Cattle prices hit new record as yardings decline

Key points

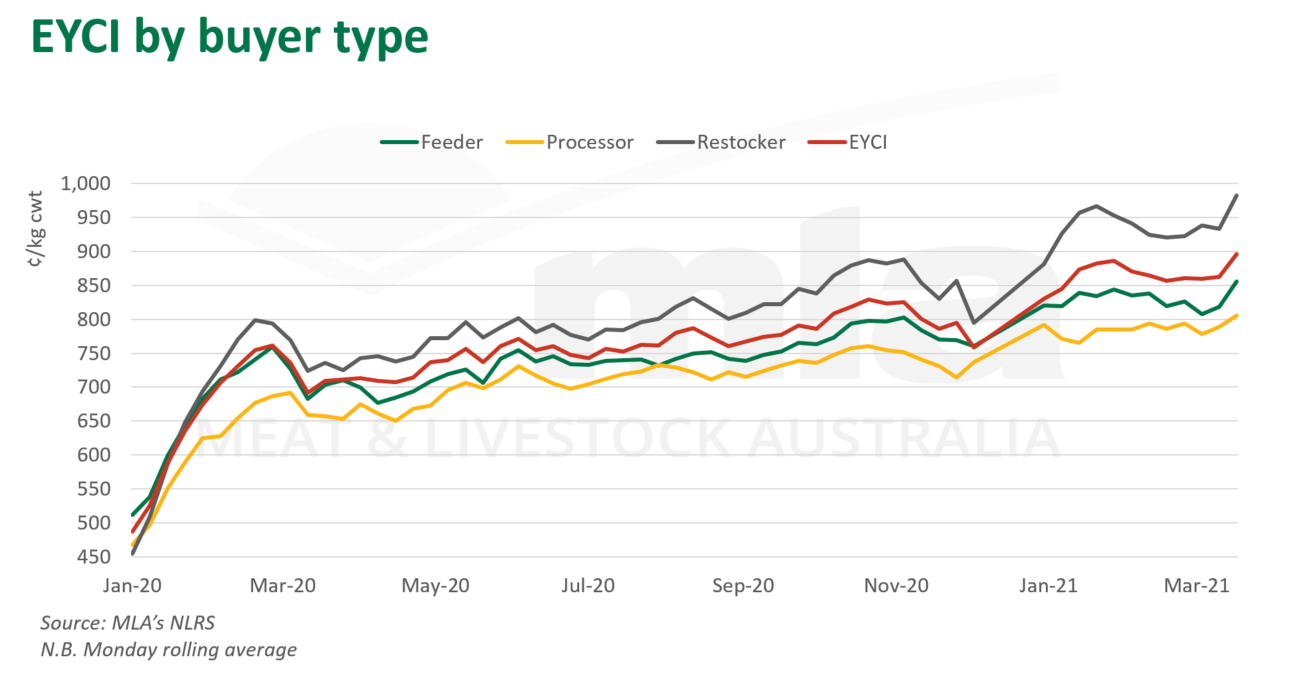

- Eastern Young Cattle Indicator (EYCI) hits new record of 896c on the back of rain-induced falling supply

- EYCI experiences more volatility as weighting of saleyards shift

- Light restocker cattle continue to assert their dominance

Excluding Easter and Christmas periods, the EYCI yarding for Monday 29 March was the lowest since July 2018, with 5,500 EYCI eligible cattle yarded. On the same day, the EYCI broke new ground, achieving 896c/kg carcase weight (cwt). Logistical transporting issues on the back of flooding in some parts of the eastern states have significantly altered supply at saleyards and traditional livestock activity, with strong demand breathing even more life into young cattle prices.

The aforementioned factors have led to heightened volatility of the EYCI, with sharper price movements occurring on any given day based on individual saleyard throughput. In the past week, 9c increases and 12c declines have occurred on consecutive days. Roma saleyard, the largest contributor for EYCI eligible cattle, has experienced turbulent throughput, with 1,418 head yarded on Tuesday 30 March, up 30% on the previous week and bouncing back from a 49% decline the week before that. Dalby also saw a 61% rise in EYCI eligible cattle this week after consecutive weeks of significant decline.

Significant changes to yardings week-on-week mean individual saleyard results are likely to have a larger influence on overall EYCI price movements, which has been the case in the last fortnight. It is advised that these factors are taken into account when interpreting the EYCI.

Yarding reductions and price hikes haven’t only been experienced at the saleyard, but also online. AuctionsPlus’ national Friday sale had 10,605 head on offer, down by 8,123 head the week prior, with solid price increases across the majority of categories.

When breaking down the components of the EYCI, the same trends can be observed for most of 2020 but on a heightened scale. Restockers continue to hold the pulling power and light weight cattle continue to break away from heavier categories.

Looking ahead

Continued shifts in throughput are likely to trigger some volatility for the EYCI. Once a consistent flow of cattle hits the market again, it is likely the indicator will return to a smoother trend. Producer decisions to hold or sell during the Easter period will be critical to the performance of the EYCI in coming weeks.

© Meat & Livestock Australia Limited, 2021