Seesawing processor and feeder margins

Key points

- The margin between restocker prices and processor prices is closing for steers

- This trend has been observed in previous years of increased rainfall

- What does this mean for producers?

Seasonal conditions have the biggest impact on market dynamics, and can be felt throughout the supply chain.

The wet conditions in 2021 mean producers are having to consider whether it is more economical to sell cattle earlier and younger to feedlots, or whether to hold on to cattle and utilise the abundant grass and feed out until they are ready to be processed.

This week MLA has analysed:

- The differential between restocker and feeder steer prices on a per head basis (feeder margin)

- The differential between restocker and processor steer prices on a per head basis (processor margin).

What can be observed is that this year, a period of increased rainfall and tighter supply, has impacted the processor margin to a greater extent than the feeder margin. This is a trend that was also observed in the previous wet years of 2016 and 2017. In drier years the inverse occurred.

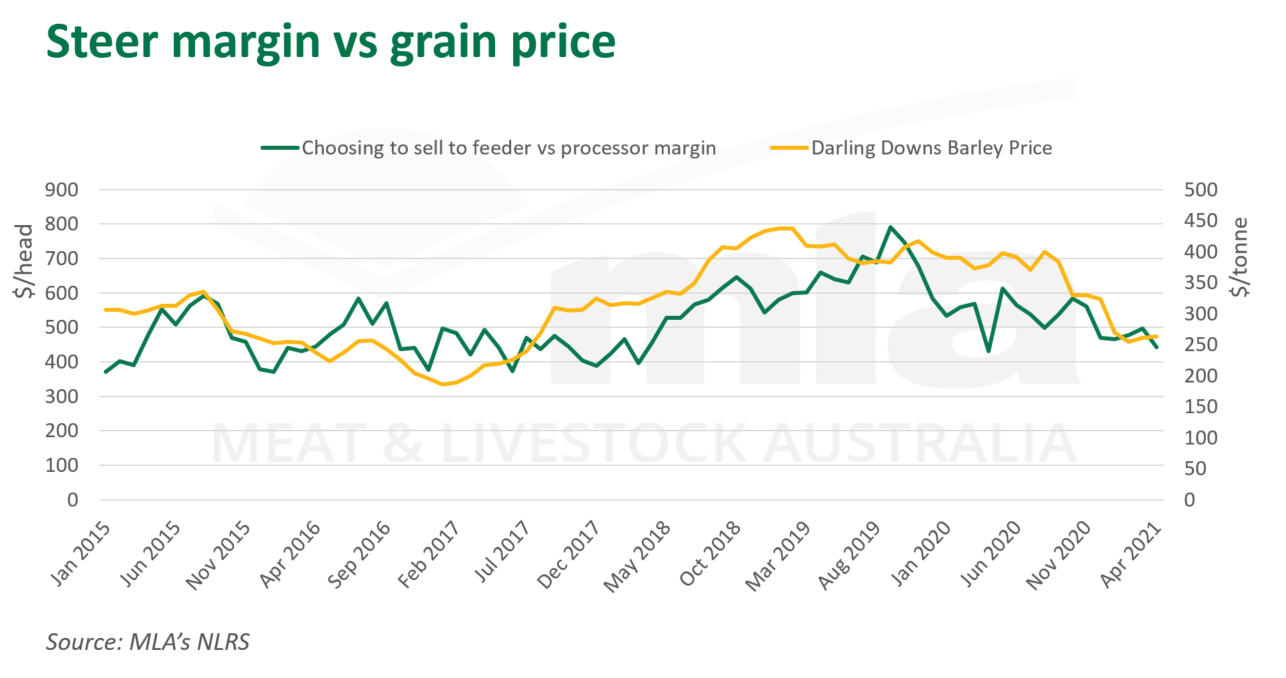

In the drought years of 2015, 2018 and 2019 the processor margin increased. These were times when generally grass and water were scarce, so producers had to rely on fodder and grain to feed out to processor weights, increasing costs of production. At the peak of the drought in 2019, cost of grain was at its highest point in the last five years (see the graph below), further disincentivising producers from carrying stock.

Alternatively, in wetter periods, restockers have been paying more for young cattle due to heightened demand. These improved conditions would naturally encourage producers to fatten to heavier weights, however, the processor margin is shrinking despite there being cheaper feed costs and more grass. This creates a tough decision for some producers – to sell lighter to feedlots or maximise grass and sell heavier.

A key consideration is the cost of feed and the impact it has on margins. The below graph shows the difference in profit when a restocker chooses to sell to a feeder vs a processor (the difference between the processor and feeder margin) and the Darling Downs Queensland barley price. The price of barley, while used as an example, does trend quite closely to the difference in margins symbolic of the relationship that feed prices have on cattle margins and therefore the decision-making process.

The relationship tells us that the cost of feed assists to balance out the shifts in price, allowing margins to move up or down to a certain degree. Generally, the higher cost of grain correlates with a poorer season, reducing incentive for producers to feed out, and pushing costs of production up across the supply chain. On the other hand, in a good season, generally lower feed prices offset tighter margins, levelling out the gap in where to sell.

© Meat & Livestock Australia Limited, 2021