Season outlook for New Zealand red meat

Key points

- Beef and Lamb New Zealand have just released their outlook for the 2019-20 season

- Forecasts are for minor growth in beef and sheepmeat production and exports next year

- Increases driven by high slaughter numbers with carcase weights down across the board

Last month, Beef and Lamb New Zealand released their season outlook for beef and sheepmeat. This report outlines expectations regarding slaughter, carcase weights, production and exports. Given the closely aligned nature of New Zealand as a key competitor in red meat, understanding how their season is shaping up is an important consideration for Australia. Export and production expectations in New Zealand are for the most part positive, with some minor growth set to come from greater slaughter numbers rather than improvements in carcase weights.

New Zealand export forecasts for 2019-20:

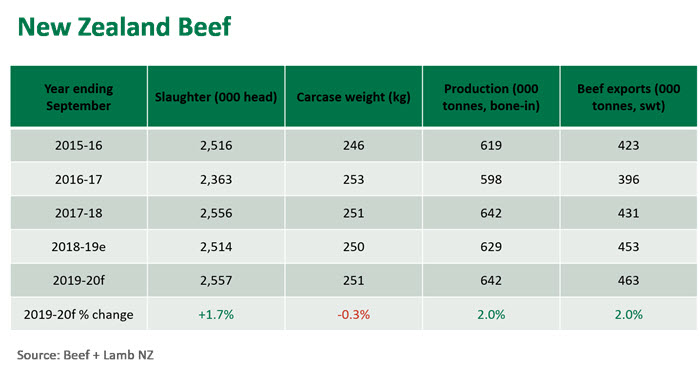

- Beef exports should see a minor increase of 2%, lifting total volume to 463,000 tonnes swt.

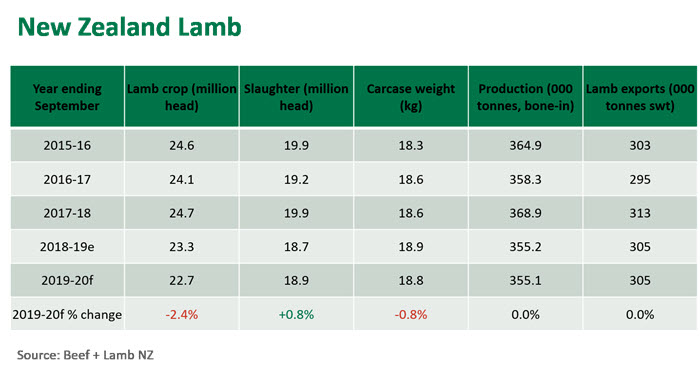

- Lamb exports are predicted to hold flat at 305,000 tonnes swt.

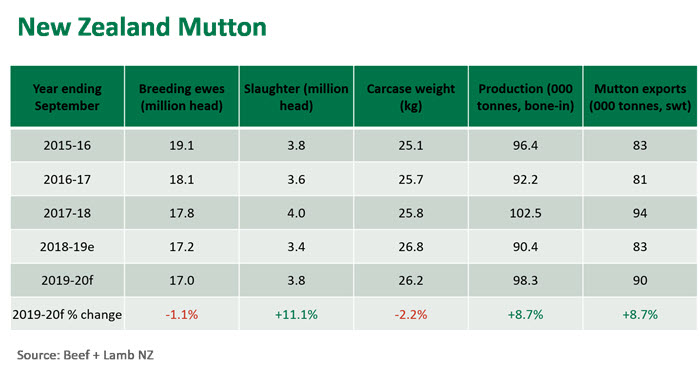

- Mutton exports are predicted to grow by 8.7% to reach 90,000 tonnes swt.

Beef exports in New Zealand look set to lift by 2% over the coming year. This growth will come from a slight lift in cattle available for slaughter off the back of a steadily increasing national herd size. Slaughter composition will consist of a greater proportion of finishing cattle with steers and heifers turn off expected to lift by 5%, bulls should have some minor growth while cows retract 1.2%. The number of breeding cows continues to rise, indicating herd growth and confidence in the industry.

Lamb production in New Zealand is set to remain steady, with exports predicted to hold at 305 thousand tonnes swt. The number of lambs tailed through spring 2019 was down 2.4% on the previous spring. The lower lamb crop is reflective of slightly lower scanning results combined with a diminished breeding flock. This comes off the back of high slaughter in 2017-18, where record prices encouraged the cull of poorer quality ewes. Nevertheless, forecasted numbers for slaughter in 2018-19 are still expected to increase. This is because the age distribution of the New Zealand flock is expected to shift back towards the norm - last year there was a greater proportion of hoggets as producers replenished their breeding flocks, subsequently reducing the number of lambs available for slaughter. This uptick in slaughter should offset an expected dip in carcase weights.

Mutton exports are expected to grow substantially off the back of much improved slaughter numbers comparative to 2018-19. Flock numbers are steady, while good international demand is likely to keep prices high, which will support mutton production over the coming year.

© Meat & Livestock Australia Limited, 2019