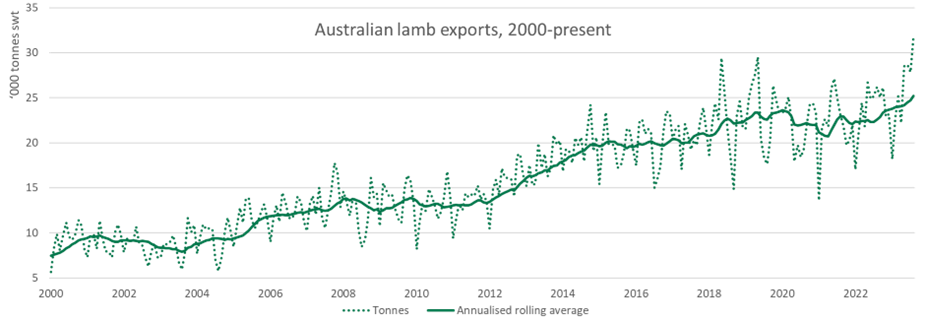

Lamb exports highest on record

Key points

- Lamb exports grew 21% year-on-year (YoY) to 31,779 tonnes, the highest on record.

- Beef exports rose by 11% YoY to 102,352 tonnes, while mutton exports rose by 29% YoY to 15,856 tonnes.

- China was the largest market for Australian red meat exports in August, taking in 37,528 tonnes.

31,779 tonnes of Australian lamb were exported in August, 21% more than August 2022 and the highest monthly export volume on record.

This was the most eye-catching figure in the August export figures but sits alongside strong export growth in all categories: beef exports were at their highest since 2019, mutton exports increased by 29% YoY and goat exports rose by 22% to 2,855 tonnes, the strongest August since 2014.

Source: DAFF, MLA (Meat and Livestock Australia)

Lamb

The largest market for Australian lamb in August was China, where exports rose by 47% YoY to 7,310 tonnes. At the same time, exports to the United States eased by 10% YoY to 6,397 tonnes, remaining the second largest lamb export market, as it has all year.

Substantial growth occurred in exports to the UK, where YoY volumes rose by 174% to 1,045 tonnes. While still relatively small, the substantial increase suggests that exporters are taking advantage of opportunities presented by the enactment of the Australia-UK Free Trade Agreement.

Lamb exports have already totalled 205,111 tonnes this year, seeing a 10% increase to the same period in 2022, a year in which exports hit a historic high. The increase in exports suggests that Australia is set to break lamb export records again.

Beef

102,352 tonnes of beef were exported in August, an 11% increase YoY and the highest monthly export volume since December 2019.

Very large volume increases occurred in exports to North America. Exports to the United States rose by 71% YoY to 25,760 tonnes, while exports to Canada rose a remarkable 669% YoY to 3,122 tonnes. As MLA has discussed previously, the ongoing US herd destock has led to lower domestic US slaughter numbers, driving demand for Australian beef to maintain consistent supply.

Exports to other markets were somewhat mixed. Exports to China rose by 3% YoY to 19,991 tonnes, exports to South Korea eased by 6% to 17,304 tonnes, and exports to Japan eased by 23% YoY to 14,435 tonnes. Current frozen stock levels in those countries are reportedly very high, so it is likely that some of the ‘backlog’ stock will need to clear before the true demand picture becomes evident.

Looking forward

Between 2018 and 2022, in a calendar year around 64% of sheepmeat exports occur between January and August. So far this year, 275,508 tonnes of sheepmeat have been exported.

In the July sheep projections update, we forecast total sheepmeat exports for the year at 462,000 tonnes, and year-to-August exports are currently 73% of that figure, suggesting that sheepmeat exports are running ahead of expectations.

In the same way, between 2018 and 2022, around 64% of beef exports occur between January and August this year, 678,038 tonnes of beef have been exported – around 64% of the 1.06 million tonnes forecast in the June cattle projections update, which suggests that beef exports are more or less on track.