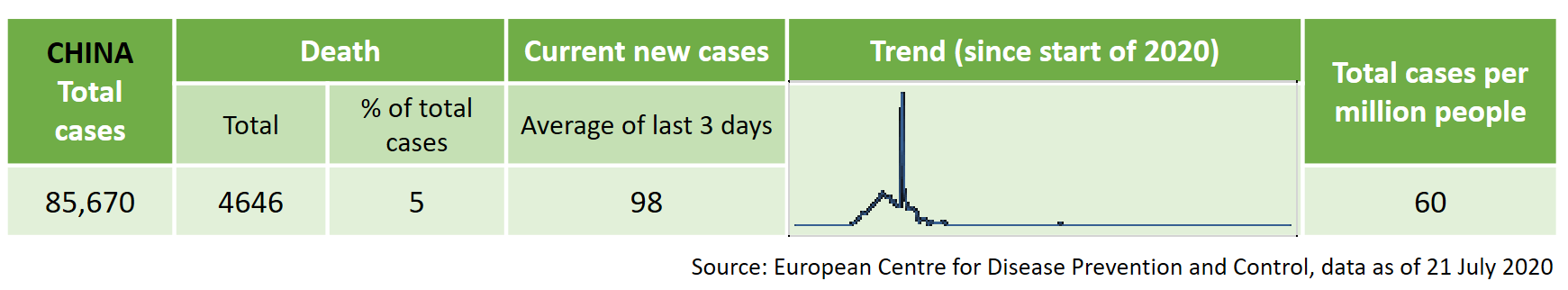

China: Front-runner in the recovery race

The latest data released by the China Hospitality Association show that China’s catering revenue from January to June 2020 decreased 33% from 2019 levels due to COVID-19 impacts. Statistics by Capital Economics also shows that earlier in July, total restaurant orders were still only at 80% of pre-COVID-19 levels, while take-out and delivery orders remained higher.

That said, in a fast-moving country like China, the situation is changing daily. MLA in-market intelligence has noted a return of lively commercial activities in Shanghai, with entertainment venues such as theatre and night markets now back to normal operation, attracting many consumers.

Looking across the nation, foodservice and hospitality operators in China have been adjusting their businesses in an effort to accelerate recovery and build long-term resilience. While diversified service offerings such as food retail, delivery and online marketing/trainings are widely seen across major cities, some providers took their innovation to an entirely new level by establishing eateries where food is prepared, cooked and served to customers by fully automated robots.

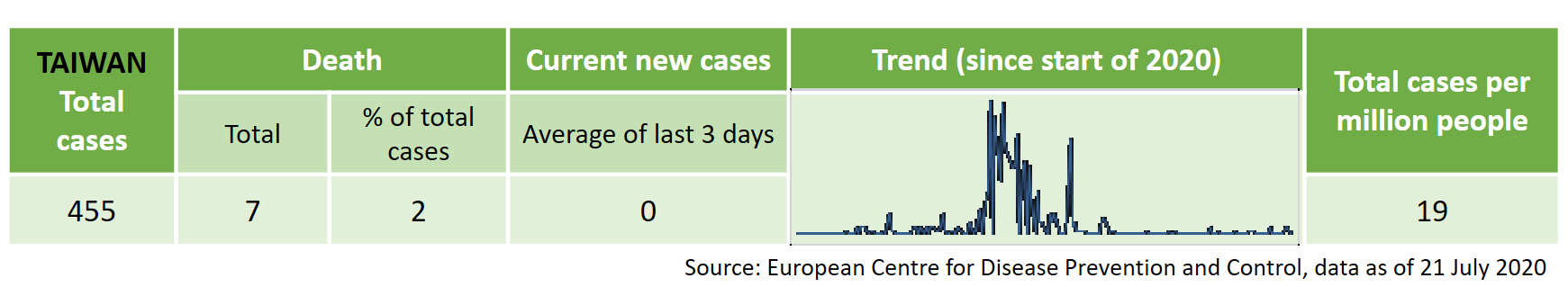

Foodservice in Taiwan is also taking the steady recovery path, with sector sales in May improving 29% from April (but still 9% lower than year-ago levels). Cautious re-opening of some mid to high-end restaurants in recent weeks will likely encourage other operators to gradually resume their business, or even launch new brands, provided the country’s COVID-19 management continues to be successful.

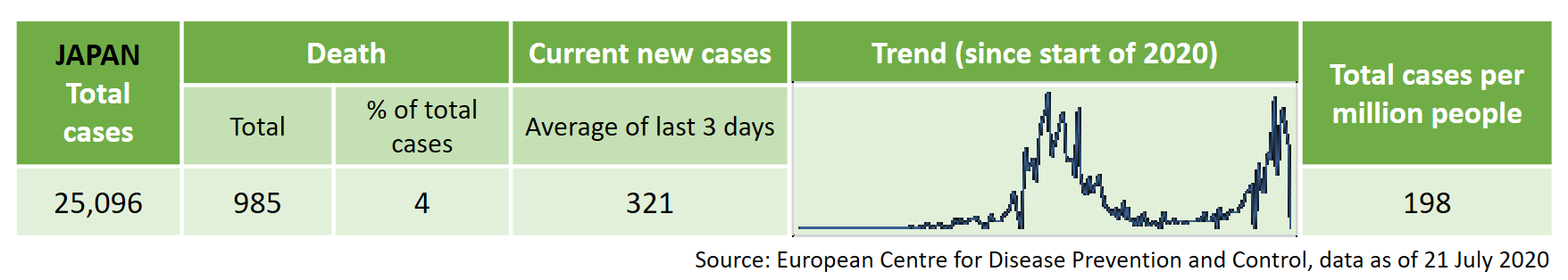

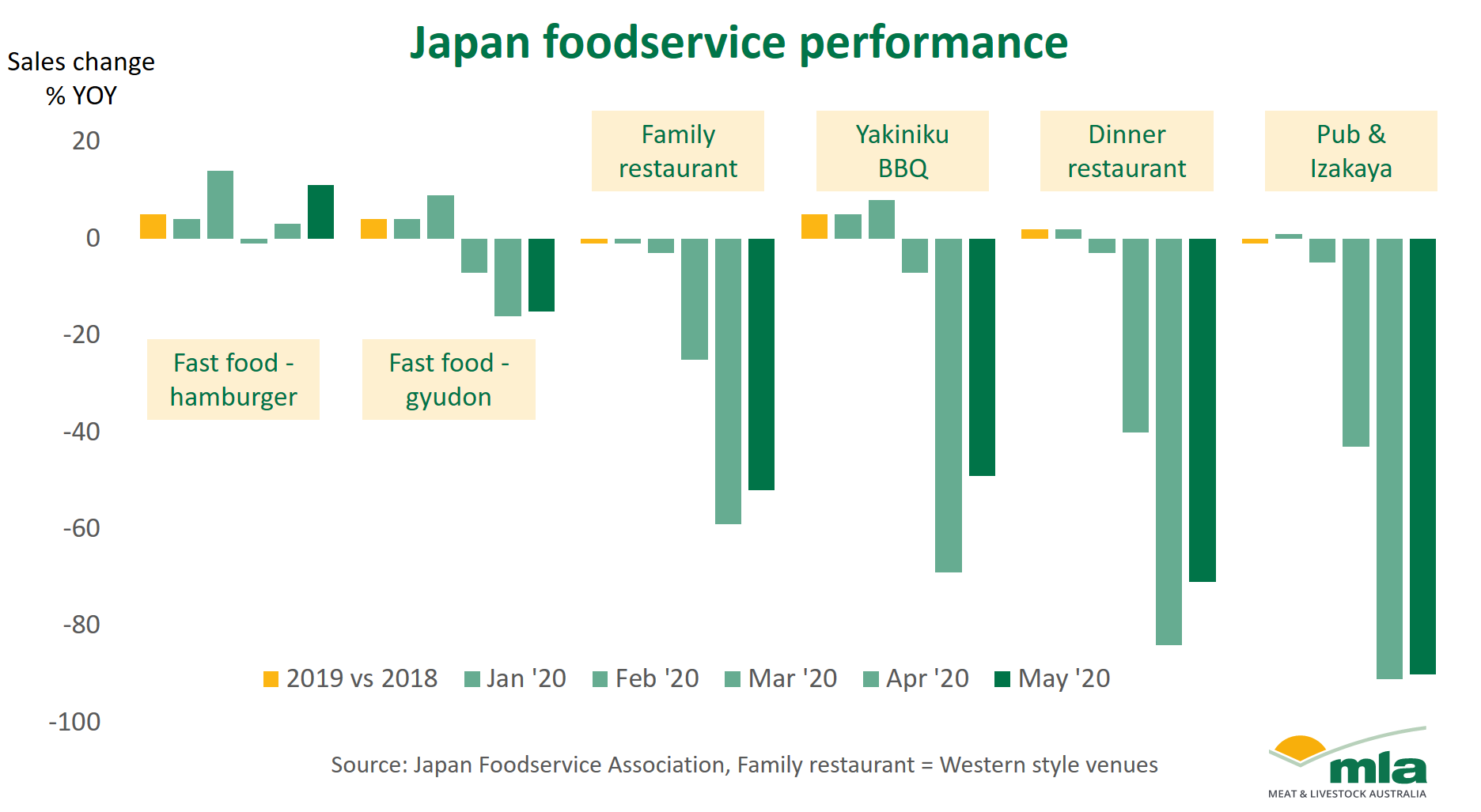

Japan: Gradual improvement in sales

Japan is yet to fully contain the pandemic, with new infections largely occurring among younger people in Tokyo. While the foodservice sector has never been ‘locked-down’ by the government, the decreased sales have already resulted in the restructure, or re-aligning of several well-known restaurant brands, including the affordable steak chain Pepper Lunch.

However, the Japanese foodservice sales data in May shows that the industry may have hit the bottom of the pandemic crisis in April, and is on a slow but gradual path of recovery. Segments such as family restaurants, yakiniku tabletop barbecues, and dinner restaurants are still seeing lower sales from year-ago levels, however not to the extent seen in April.

Besides consumers gradually returning to dining out, the improvement in sales has been assisted by increased use of take-out and deliveries from restaurants. According to a survey by MMD Labo, the majority of respondents (86%) said they used either take-out or delivery services since April this year, while 46% used online food delivery services, up 16% from last year.

Similar to China, Japanese hospitality operators are also trialling new business models - including a full wedding package that combines a ceremony through Zoom and a full course meal delivered to online participants, followed by the married couple visiting each guest table online.

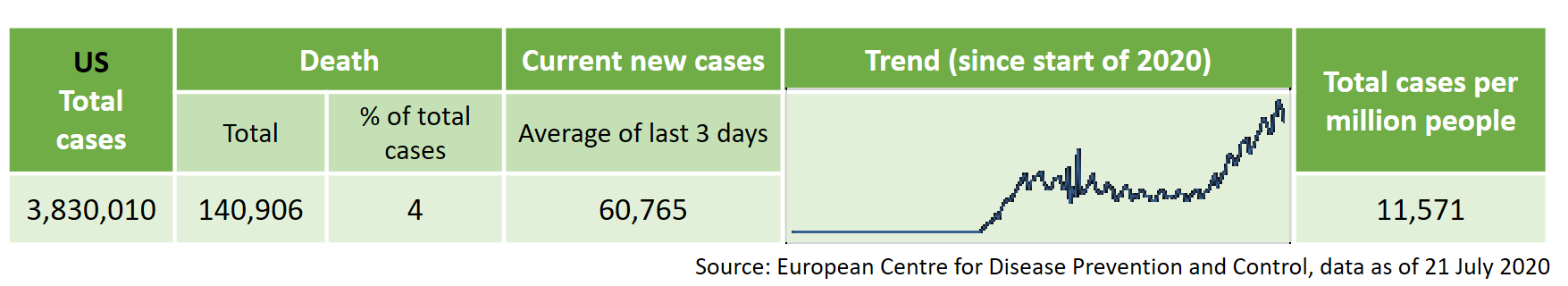

US: High uncertainties affect consumer sentiment

The foodservice situation remains fluid in the US, with some states reverting back to stricter social distancing and/or considering another lockdown, impacted by a recent spike in COVID-19 cases. The pandemic hot spots include California, where indoor dining is currently prohibited state-wide.

Key developments and recent data on the country’s foodservice include:

- Delivery/take-outs and outdoor dining are permitted in California

- COVID-19 cases are increasing in the state of Texas, although dine-in is still allowed with restrictions

- Outdoor dining is allowed with restrictions in the state of New York; indoor dining allowed with restrictions everywhere except New York City

- The state of California has the highest GDP in the US, followed by Texas and New York – the ongoing foodservice restrictions across the top earning states will likely place significant pressure on the recovery of the sector

- A study of credit card spending shows a 25% gap between large and small restaurant spending among consumers, indicating greater recovery among national restaurant chains, in comparison to smaller, independent operators.

- Only 36% of US adults are comfortable dining out right now, compared to 41% back in April

- In an attempt to fill the void left by a lack of business, travel and tourism, many businesses are pivoting to more personalised offerings, such as in-room services and all-inclusive deals for local families and individuals.

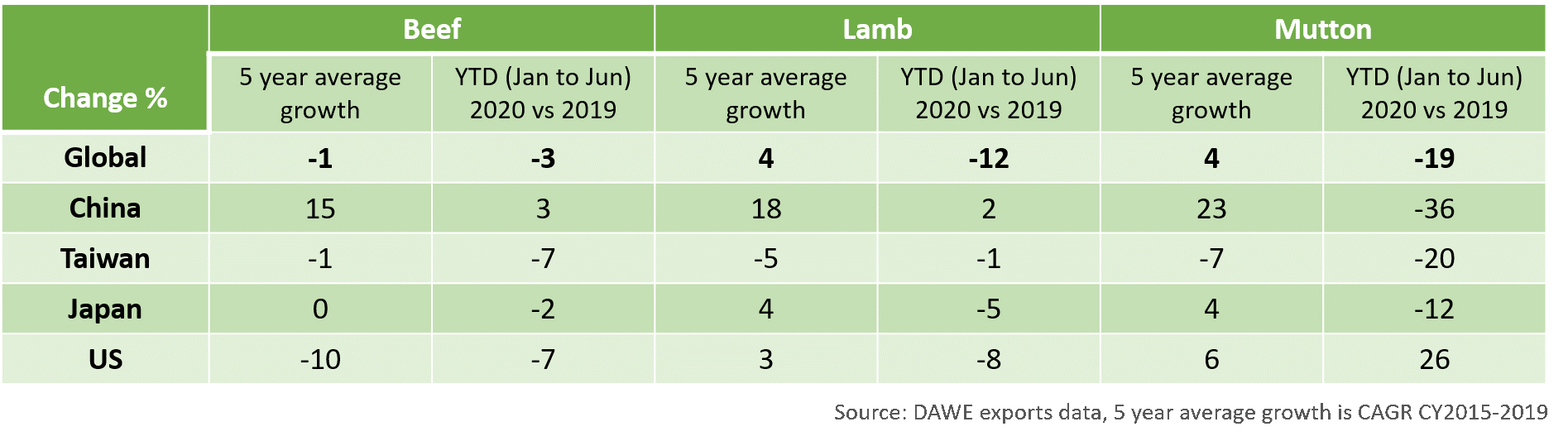

Australian red meat exports: performance by market, based on change in volume

Consumers across the world enjoy the taste, variety and experience that the foodservice industry has to offer. While the recovery of the sector will largely be influenced by the economic performance of each market, it is also supported by individual businesses coming up with agile and innovative solutions for consumers. Understanding consumer needs and identifying opportunities through data and comprehensive insights has become even more critical under the current operating environment.

© Meat & Livestock Australia Limited, 2020