Market watch: South Australia

After a strong start to the year, South Australian lamb prices may come under pressure with the temporary closure of a key processing plant. Cattle prices have also eased following recent hot and dry conditions.

Sheep

SA sheep and lamb saleyard indicators tracked below 2016 levels for much of July, August and into September last year. From early October onwards, prices recovered and moved well above year-ago levels.

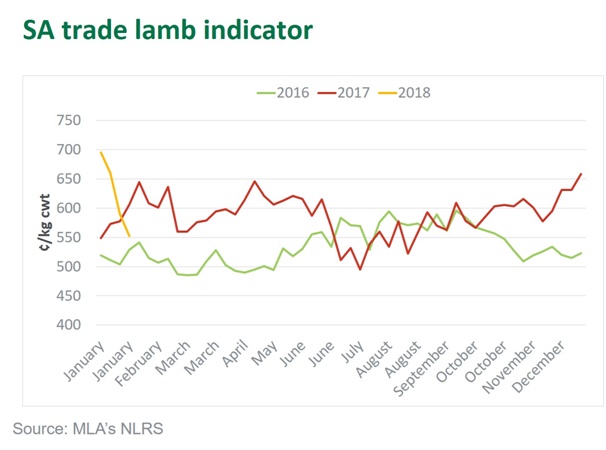

The SA trade lamb indicator had a strong start to the year averaging 624¢/kg cwt in January, up 8% year-on-year. Although, the indicator finished the month at 552¢/kg cwt. Preliminary slaughter figures have eased on year-ago levels. The temporary closure of a key processing plant may see further pressure on prices if supply outstrips demand.

The intention to rebuild flock numbers is apparent. If a reasonable autumn break eventuates, this will continue to encourage restocking activity and provide support to the market over the coming months.

Cattle

SA cattle saleyard indicators tracked below year-ago levels since late June 2017, driven by higher turn-off due to the dry conditions experienced in late winter and into spring. Above-average rainfall across much of the state throughout the summer months lent some support to cattle prices and saw trends steady. However, the return of hot and dry conditions more recently have seen prices ease.

The SA trade steer (330–400kg, C3) indicator averaged 267¢/kg live weight in January, down 20% year-on-year – although still historically high (17% higher than the five-year average for the month). Cattle saleyard throughput across the state increased 4% year-on-year in January to 11,000 head.

December slaughter in SA was 10% lower than 2016 levels, illustrating the ongoing tight herd supply situation compared to year-ago levels. Preliminary slaughter figures for January were back considerably year-on-year. While other plants have absorbed some of the capacity, the temporary closure of one of the state’s major processing plants has contributed to the decrease.

Unlike that of southern NSW and Victoria, SA herd numbers remain below the long-term average and given sustained average seasonal conditions, producer intent to rebuild remains.

For further information on Australia’s sheepmeat markets in 2018, visit MLA’s Sheep Industry Projections.