Argentina self-imposes beef export ban

Key points

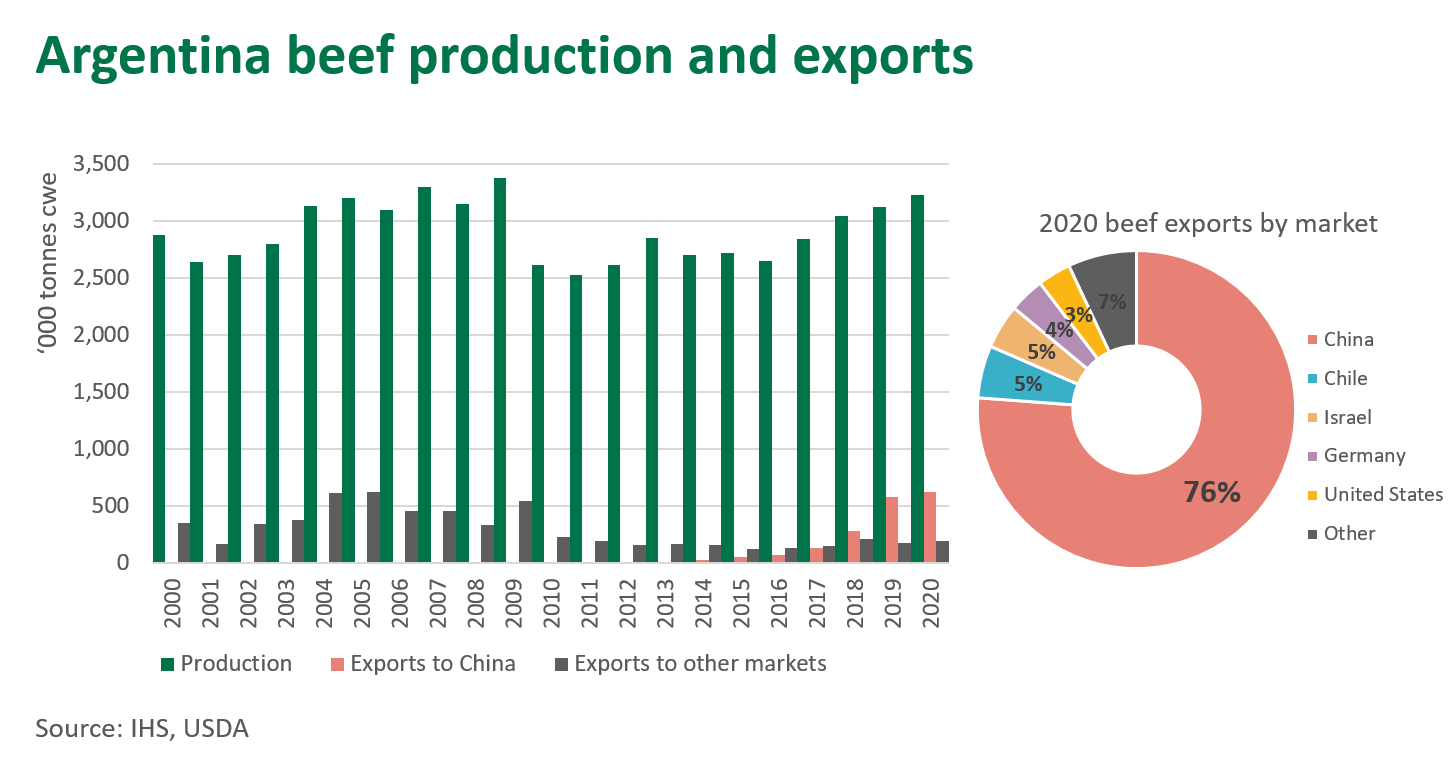

- Argentina has introduced a 30-day ban on beef exports to control domestic price inflation

- China is Argentina’s largest export market, accounting for 76% of exports in 2020

- If the ban is extended, this could place upward pressure on global beef prices

Last week, Argentina introduced a self-imposed ban on beef exports in an attempt to control rapidly inflating domestic beef prices. This ban is set to last for 30 days, however, the Argentinean Government could extend this if they don’t see domestic price improvements. They could also cut it short if it delivers the desired outcome.

In Argentina, the price of beef, a staple source of protein, has risen 65% in the past year. The government is anxious that accelerating inflation will be detrimental in the coming mid-term elections in November.

The ban itself is not a new occurrence, with Peronist governments using export taxes and bans in the past to try and control domestic beef prices. Similar policy interventions from 2006 through to 2011 led Argentina's share of global exports to fall from 9% to 2%.

In response to the ban, the Argentinean cattle industry has committed to a strike on the sale of cattle for slaughter for nine days, beginning May 20.

President Fernandez has indicated the period of the export ban may be reduced if domestic prices fall, but this is unlikely to happen if cattle are not coming onto the market.

Given the ban is for a limited period, there may not be a significant impact on trade and pricing, as exporters can freeze product and export it after the 30-day period. Meanwhile, wider inflation and a depressed currency present challenges for reducing the price of any goods in Argentina.

How will the ban affect China?

Argentina exported 609,000 tonnes shipped weight (swt) of beef in 2020, worth close to US$2.7 billion. China was the largest destination, accounting for 76% of Argentinian export volumes in 2020, followed by Chile, Israel and Germany.

Australian beef exports only really overlap with Argentina in China. For Q1 this year, Argentina was the second largest supplier of beef to China, behind Brazil, while Australian exports to the market have eased on the back of supply challenges and processor suspensions.

Most other major global suppliers are already heavily geared towards China and may not have additional product to divert to the market. If the ban extends, this could mean a shortage of product on route to China.

The big picture

Longer term, this move could undermine confidence in Argentina’s beef industry. This has the potential to shift investment away from the sector, resulting in a reduction in the herd, as seen after previous government interventions. This could create space in markets for Australia to capitalise on and grow market share, especially if the ban proves long-term.

Globally, the five largest beef exporters are facing supply and export challenges to some degree. Australia and Brazil are rebuilding herds, Indian buffalo meat production and supply chains face ongoing COVID-19 disruption, US domestic demand remains very strong, and now Argentina has self-imposed an export ban. All this may boost global prices for beef for the remainder of 2021 and potentially beyond.

© Meat & Livestock Australia Limited, 2021