The cattle market – what has turned and why?

Key points

- Australian cattle slaughter is up 10% year-on-year with cows contributing significantly to these numbers.

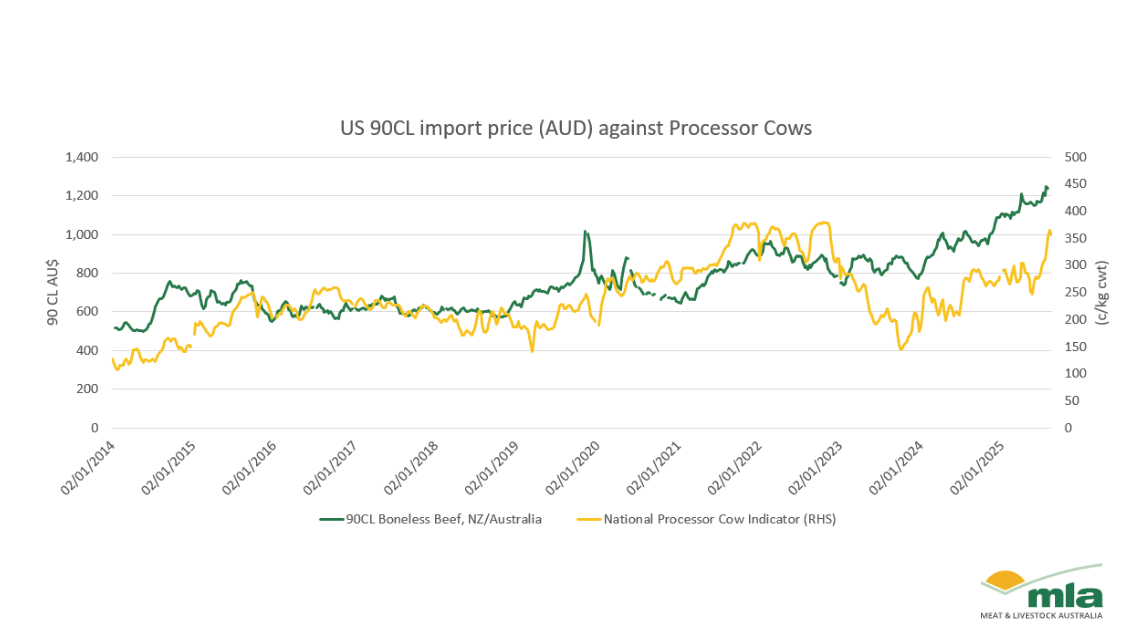

- Lifts to the 90CL price have not matched saleyard cow prices.

- Competition for feeder animals has influenced other cattle indicators.

Cattle supply has continued to meet consistent demand from restockers, feedlots and processors. Most cattle indicators are surpassing or sitting close to the $4/kg mark, indicating market strength. Processing demand from the south and rebuilding demand from the north have balanced the market, despite strong throughput.

Cow prices return as margins shorten

Australian processor numbers are tracking 10% above August 2024 figures. Cow slaughter represents a significant portion of these numbers, driven by southern destocking levels, paired with stability, if not consistent growth, in the north. Cow prices continued to rise last week, lifting to 366¢/kg liveweight (lwt), just 14¢ below the October 2022 record. These figures were driven by a combination of export trim prices and a processor drive for maintenance stock. This week has seen a 9¢ ease. However, at 357¢/kg lwt, the price remains strong.

Export prices, while a motivator, are not the most significant driver of saleyard prices. In the past month, saleyard cow prices have increased 23%, while 90 CL prices have risen 6%. With both indicators at or near records, there is some correlation between export and saleyard price, but supply remains the largest saleyard price driver.

MLA market reports provide insights into saleyard buying trends. Queensland saleyards have seen a rise in participation from southern processors specifically seeking cows. As the supply of cows reduces in the south, processors have travelled north, increasing northern saleyard competition.

The market easing has likely been influenced by southern processors’ inability to maintain prices when factoring transport and processing costs, and northern buyer competition. With less north and south competition and some processors reducing capacity, the market has softened.

Feedlots remain a key competition driver

The two feeder indicators have significantly driven the total market. Feedlots have always been an important outlet for Queensland cattle, but with increased use of grain-fed finishing, their market influence continues to grow. Saleyard feeder cattle supply has pushed buyer competition into this restocker market. The National Feeder Heifer Indicator and National Feeder Steer Indicator now both sit above 400¢/kg lwt – for the first time since 2022.

Attribute to: Erin Lukey, MLA Senior Market Information Analyst