Positive signs for global demand in 2021

Key points

- Positive GDP growth is forecast across major Australian markets in 2021

- Asian middle-class income growth is expected to continue

- Foodservice spending across markets is expected to rebound next year

The impact of COVID-19 on global economies has been well publicised, with few countries immune to the impact of reduced tourism, higher unemployment levels and constrained consumer spending.

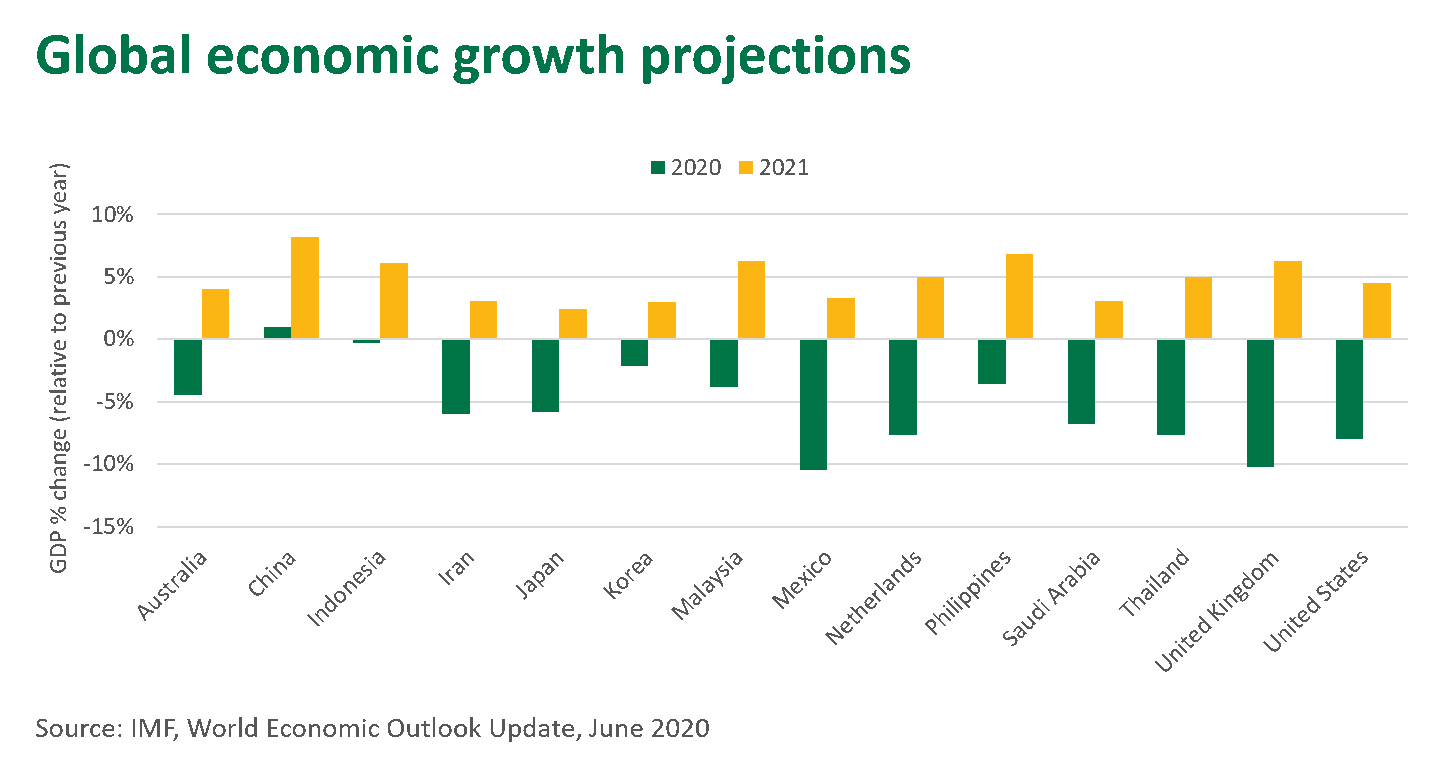

Eleven of Australia's top-15 most valuable red meat export markets are now expected to enter recession in 2020, and those still expanding have had lowered growth rates. This impending contraction in key economies around the world will act as a handbrake to export demand.

Global GDP growth is forecast to contract 4.9% in 2020. However, there are some positive signs on the horizon, with the International Money Fund (IMF) predicting global GDP growth to lift by 5.4% in 2021. Given the levels of contraction seen in 2020, it is encouraging that the majority of markets will enter growth periods next year.

Global incomes on the rise

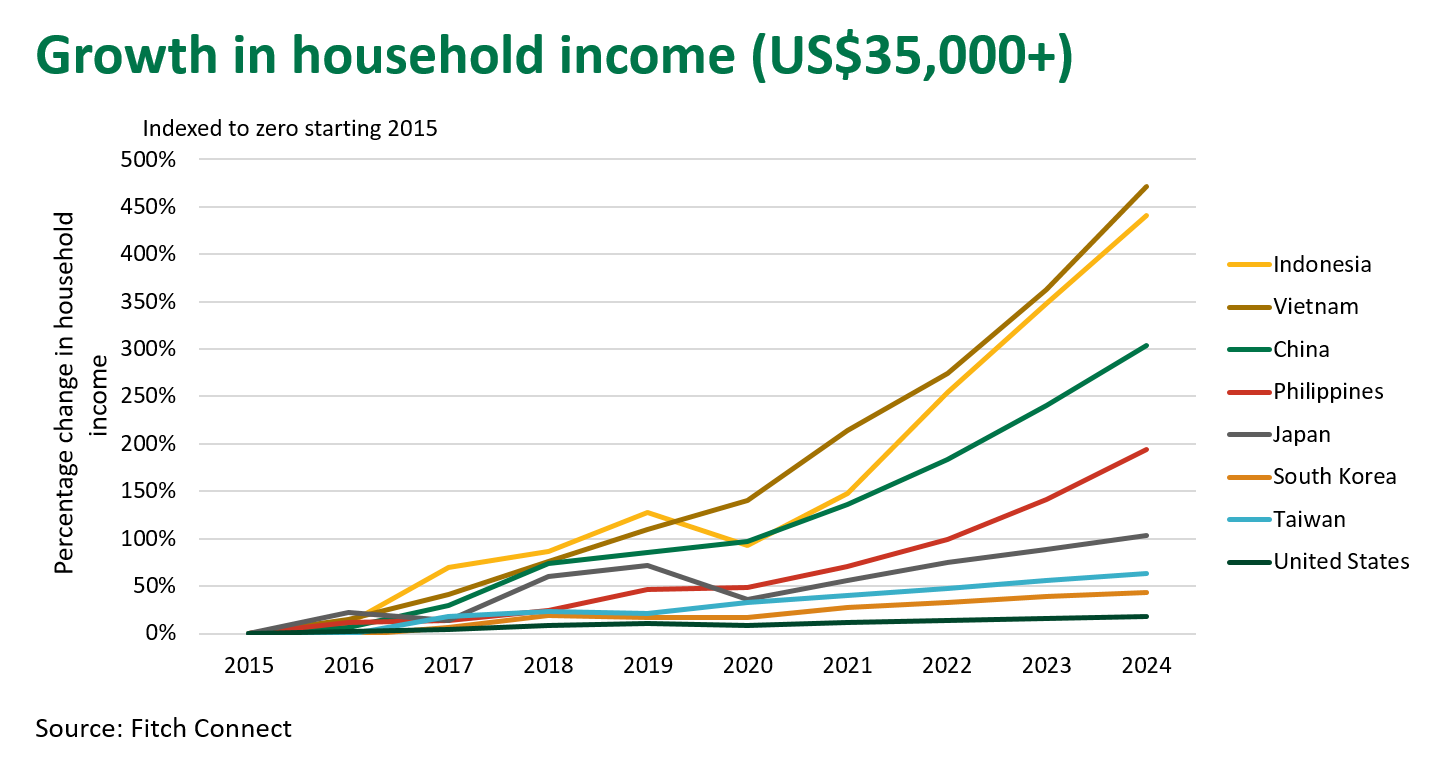

While GDP growth is a good indicator of the overall health of an economy, there are a number of other key indicators that can be used to measure the potential value of a market. One of these indicators is the number of households with an income over US$35,000 per year.

Income levels across South-East Asia in particular are forecast to continue growing, giving rise to an increasing number of middle-class consumers able to engage with a wider range of dining experiences and protein sources. Given the premium nature of Australian beef and lamb, it is a positive sign that a greater range of consumers may soon have the financial flexibility to purchase Australian red meat.

Additionally, Australia’s diverse portfolio of over 100 export destinations means that as opportunities to capture value within these emerging nations arise, exporters are well positioned to engage and achieve a share of the market.

Foodservice industry forecast to rebound

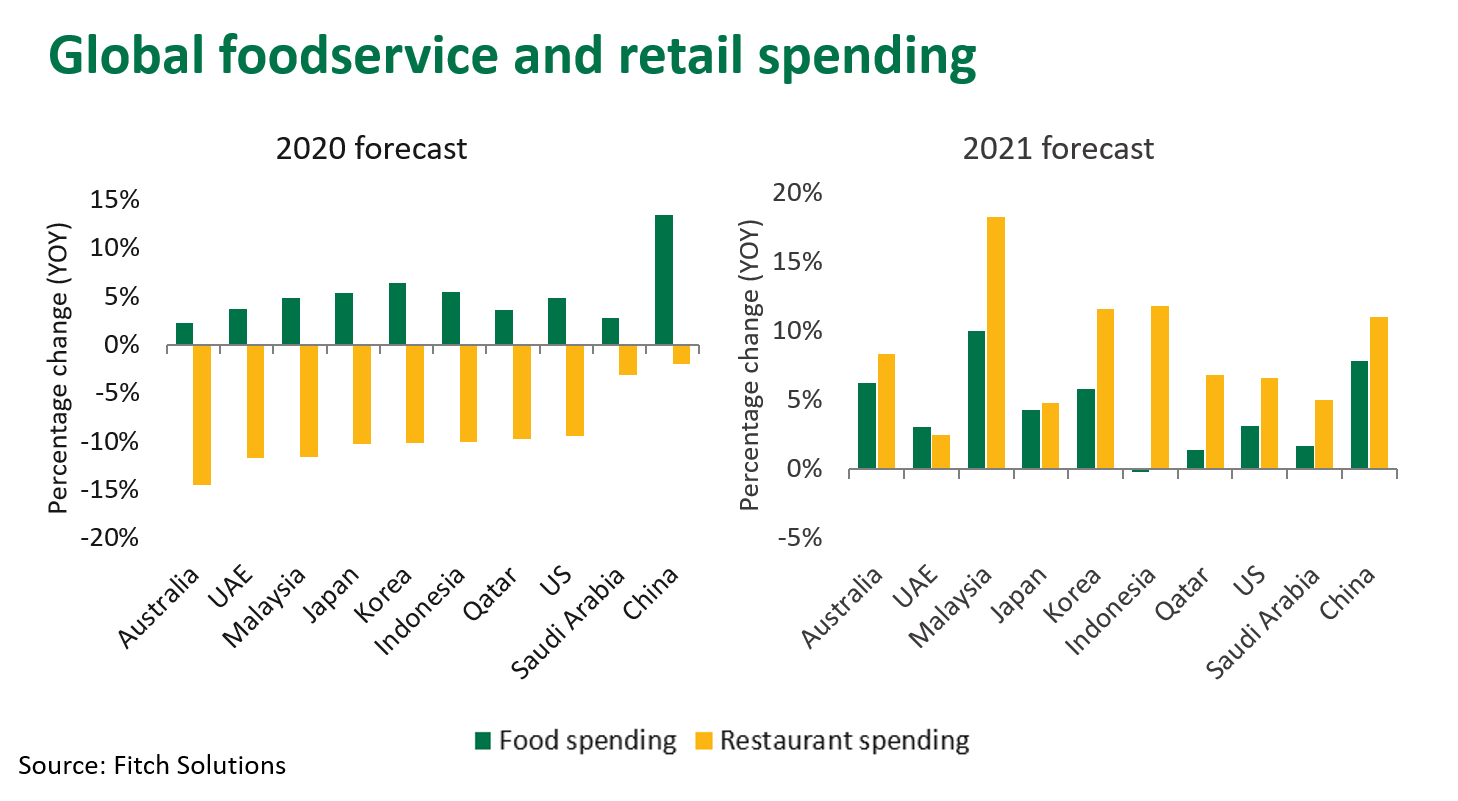

Foodservice industries around the world have experienced a major downturn in spending as a result of COVID-19 restrictions. Through the year numerous challenges have emerged, which have curtailed foodservice activity globally. As a result retail spending has lifted as consumers spend more time cooking at home.

Next year, spending in restaurants is expected to grow substantially, although it is important to keep in mind that this is relative to the reduced levels seen through 2020. However, this growth bodes well for Australian red meat demand and should provide support for prices, particularly as the national herd and flock enter a period of rebuild and supply availability tightens.

© Meat & Livestock Australia Limited, 2020