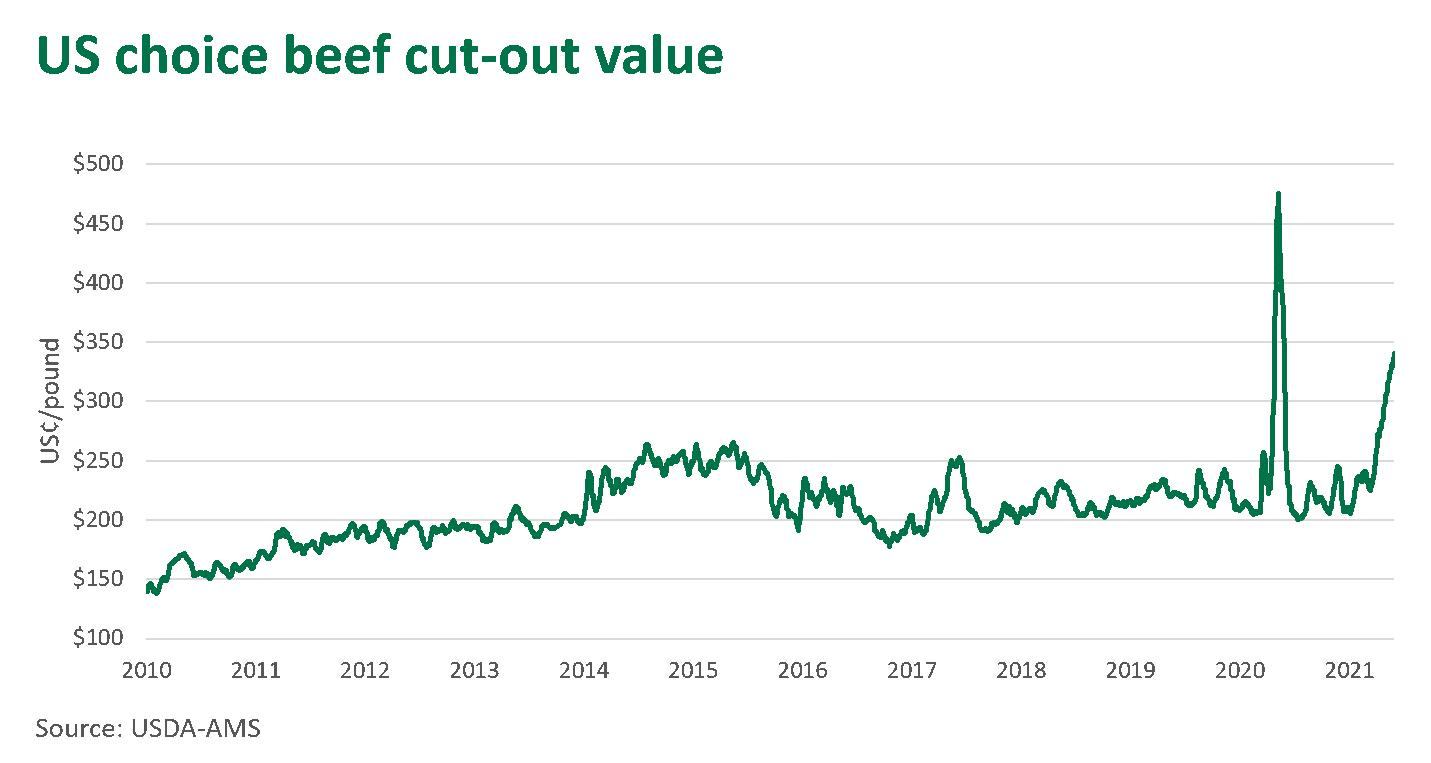

US wholesale beef prices rally

Key points

- Foodservice demand is benefiting from vaccine distribution and government stimulus

- Cyber-attack on JBS forces a number of US plants to close

- Imported beef prices continue to trend higher as tight supplies and high domestic prices create upwards pressure

There is growing concern regarding the beef supply scenario in the US. Cold storage levels are down on a year ago, there are operational disruptions to several JBS processors and tight cattle supplies continue from Australia and New Zealand. All of these have coincided with a rebound in consumer demand.

The US economy has regained some momentum post-COVID, contributing to the rapid increase of wholesale beef prices. As lockdown measures are rolled back, foodservice demand continues to improve, while government stimulus packages further aid consumers and encourages dining activity.

Typically, US end users build up inventories ahead of summer demand. However, this year, the latest cold storage data (measuring food supplies held in commercial and public warehouses) shows that freezer inventories are at the lowest point in many years. As of 30 April, the combined inventory of beef, pork, chicken and turkey in cold storage was estimated at 905,000 tonnes swt, 18% lower than the previous year and 16% lower than the five-year average.

Cattle slaughter in the US has been running at an accelerated pace with drought conditions incentivising turn-off. Regardless, high prices and limited supply availability have prevented processors and end users from building stock, as the escalating wholesale prices result in above-average inventory liquidation. Consequently, buyers are heavily reliant on the spot market to cover needs, with demand for lean meat particularly high, while in contrast, prices for fatty trim are subdued.

© Meat & Livestock Australia Limited, 2021